CLIENT BENEFITS

Dentist Advisors is a premiere wealth management firm for dentists and specialists. Put our experience to work for you. As a client, you’ll receive customized portfolio management, retirement progress tracking, and ongoing coaching from a CFP® professional who understands dentistry.

Click to speak with a dental-specific CERTIFIED FINANCIAL PLANNER™ professional about your individual situation.

Book Free ConsultationPrivate Wealth Management Features

Dedicated CFP® Advisor (Unlimited Access)

Dedicated CFP® Advisor (Unlimited Access)

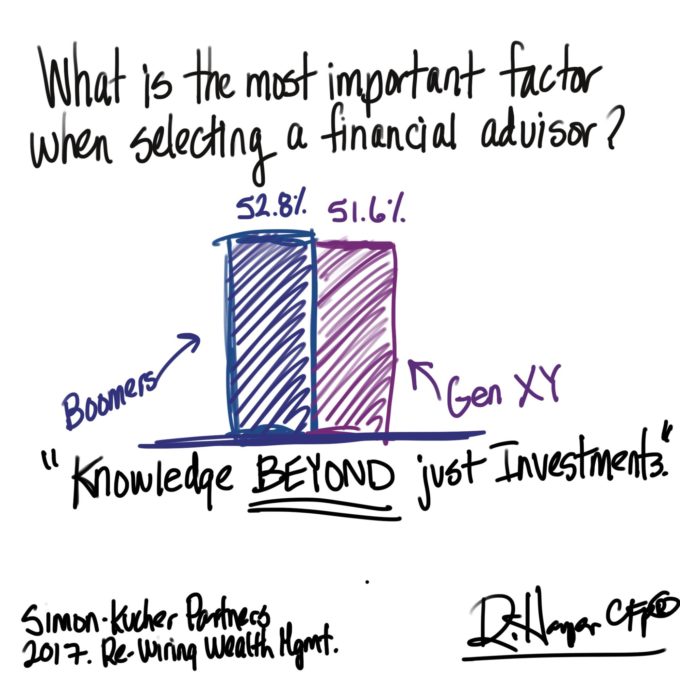

CERTIFIED FINANCIAL PLANNER™ certification is a standard of excellence in financial planning. CFP® professionals meet rigorous education, training and ethical standards, and are committed to serving their clients' best interests.

As a Private Wealth Management client of Dentist Advisors, not only will you work directly with your own CFP® advisor, you'll be working with one who understands the unique challenges and opportunities of a dental career.

Plus, because of our fee-only compensation structure, you can be assured that your advisor will never be paid commission to sell you financial products.

Call, text, email, or meet with your advisor anytime to receive objective, fiduciary, and personalized guidance.

10 Questions You Should Ask Before Hiring a Financial Advisor

Don’t Get Financial Advice From a Salesman

Custom Portfolio Management

Custom Portfolio Management

It might surprise you that Vanguard estimates for some people, using the right kind of advisor can add 3% in net returns each year; much more than a typical financial advisor may charge to help you. Read Vanguard's full report here to see how a combination of behavioral coaching, asset location, proper rebalancing, trading, and withdrawals can substantially alter your performance over time. Unfortunately, it's not as easy as just buying cheap index funds and putting things on autopilot.

At Dentist Advisors, once your dashboard is built, and we have a complete and accurate view of your entire financial picture, we'll make adjustments to your current strategy, or put your strategy in motion for the first time. We'll build on what you already have—especially if it's already well positioned. We'll be cautious as we analyze the tax impact of any changes, and start to position your portfolio with cost-effective investments and a highly disciplined approach that captures value across countries, companies, currencies, and real estate. Your tax rate, liquidity, cash flow, personality profile, time frames, and risk tolerance will all be factored into your investment strategy. As markets go through ups and downs, we'll be your voice of reason to help you navigate adjustments and stay consistent when it's difficult to do so.

Where Vanguard Really Stands on Using an Advisor – Episode 174

Elements® Financial Monitoring App

Elements® Financial Monitoring App

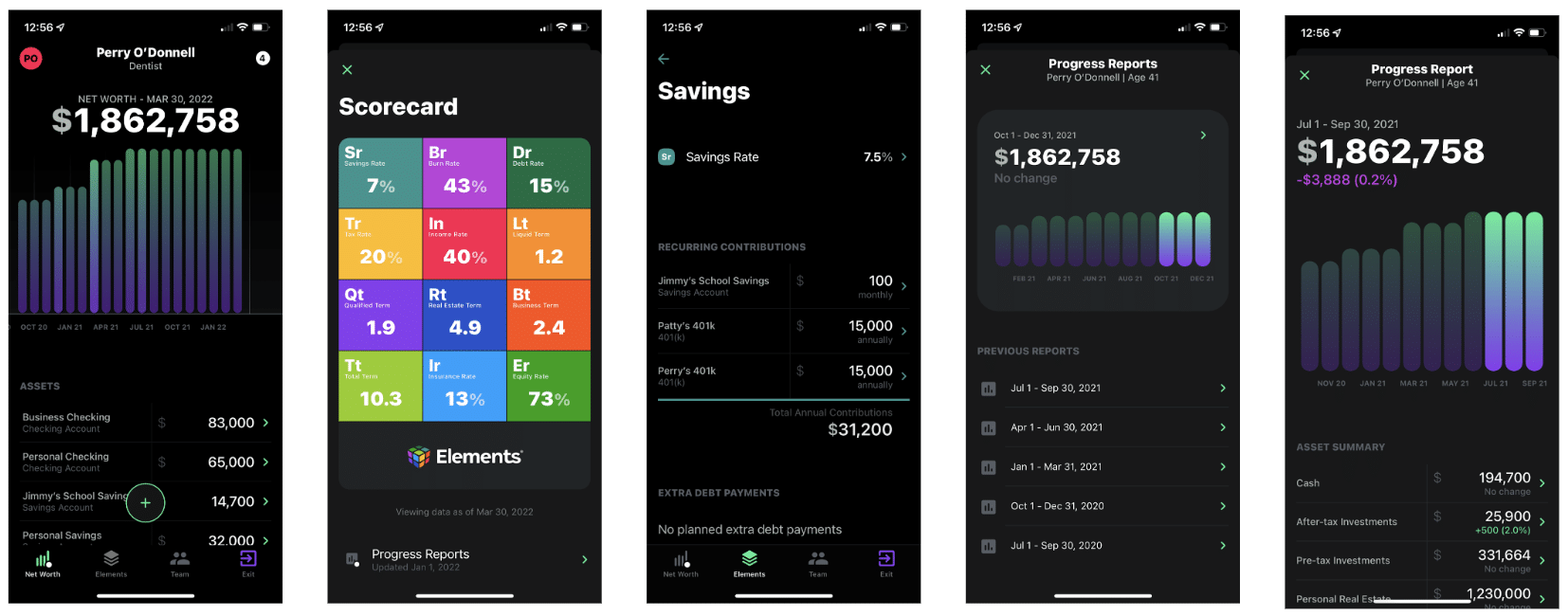

- See all your financial accounts in one place

- Measure your financial health through a scorecard of key indicators

- Track your progress through quarterly reports

Quarterly net worth reports

Quarterly net worth reports

Know your wealth is growing fast enough to fulfill your long term goalsAlong with a real time net worth summary, which you can always view on your dashboard, we will deliver quarterly net worth progress reports to show a historical view of your progress. The report includes a detailed breakdown of your assets and debts so it’s clear which factors are contributing to growth (or decline).

How Fast Should Your Net Worth Grow? – Episode 151

There’s Only One Number You Need to Predict Your Retirement

Collaboration with your other service professionals

Collaboration with your other service professionals

Save time by authorizing Dentist Advisors to gather data directly from your CPA, attorney, office manager, payroll provider, and other contactsUsing a limited power of attorney, we will establish lines of communication with each of your professional contacts to request data and documents on a regular basis. In essence, we'll be the quarterback of your service provider team and make sure your financial playbook includes the most up-to-date information from all the right sources. This allows us to complete much of our analysis behind the scenes without disrupting your busy schedule.

9 People Dentists Need to Know – Episode 26

Dentist Money: Why Your Practice is Like a Pencil – Episode 5

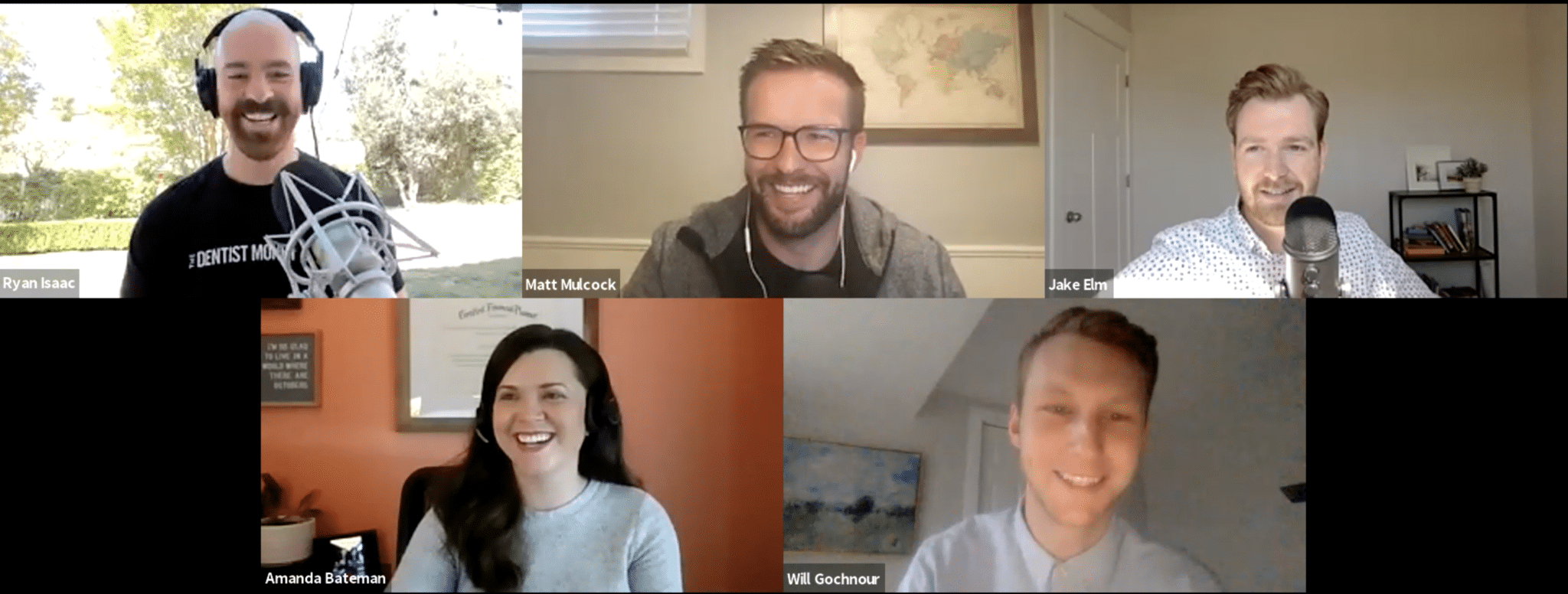

Quarterly Clients-Only Huddles

Quarterly Clients-Only Huddles

Each quarter, our financial advisors and other professionals provide updates and commentary about current events such as market conditions, tax policy, media headlines, and dental industry trends.

Work with a dedicated CFP® professional who specializes in financial planning and investment management for dentists.

Unrestricted access to a financial advisor who knows your situation and can hold you accountable. Call, text, or meet anytime to evaluate your progress and discuss important financial decisions. Our advisors are CFP® professionals who know dentistry and are vetted to the highest standards.

WATCH TO LEARN

How we approach financial planning

Why Our Advisors Are Different

The Keys to Better Investment Performance

How Dentist Advisors Delivers Comprehensive Planning

FOR PRIVATE WEALTH CLIENTS

How we approach financial planning

Private Wealth Clients receive additional benefits for a customized investment management experience:

Daily CFA® professional oversight

Daily CFA® professional oversight

Daily trading, managed and monitored by our onsite CFA® professional, means that every dollar you invest is put to immediate use. Because we trade on a daily basis, we can react quickly to the moving parts in your portfolio and keep more of your cash invested.

Tax-efficient Rebalancing is how we maintain the right ratio of stocks and bonds in your portfolio while minimizing the tax hit. Because performance of stocks and bonds fluctuates, we can use new deposits to keep your portfolio focused on the optimal outcome. This differs from “static” rebalancing where existing holdings are sold, which can create a tax liability.

Strategic withdrawals means we’re thoughtful about the tax implications when you need to cash out an investment. We’re able to maintain the proper mix of stocks and bonds in your portfolio while minimizing the tax impact when you request a withdrawal from your account.

Tax-efficient rebalancing

Tax-efficient rebalancing

Many investment firms try to minimize taxes, but personalized tax management can be challenging if your advisor does not have complete visibility into your overall net worth and cash flow. Your taxable investment accounts (like a brokerage account where you hold mutual funds or ETFs) will incur gains over time as your investments appreciate in value. Those gains are known as short term gains (appreciated investments that you’ve owned for less than a year) and long-term gains (investments you’ve owned for more than a year).

As we make adjustments or changes to your account, we review any trades that might cause a taxable event, and assess other opportunities to improve your account performance without incurring the impact of capital gains taxes. As an example, we could make customized trades with new cash flow to rebalance your account without selling off appreciated stock, or make in-kind donations from your account instead of using cash for charitable donations. In some cases, it could make sense to sell off securities that are currently lower than when you purchased them, incurring a loss. By replacing them at the same time with a security with similar upside potential, we can maintain diversification without trying to time the overall market. No matter how we proceed, your advisor will review any significant taxable event to ensure that changes to your accounts are always thoughtfully implemented.

Retirement Plan Implementation

Retirement Plan Implementation

Choose, monitor, and adjust your retirement plan to maximize tax benefitsA retirement plan is one of the most proactive ways to reduce and defer taxes, and to attract the best employees. This could mean a SIMPLE IRA, Safe Harbor 401(k), profit sharing plan, cash balance plans or other pension plan designs. It’s important to get advice from someone who is not incentivized to sell you a retirement plan. In many cases, the timing and type of plan you establish will either accelerate your growth or hold you back. We will provide an independent voice of reason to help you understand all the options available in the marketplace—not just the ones available through a single provider.

As technology and service models change, the best-of-class retirement plans also change. We can work with your existing provider to enhance the investment selection and design of your existing plan, or we can recommend a more optimal solution with a new servicing partner that might be a better fit for your situation. The optimal design is often different for each practice. Every year, we’ll collect a new practice staff census and analyze your retirement plan to see if we can increase your tax deductions. This is particularly important as your collections and personal income reach new levels and higher tax brackets.

Everything You Need to Know About Retirement Plans – Episode 53

Why a Cheap 401(k) Provider Will Eventually Cost You More – Episode 130

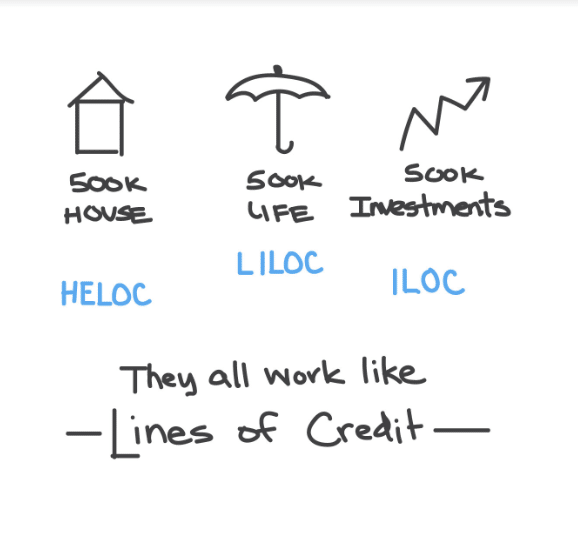

Borrow Against Investment Accounts

Borrow Against Investment Accounts

As your net worth and liquidity increase, you can borrow against your own investment accounts. As your accounts grow, margin lending can be done at very attractive interest rates which may allow you to pay off loans with less favorable interest rates, like practice debt or student loans, without having to liquidate any of your investments or stop them from compounding. The margin loan can be paid off with your regularly scheduled contributions while your investments continue to grow. This strategy is advanced and requires very detailed communication with your advisor, but for some dentists it can be a very powerful way to eliminate debt and avoid unnecessary capital gains taxes on investment accounts.

Why Borrowing Against Life Insurance is Not a Secret Sauce

By Reese Harper, CFP® , CEO of Dentist Advisors

Tax-Advantaged Charitable Planning

Tax-Advantaged Charitable Planning

When making charitable donations, many of our clients make in-kind donations. By taking highly appreciated stocks, ETFs or mutual funds and donating them directly to the 501(c)(3) of your choice, you can reduce the capital gains you would eventually pay during retirement. Instead of paying charitable contributions with cash, you can work with your advisor to strategically review your account for opportunities to donate your shares. Ultimately this can increase the effective return inside of your portfolio, as long as you replenish securities with the same amount of cash you would have paid to the charity.

Custom portfolio construction

Custom portfolio construction

Passive, Active, Private, and PublicAs an independent registered investment advisor, we aren’t limited to the investment styles, products, or companies we recommend. Although we have preferred partners that fit many of our investment philosophies (low-cost, broad diversification, and factor-based investing), we have clients with unique preferences or circumstances whom we accommodate alongside our core philosophy. As your income and wealth increase, you’ll likely unlock more investment preferences and interests. We believe that a low-cost portfolio of Dimensional, Vanguard, SPDR, or iShares mutual funds or ETFs, serves as an essential core to your overall asset mix, and for some people that may be all they ever choose to own. But if your final retirement portfolio contains a much more diverse set of investments, including real estate, individual securities, bond ladders, private placements or even an investment in your family burger franchise, you can count on our guidance to help make sure it all comes together within the context of a balanced, liquid and diverse strategy.

Where Vanguard Really Stands on Using an Advisor – Episode 174

Ask These Questions Before Investing in a Startup – Episode 99

Why Stock Market Curve Balls Are Getting Easier to Hit – Episode 184

Access to private investments

Access to private investments

We’ll help you understand when the timing is right for you to explore private investments as part of your financial strategy, and give you access to an array of alternative investments—such as private equity, real estate, and venture capital—that fit your unique timelines, needs, and goals. And if you have an investment opportunity you want us to review, we can help you with that too.

Did you know?

Vanguard research shows an advisor can add:

- 1% to 2% in net investment return with behavioral coaching

- 0.75% in net return by selecting the right account types

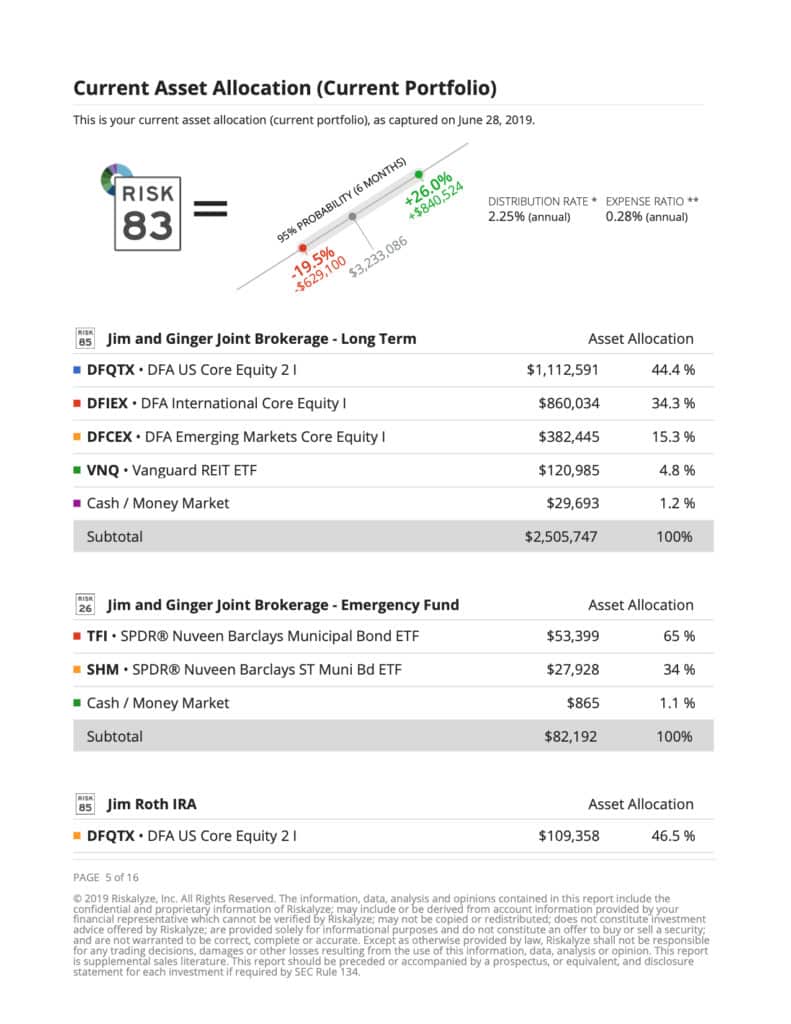

VIEW A SAMPLE

Quarterly Net Worth Progress Report

In addition to a dashboard with real time updates for your accounts and net worth, as a Private Wealth Client, you’ll receive a quarterly net worth report to show how your wealth is growing over time. The report includes a detailed breakdown of your assets and debts, and provides a valuable “moment of truth” to understand which factors are contributing to growth (or decline).

SEE HOW WE USE

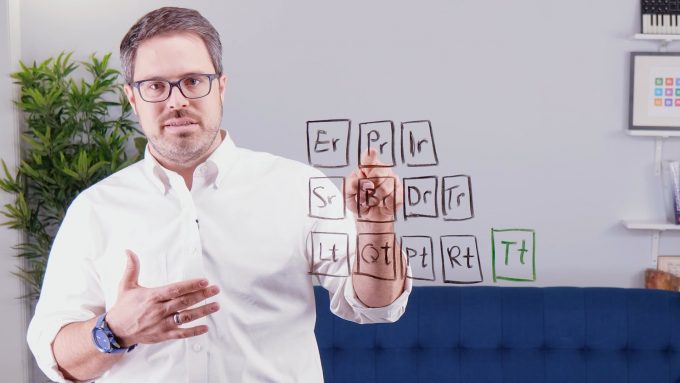

Elements Financial Planning System™

The Elements Financial Planning System™, originally developed by Dentist Advisors, is a proactive treatment plan for your financial health. Our advisors use Elements to monitor your key financial indicators, benchmark your performance against other dentists, and optimize each moving part of your wealth strategy.

Related Resources

A Year in the Life of a Dentist Advisors Client – Episode 282

Why Are Some Dentists Hesitant to Hire a Financial Advisor?

By Reese Harper, CFP® , CEO of Dentist Advisors