Throughout our lives, there will be various big purchases that need to be budgeted for separately from regular spending and retirement savings. Whether it’s a home, a home remodel, a wedding, a car, a business venture, or some other large but infrequent expense, I get questions all the time that are some variation of the following:

“I want to buy X, how should I go about saving for it? And should I save or invest that money?”

As with all investment decisions, the answer boils down to your risk profile and time horizon.

In almost every case, cash is the most flexible and most reliable way to save for a big, upcoming purchase in the short term (i.e. a few years).

Now, I know what you’re thinking, “But what about inflation?”

I get that it feels counterproductive to just let your savings sit in cash earning nothing while you wait to use it, especially during this past year where we’ve seen inflation in the U.S. climb to 9.1%. Yes, historically inflation will cost you 2-3% a year while you save, but given that you’re only saving for a short period of time, the impact will be small.

For example, if you needed to save up $24,000 for a down payment on a house and you could afford to put away $1,000 per month, it would take you two years to get there without inflation. However, with 2% annual inflation, you would actually have to save for an extra month to make up for the $1,000 in purchasing power that inflation eroded away over those two years.

This isn’t ideal but is a small price to pay for the guarantee that you’ll have your money when you need it. The purpose of cash is flexibility and stability, not growth.

But what if you wanted to try and fight inflation while you were saving? Are there alternative options to just holding cash?

Yes, let’s take a look at a couple.

A common place for people to park money for short-term purchases is in bonds. For example, U.S. Treasury bonds can earn some yield while still being a low-risk asset. Well, low risk isn’t the same as no risk.

Nick Magguili, author of the finance blog Of Dollars and Data, studied historical data to see if investing in U.S. Treasury bonds (via an ETF/index fund) beat holding cash over time. What he found was that bonds beat out cash when saving for about three years, but not by much. In fact, 30% of the time you would have been better off holding cash.

This suggests that when saving for less than three years, cash is the optimal way to go since there is less risk around what might happen with your money. If you need to save for something that will take longer than three years, you can put your savings in bonds.

So, what about stocks?

Stocks offer a higher potential return than bonds but are more volatile. If you put your savings into stocks there’s a good chance you’ll make money, but also a chance you could lose a lot of money.

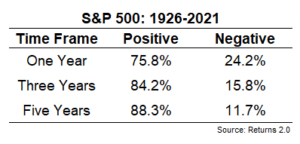

Going back to 1926, here are how often the U.S. stock market was positive over rolling one, three, and five-year periods:

That’s a pretty good winning percentage. However, there’s still a chance you could need that money in the midst of one of those negative periods and you’d be out of luck.

For example, let’s say you decided to invest the $50,000 you saved up for a down payment on a house in November of 2021 because the stock market was hot and you felt you were missing out on some returns. If all of a sudden the perfect house popped up right now and you had to sell your stocks, that $50,000 would only be worth $39,000.

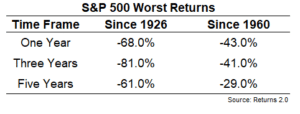

Here are the worst returns over the same time frames:

Even in more modern times, there have been market environments that were unkind to investors going out even five years.

When investing cash earmarked for an upcoming purchase, you just have to ask yourself if it’s worth the risk of potentially having less money if the stock market takes a dive at the exact moment you need to spend it.

You also have to consider how much money you can really add by taking on more risk. With upcoming purchases, you don’t have as much time to allow compounding to do the heavy lifting for you when you’re saving over a handful of years. Not to mention that any gains will also be subject to capital gains tax, which will eat into your return.

An extra 5% on $10,000 is $500 per year. That’s not nothing, it’s real money, but it’s not changing your life either. If you want life-altering money in the short term, you have to move from investing to speculation.

In short, the length of time over which you have to save for a big purchase should determine how and where you save for it.

For big financial goals that are many years to decades into the future—like retirement—you need to invest your money to preserve its purchasing power and build wealth. Over the long run, holding onto cash is dangerous because its value will be washed away due to inflation.

However, when saving for big purchases within the next few years, cash is king.

Thanks for reading!