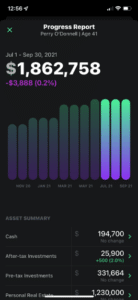

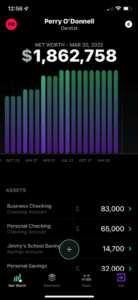

- See all your financial accounts in one place

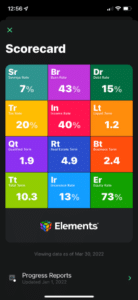

- Measure your financial health through a scorecard of key indicators

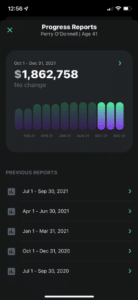

- Track your progress through quarterly reports

Use Elements® to Easily Monitor Your Financial Health

The Elements scorecard provides a set of standard vital signs for assessing your holistic financial health at a glance.

Elements® App Setup

The following instructional video will assist you in setting up your Elements® app.

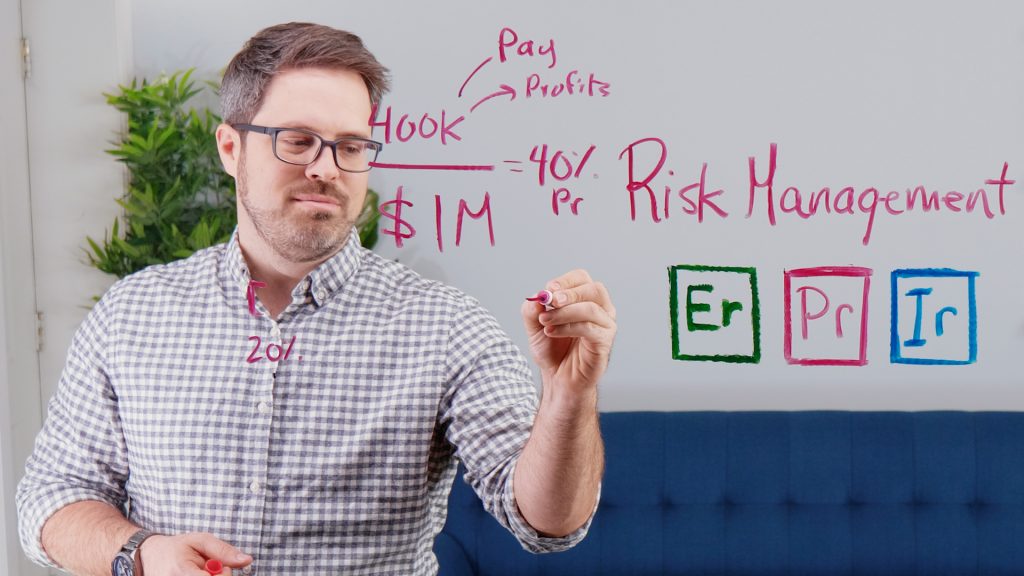

Er [Equity Rate]

Helps us determine whether the client will experience too much volatility risk for their personal level of spending and age.

EQUITY INVESTMENTS

TOTAL INVESTMENTS

Podcast

Six Keys to Powerful Investment Portfolios – Episode 55

Education Library

Explore Er (Equity Rate) related Resources

Pr [Profitability Rate]

Measures how much money the practice owner keeps as a percentage of collections. This serves as an important indicator of business efficiency.

TOTAL PRACTICE-

RELATED INCOME

TOTAL COLLECTIONS

Podcast

Dentist Money: The Profitability Killer – Episode 8

Education Library

Explore Pr (Profitability Rate) related Resources

Ir [Insurance Rate]

Measures how much insurance a person has compared to how much they need based on annual spending and net worth. Coverage is evaluated for the following types of insurance: life, general disability, business overhead disability, buy-sell, key person, personal liability, and business liability.

INSURANCE

COVERAGE HELD

INSURANCE

COVERAGE REQUIRED

Podcast

How to Bullet Proof Yourself Against Litigation – Episode 18

Education Library

Explore Ir (Insurance Rate) related Resources

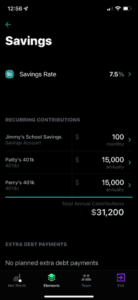

Sr [Savings Rate]

Indicates how much of a person’s income is being put away for future expenses, emergencies, and retirement.

ANNUAL SAVINGS

TOTAL

PERSONAL INCOME

Podcast

The Hidden Costs that Delay a Dentist’s Retirement – Episode 61

Education Library

Explore Sr (Savings Rate) related Resources

Br [Burn Rate]

Helps us understand a client’s spending patterns and retirement preparedness.

ANNUAL PERSONAL

SPENDING

TOTAL PERSONAL

INCOME

Podcast

This is Why Dentists Spend Too Much Money – Episode 95

Education Library

Explore Br (Burn Rate) related Resources

Dr [Debt Rate]

Indicates whether a person is servicing too much or too little debt for their individual circumstances.

ANNUAL DEBT

PAYMENTS

TOTAL PERSONAL

INCOME

Podcast

How Fast Should You Pay Off Your Loans? – Episode 102

Education Library

Explore Dr (Debt Rate) related Resources

Tr [Tax Rate]

Indicates whether tax liability could be reduced with better tax planning.

ANNUAL TOTAL TAXES

TOTAL PERSONAL

INCOME

Podcast

Dentist Money: Do You Have a Tax Strategy? – Episode 10

Education Library

Explore Tr (Tax Rate) related Resources

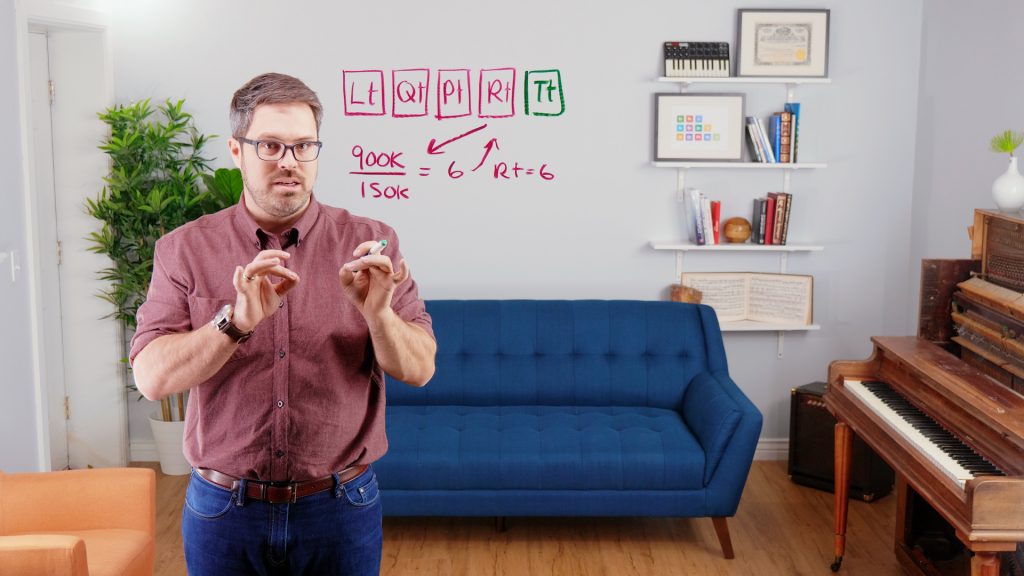

Lt [Liquid Term]

Estimates the number of years a person could live on his/her cash or cash-like assets outside of a retirement plan. Lt also indicates the amount of after-tax money an individual can access if needed.

TOTAL LIQUID ASSETS

ANNUAL PERSONAL

SPENDING

Podcast

How Much Money Should You Keep in Your Bank Account? – Episode 17

Education Library

Explore Lt (Liquid Term) related Resources

Qt [Qualified Term]

Estimates the number of years a dentist could live on the assets he/she has within qualified retirement plans (401k, IRA, etc.).

RETIREMENT ACCOUNTS

ANNUAL PERSONAL

SPENDING

Podcast

Everything You Need to Know About Retirement Plans – Episode 53

Education Library

Explore Qt (Qualified Term) related Resources

Pt [Practice Term]

Estimates the number of years a person could live on his/her current practice equity. It also indicates how much of a person’s wealth is concentrated in the practice.

TOTAL PRACTICE EQUITY

ANNUAL PERSONAL

SPENDING

Podcast

How to Stop Your Practice from Bossing You Around – Episode 92

Education Library

Explore Pt (Practice Term) related Resources

Rt [Real Estate Term]

Estimates the number of years a person could live on his/her current real estate equity. It also indicates how much of a person’s wealth is concentrated in real estate.

TOTAL REAL

ESTATE EQUITY

ANNUAL PERSONAL

SPENDING

Podcast

The Truth About Real Estate Ownership – Episode 60

Education Library

Explore Rt (Real Estate Term) related Resources

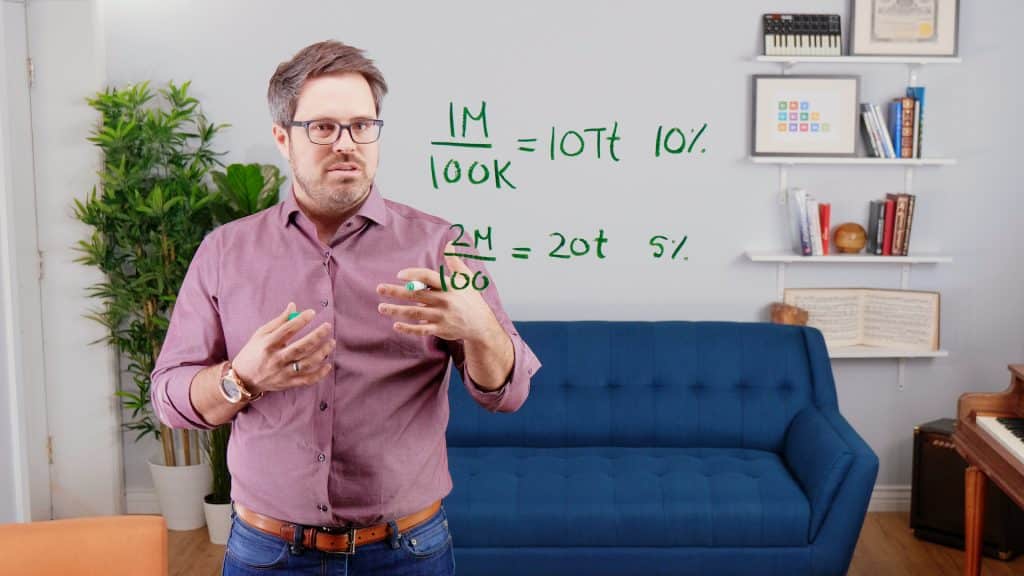

Tt [Total Term]

Estimates the number of years a person could live on his or her current assets if they did not grow. This includes cash, investments, practice value, and real estate equity.

NET WORTH

ANNUAL PERSONAL

SPENDING

Podcast

How Successful Dentists Track Financial Progress – Episode 64

Education Library

Explore Tt (Total Term) related Resources

How much wealth do I need to make work optional?

Tt (Total Term) is the crown jewel of the Elements® table because it indicates how long you could live on your current wealth if it did not grow. In other words, it provides a conservative estimate of how many years you could survive if you stopped working today. Tt is calculated by dividing net worth by annual personal spending. It is also a summation of the four blocks to its left which represent each asset type: Rt (Real Estate Term), Pt (Practice Term), Qt (Qualified Term), Lt (Liquid Term).

Do I have the right mix of assets?

The four blocks to the left of Tt (Total Term) estimate how long you could live on your liquid assets, qualified retirement plans, practice equity, and real estate equity respectively. These represent the four asset types in a dentist’s portfolio, and when added together, they create your Tt. These four blocks also provide a clear view of your asset distribution to help you and your advisor understand if there’s an opportunity for better diversification.

Podcast #82

The Numbers Dentists Need to Know to Retire Better

Am I using my income wisely?

The second row of the Elements® table calculates the percentage of your total income that goes toward savings (Savings Rate), spending (Burn Rate), Debt (Debt Rate), and Taxes (Tax Rate). These are the only four places your income can go and it’s important to keep them optimized to accelerate growth.

Podcast #95

This is Why Dentists Spend Too Much Money

Am I taking the right amount of risk?

The top row of Elements® contains Er (Equity Rate), Pr (Profitability Rate), and Ir (Insurance Rate). These ratios indicate risk levels within your investment portfolio, business, and insurance profile respectively. The amount of risk you should take in each area will depend on a number of factors including your tolerance for risk, career phase, liquidity, and financial goals.

Podcast

How Much Insurance Does a Dentist Need? – Episode #100