Where do I start? It’s such a simple financial question that most are afraid to ask. The ubiquity of money might create a misconception in your mind that you should be an expert with it. But maybe you’re not. So you don’t ask and you go on not knowing. Even worse, you assume everyone else knows what they’re doing. And it’s a huge reason no one talks about it. So let’s talk about it.

Here’s your starting point.

Get Organized

If you had a goal to lose weight, what would be your first step? I’d guess it would be to step on the scale. At least it should be. You need to know where you stand in order to know where you’re going. For those who remember going to malls, it’s kinda like the maps with the red dot that say “you are here.” You find the dot. Then you find your destination in relation to the dot. Money is the same. You need a reference point for your wealth. Then you can start game-planning where to go next. The red dot of wealth is your net worth.

Here’s how you do it:

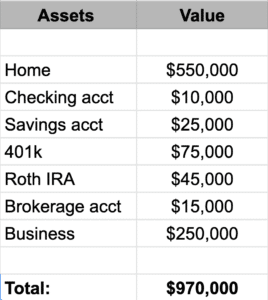

Step 1:Get a sheet of paper (or a spreadsheet). Write down all the things you own (assets) in one column. Common things on this list would be your bank accounts, investment accounts, 401k, and any businesses or real estate you own.

(Note: In general, I wouldn’t include your car as an asset. For most people, this is simply a consumer expense that will be included in spending).

Step 2: Write down the value of each asset in a second column.

Step 3: Total the values of all your assets at the bottom of the second column.

It might look something like this:

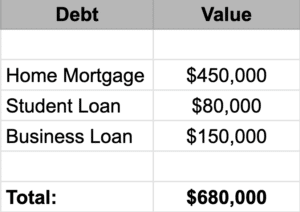

Step 4: Do the same as steps 1-3 but with all of your debts. This list would include things like your mortgages on any real estate, student loans, and any business loans you may have.

(Note: If you don’t include your car on the asset side, don’t include your car loan here. Also, if you’re paying off your credit card balance every month, don’t include it here. If you have a credit card balance that you carry from month to month then you should include it).

Your list of debts might look something like this:

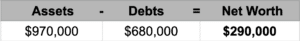

Step 5: Subtract the total value of your debts from the total value of your assets. The result is your net worth.

Assets – Debts = Net Worth

In our example, it would look like this:

Track Net Worth Over Time

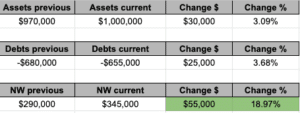

Now you have a starting point. Go through this at least twice per year. Keep your previous numbers and compare them each time you review. This will help you see if your net worth is moving in the right direction—up. Even better, you’ll be able to see what’s making it move.

There are three levers that move net worth:

1. Savings

2. Debt reduction

3. Investment growth

Over time, it might look something like this:

It’s easy to lose track of your progress. Oftentimes, it might feel like you’re not making any. And maybe you’re not. But until you step on the scale, you won’t know. As you build the habit of tracking, you’ll know where to make tweaks or double down. You’ll know where to look if you’re not seeing the growth you want. This isn’t a cure-all for your money worries and stresses. It’s simply a starting point. Getting organized gives you control. It gives you an understanding of where to go next.

The more often you do this exercise, the better. Tracking your progress is a powerful money tool. It builds momentum and motivation. As you see your net worth growing, you’ll feel inspired to keep up good habits like saving and investing. If you’re seeing a downward trend, you’ll know you need to make some changes. The starting point is getting organized.

Here’s to making money matter!