Executive Summary

Some professions (medical, dental, accounting, and law) date back hundreds, even thousands of years. These professions have established a commonly shared body of knowledge that’s taught at universities, and a code of ethics that is generally agreed upon.

For example, the dental profession has evolved from a tangential, health-related occupation to a more holistic physician of the mouth. It’s an evolution that takes time before standards of education are reached, proven science is formed, and ethics that build public trust are created.

The financial planning industry is much younger. It really only dates back to the 1970’s. And during its early phases, the majority of the 20th century, financial “planning” professionals were affiliated with or working for insurance companies.

Over the last several decades, the public demand for fee-only, financial advice has steadily increased. But even today, the majority of “financial planners” are still commission-based salespeople who receive their education and influence from product manufacturers (life insurance companies, mutual fund companies, etc). Most financial planners still don’t receive their education from independent sources.

Today the CFP® Board continues to institute a level of competency, educational standards, and ethics to make it easier for consumers to know what they can expect from an “advisor.” But the industry still has a ways to go, and dentists should learn to examine the source of education that is driving their advisor’s opinions. Finding a good advisor today is easier than ever before, but fee-only fiduciaries still make up a small minority of the overall advisor population.

Why Are Some Dentists Hesitant to Hire A Financial Advisor?

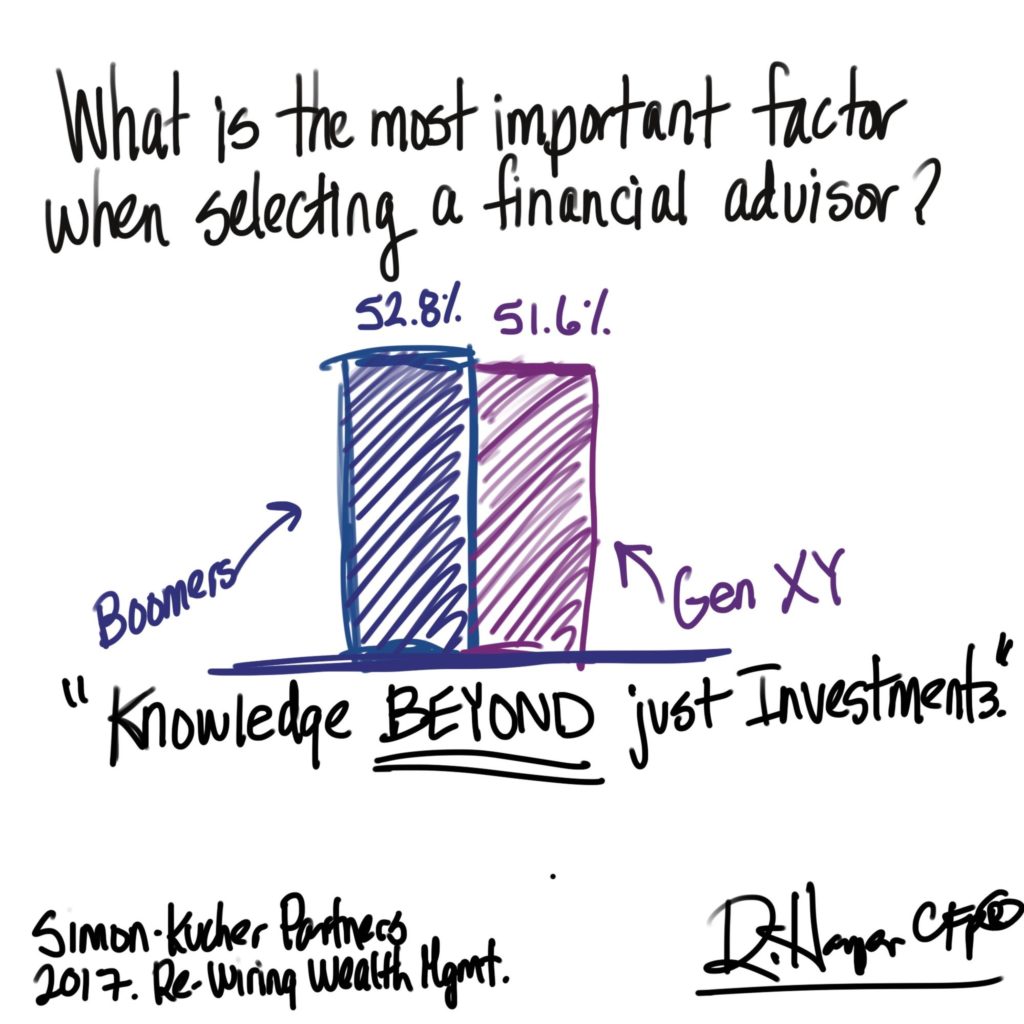

In a recent survey, Simon Kucher & Partners found that the number one factor for hiring an advisor was “knowledge beyond just investments.” This was consistent among younger Gen XY clients, and boomer age groups.

This is super interesting to me. You’re hiring a financial advisor to manage your investments and ensure that you achieve good returns but your primary value is whether he or she can provide you with knowledge beyond just investing.

To me, this is more evidence of how investment management is really becoming a commodity—and the public is rightfully looking for financial advice that helps them integrate the overwhelming amount of information they have to process. But the public is asking for “knowledge beyond investments,” which is still largely undefined. And the great majority of advisors fall short of expectations on a regular basis.

For this reason, some dentists are hesitant to hire a financial planner. The problem seems to be most advisors don’t add enough value for what they’re charging (and they tend to offer a fairly limited scope to the services they actually do provide) many of them focusing almost exclusively on investment management.

Because the financial planning industry is so new, there are very few standards that define what a “financial advisor” does. Of course, they advise people, but unlike more mature industries (dental, legal, accounting) each advisor’s services vary significantly. That’s partly because financial planning tends to be such a broad, open-ended term. A financial plan can be quite holistic, and dynamic, or it can be very narrow in scope and more like a dusty binder on a shelf. Although that’s changing, you can’t speed up history.

Unfortunately, because the financial planning industry is so new, it’s likely that among the sea of people who call themselves financial advisors you’ve yet to come across one with real training in exactly what you’re looking for. So don’t be surprised if you haven’t found an advisor you align with. But a competent and specialized financial advisor can be an integral part of your advisory board, and dramatically improve your ability to make smart financial decisions.

This is What I Mean by “New Industry”

Dentists started to be necessary as soon as people’s teeth began to hurt (and that was a long time ago) making dentistry one of the oldest medical professions dating back to 7000 B.C. Lawyers were needed as soon as there were laws passed in ancient Greece. The accounting profession dates back to ancient Mesopotamia as the need for counting became a thing. Rudimentary auditing and accounting systems were also essential in early Egyptian and Babylonian societies.

However, personal financial advisors really didn’t become necessary until the late 20th century. As our modern economy became more complex, personal finance also became more complex. And as this happened, it became more difficult to organize everything, analyze alternatives, make decisions, and take all the necessary actions.

Financial Planning Roots Only Date Back to the 1970’s

Today, the most respected association of financial planners is called the Certified Financial Planner Board of Standards. This board administers the CFP® certification. Headquartered in D.C., it’s primary objective is to benefit the public by promoting the value of professional, competent and ethical financial planning services, as represented by those who have attained CFP® certification (an education, ethics, and testing system that is quite rigorous).

The existence of a credential that establishes minimum levels of competency was a big step forward for the industry (although the CFP® is not the only factor to consider when hiring an advisor). If you can find a CFP® professional who has experience in dentistry, and who is a fee-only fiduciary, you’re going to work with someone who has an acceptable degree of competence, plus the right incentives. We had a good podcast on this topic, which described how to understand whether your advisor is one of the “good guys”.

The intention of my short history lesson is to simply illustrate how professions that have been around for generations are likely to have more consistent standards and practices, more public awareness, and more general competency within the entire body of professionals. Financial planning is making great strides and I’m proud to be a part of an industry that is helping people save time, and navigate a complex financial world. But as a whole, there are still too many advisors that are falling short of the commitments they are making to their clients.

What is Meant by Financial Planning?

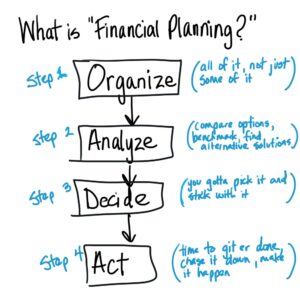

The process is actually pretty simple—organize stuff (constantly); then analyze stuff (once it’s organized); then make decisions (between various choices); then act (go get er done). But you can’t leave any financial subject out––debt, taxes, legal, estate planning, insurance, retirement, and a dozen more topics. Real financial planning means all of these areas need this same systematic treatment.

The person who follows this process across all areas of their finances ultimately grows their total wealth faster and makes the most of what they have (the lifetime income they’ve made).

Take a minute to think about how financial markets and financial planning has changed over the past 50 years. Technology and the internet have brought unprecedented access to consumers. But they have also increased the complexity of many things, including financial planning. There is MORE to organize, MORE to analyze, MORE decisions to make, MORE actions to take. For this reason, the future of the financial planning profession is bright. Unless you bring a fairly substantial financial background to the table, it can feel overwhelming and complex. And because of the broad financial background, it takes to be a real advisor, for too many, it’s easier to concentrate on selling products and calling it financial planning.

Conclusion

There are some critical advantages to a profession that has a few hundred or a few thousand years of history. The professional education curriculum, university tracks, job descriptions, and mentorship opportunities are more prolific. The public understands what to expect from those services too.

Similar to how the medical and dental industries have developed into more standardized, and fully embraced professions, I believe the financial planning industry will continue to evolve, mature, and become more integrated into the lives of every-day consumers.

One advantage of being a newcomer industry is the necessary innovation that takes place to educate people and help them accelerate their progress. This results in new ways to solve difficult wealth building obstacles and new ways to address the financial complexities that stretch each individual.

You’ll find that financial advisors will have the most impact when they select an individual area of specialization. And the financial complexities within the dental industry are quite unusual and difficult to maneuver. My advice is to find an independent, fee-only fiduciary with a background in real financial planning who understands the financial intricacies and challenges of your occupation.