Every year Gallup conducts a survey that asks a group of 500 Americans what they think is the best long-term investment between stocks, bonds, cash, gold, and real estate.

Your mileage may vary on how much stock you put into surveys like this. Still, regardless of how accurate a representation it is of how Americans truly feel, the data makes for an interesting discussion at the very least.

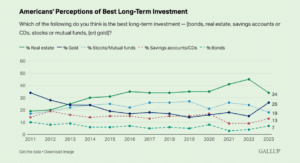

Here are the survey results for each year dating back to 2011:

Since 2014, real estate has held the top spot as the best long-term investment in Americans’ minds.

I don’t find this surprising. Anecdotally, pretty much every person I talk to about money or investing tells me they’re passionate about getting into real estate.

More people own real estate than own stocks. Around 50% of households in the U.S. own stocks and the homeownership rate is over 65%. Real estate also makes up a significantly large portion of people’s wealth. For the bottom 80% of Americans, two-thirds of their wealth is tied up in their primary residence while just 12% resides in other financial assets like stocks or bonds. And people tend to believe that whatever asset class they own is the best investment.

It’s difficult to calculate your actual return on real estate because most people underestimate all of the ancillary costs involved like property taxes, insurance, maintenance, upkeep, renovations, and borrowing costs. But for the majority of the past century, house prices have barely kept pace with inflation.

However, there has been an upward trend in housing returns over time with prices growing at around 6% annually in the past decade or so. I would hazard a guess that this recent housing boom coinciding with the respondents of the survey favoring real estate over these other asset classes isn’t a coincidence.

Although, it is worth noting that the 34% of Americans choosing real estate this year is a steep decline from the record-high of 45% last year. With interest rates skyrocketing over the past year and house prices continuing to rise, housing has never been more expensive. I can see why people would look at the real estate market now with less exuberance than in the past few years.

What is surprising to me is that gold took over the number two spot this year. The perception that gold is the best investment has almost doubled since last year, rising from 15% to 26%.

I would assume this has something to do with people being wary of the real estate market and anticipating a stock market crash. So gold seems like a safe alternative.

This has happened before. In fact, back in 2011 and 2012, gold was perceived as the best long-term investment according to this study.

How did that intuition turn out?

Well, the following graph from Ben Carlson shows that the yellow metal hasn’t quite performed as well as people thought it would:

After adjusting for inflation, an investor in gold has lost money over the past decade.

Now, I’m not sharing this chart to dunk on gold or to say that you shouldn’t invest in it. The point I want to make is that we’re not good at predicting the future.

Our perception of what we think will be the best long-term investment changes from year to year. And it’s largely based on what is currently happening in the economy. When real estate prices soar the popularity of the investment goes up. When there are worries about the economy, gold surges to the top.

In short, we are extremely vulnerable to getting caught up in the moment.

“People spend too much time on the last 24 hours and not enough time on the last 6,000 years.” – Will Durant

The good news is, unlike they do in a survey, no one is forcing you to pick one asset class to invest in for the rest of your life.

Thanks for reading!