March Madness. There’s something special about it. I never watch college basketball. Then the NCAA basketball tournament rolls around in early Spring and I’m glued to the screen. My heart is racing as I watch the final minutes between two teams that—outside of this event—I care nothing about. Then something occurred to me. Without the scoreboard, none of this would matter. That’s what creates the drama. The scoreboard is what gives the game meaning. In the end, that’s really the only reason people watch.

The same is true for money and life. We need a scoreboard to care.

The Investing Scoreboard

Benchmarking is common in investing. The tradition has been passed down from institutional money managers to personal investors. As an advisor, I often hear, “How did I do against the market?” Of course, the market they’re referring to is usually the S&P 500 index. It’s a valid question but flawed logic. The S&P 500 is comprised of the 500 largest companies in America. It has a tilt toward growth stocks. So unless your portfolio consists of 100% U.S. large-cap growth stocks, it’s not a great comparison.

You may be thinking the S&P 500 is still a valid benchmark for two reasons:

1. Warren Buffett said it’s where most people should invest their money

2. The S&P has crushed it for the last decade

Let’s address both of these points by referencing a period in history not too long ago.

A period many refer to as the lost decade.

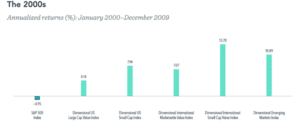

If you would’ve invested in an S&P 500 index fund at the beginning of 2000 and come back in 2009, you’d have less money than when you started. In fact, you’d have lost nearly 1% per year for a full decade. That’s the worst full decade for the US stock market in history. It’s easy to know why. During that period we saw the dot com crash of 2000 and the great recession of 2008.

The S&P couldn’t have been the only one. Surely stocks all over the world were getting killed during the same timeframe. Not so fast.

The S&P was, in fact, the only one. If you would have had a globally diversified portfolio, you would have avoided the negative returns of the lost decade.

To be fair, the S&P 500 rebounded and led all other regions of the world by averaging 13.56% per year the following decade. But let’s come back to the point of using the S&P 500 as your investing scoreboard. It’s not that it’s a bad metric, it’s that it’s an incomplete view of what a properly constructed portfolio should look like. Using an arbitrary benchmark—like the S&P—as your scoreboard provides an imperfect view of success.

Maybe you’re still questioning the logic. So let’s do a quick thought experiment.

If by the end of your career you realize you don’t have enough to retire but you beat the S&P 500, does it really matter? Conversely, if you reach your goals but underperform the market, do you really care?

Shifting your focus can be the difference between success and failure.

The Life Scoreboard

Research by Meir Statman and others found that the link between income and life satisfaction is relative. It’d be rational to think that a higher income would increase your lifestyle, which would increase life satisfaction. That’s a true statement… sort of. There is one key factor: how much your neighbors make in comparison to you.

In his book, Finance for Normal People, Statman references a survey that found participants would rather make $50,000 in a neighborhood where the average salary is $25,000 than make $100,000 in a neighborhood where the average salary is $250,000.

This isn’t keeping up with the Joneses. This is more about being well beyond the Joneses. Even if that means making a lot less money.

One study done in 2010 backs this up. The researchers state:

“We found the ranked position of an individual’s income predicts general life satisfaction, whereas absolute income has no effect.”

The scoreboard of money is a comparative one. We live in a world where being rich is not binary. Being rich is relative.

This is why you read a news story about how 64% of Americans have saved almost nothing for retirement. You feel grateful for your situation for five minutes before going right back to being jealous of your neighbor’s BMW.

A Better Way

Unlike basketball, you get to choose the game you’re playing. Choice brings power. But it’s also the essence of what makes the game so hard. When there are pre-established rules, it takes the guesswork out of it. That doesn’t exist in everyday life or with building wealth.

You decide whether you’re going to use a personal scoreboard based on your values and goals or a comparative one like how expensive your neighbor’s house is. The former has a possible end point filled with satisfaction and fulfillment. The latter is a game that never ends and will most likely drive you crazy.

Jason Zweig once wrote:

“Investing isn’t about beating others at their game. It’s about controlling yourself at your own game.”

You could replace the word “investing” with life and that sentence would be just as true.

What if instead of a random group of stocks, we used our personal goals as the finish line?

What if instead of what we see on Instagram, we used our own life as the scoreboard?

It’s worth a shot.

Here’s to making money matter!