Elements® Comprehensive Financial Planning for Dentists

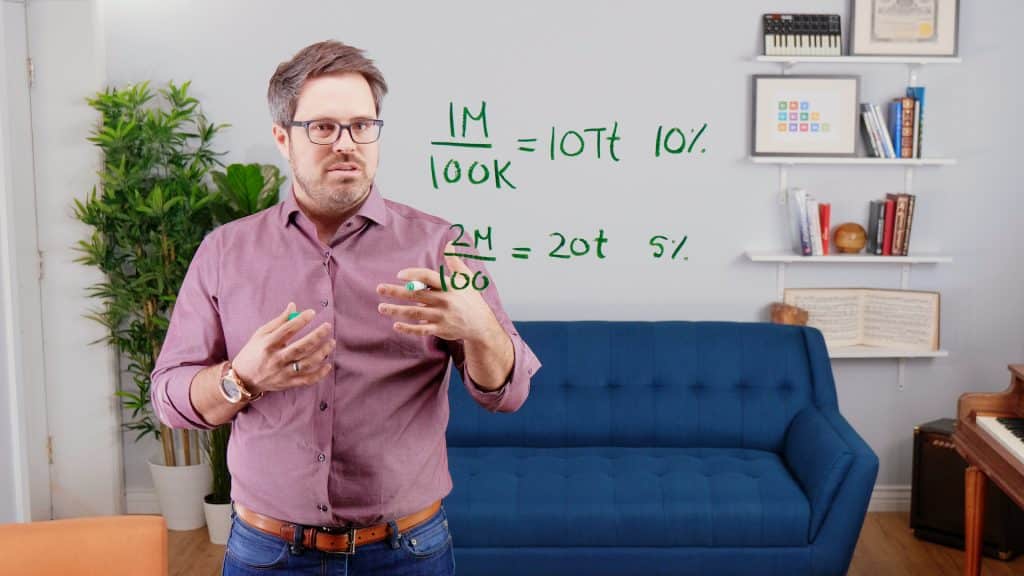

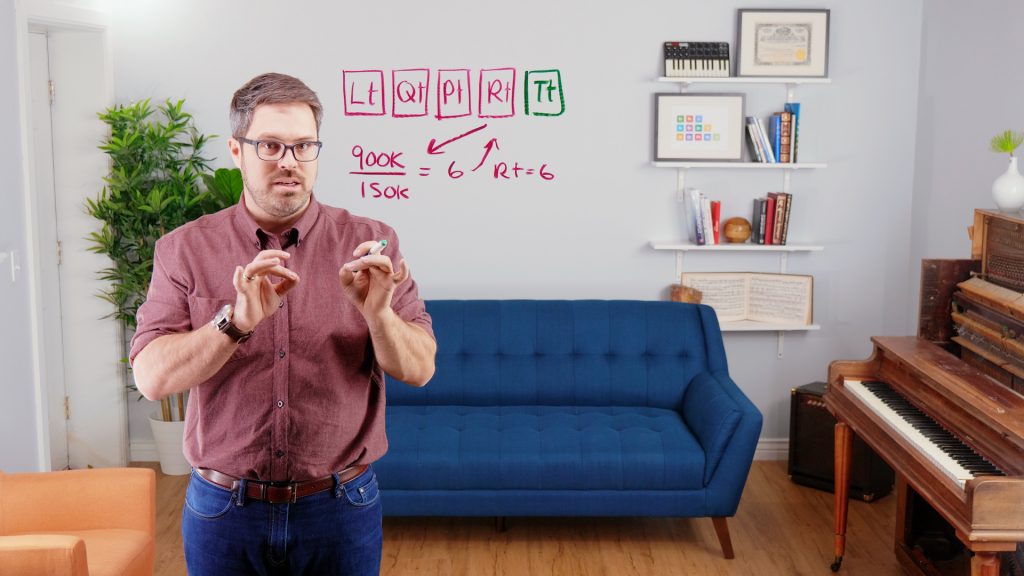

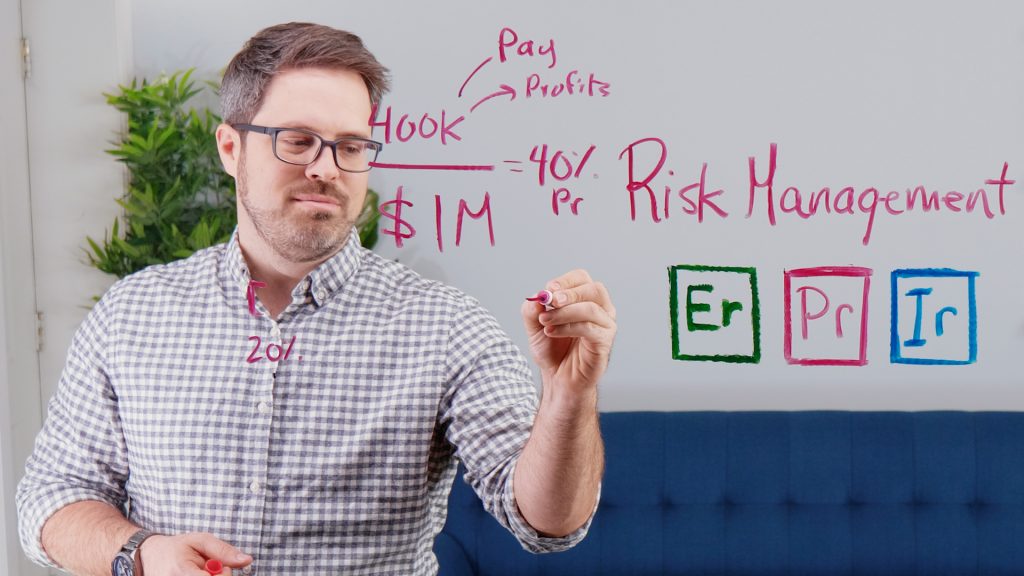

The Elements Financial Planning System™, originally developed by Dentist Advisors, is a proactive treatment plan for your financial health. Our advisors use Elements to monitor your key financial indicators, benchmark your performance against other dentists, and optimize each moving part of your wealth strategy.