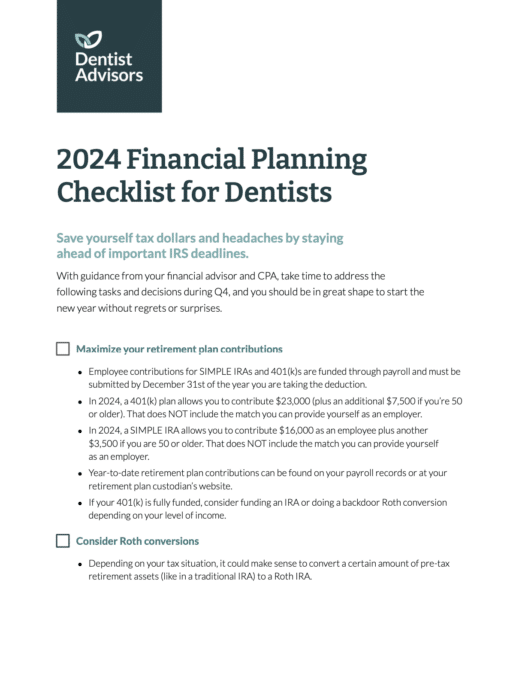

2024 Tax Strategy Resources

Welcome to Dentist Advisors, where we are dedicated to helping dentists make smart financial decisions.

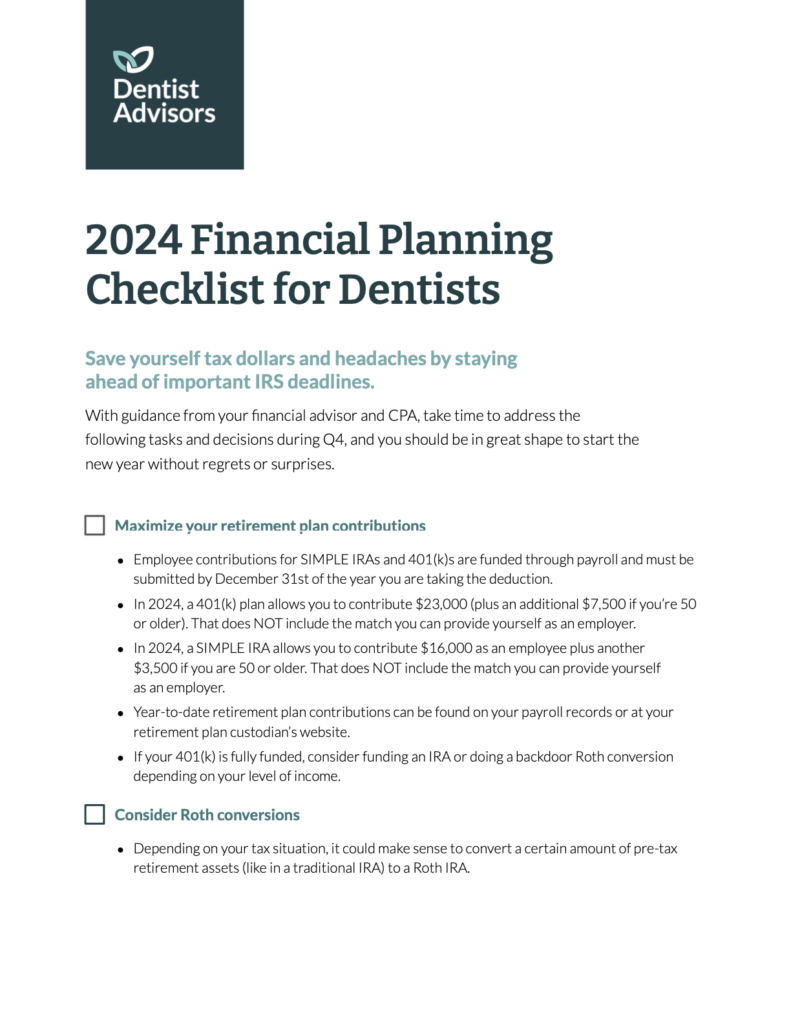

As we approach tax season, it is time to seize the opportunity to minimize your 2024 tax obligations.

Dive into our library of free tax strategy resources below!