Let’s talk about investment performance.

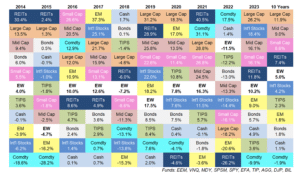

One of my favorite investing charts is Ben Carlson’s asset allocation quilt which shows the annual performance of different segments of the market. He updates the chart at the beginning of each year and I wanted to share the most recent version here.

Before we dive in, here’s a key to help understand the chart:

Large Cap – Big U.S. stocks. Think Apple, Amazon, and Google.

Mid Cap – Medium-sized U.S. stocks. Think DocuSign, Zoom, and Monster Energy.

Small Cap – Small U.S. companies. Think Cracker Barrel, Crocs, and Etsy.

REITs – U.S. real estate.

EW – An equal-weighted portfolio of U.S. stocks. Meaning each stock within the portfolio is given the same weight or allocation regardless of its size.

Int’l Stocks – International stocks across 21 developed market countries within Europe, Australasia, and the Far East.

EM – Emerging markets include stocks across 24 emerging market countries like Brazil, Poland, and Greece.

Bonds – Total U.S. bond market.

TIPS – Bonds issued by the U.S. government that adjust their value based on inflation.

Cash – Self-explanatory.

Comdty – Commodities like gold, silver, crude oil, and natural gas

Ok, without further ado, here’s the latest update through the end of 2023 along with 10-year trailing returns:

A few comments:

2023 was a bounce-back year. 2022 was a bad year for most asset classes and 2023 was a good year for most asset classes. In 2022, commodities did well. In 2023, they did not. Stocks and real estate got crushed in 2022. In 2023 they bounced back. Mean reversion was the lesson over the past two years.

• From 2008 to 2022, cash returned a total of just 13%, which is an annual return of around 0.8% per year. This makes sense because interest rates were so low for so long. One of the benefits of interest rates increasing is that you can now get paid to hold onto cash. Cash returning almost 5% last year is the best year for cash since 2000 and the first time you could get over 4% since 2007.

• Bonds haven’t had the best decade. The Aggregate Bond Index had roughly the same return as cash over the past 10 years, which is to say, not much.

• It’s also been a rough decade for people holding onto commodities. Negative returns over the past 10 years.

• On the flip side, large U.S. stocks led the way again in 2023 and have been the best-performing asset class over the past decade. Since 2009, the S&P 500 is almost up 14% per year or close to a 350% total return.

• The performance of the S&P 500 over the past decade or so has led many people, and reasonably so, to wonder, “Should I just own a 100% U.S. stock portfolio?”

I don’t have the time this week to dive into that question, but fortunately, Nick Maggiulli recently wrote an awesome article addressing that exact question in a far better way than I could anyway.

Here’s a link to the article. I would highly recommend giving it a read when you get the chance.

He gives historical data and evidence to show that while large U.S. stocks have performed well over the past decade, that hasn’t always been the case nor does it mean this trend will continue indefinitely into the future.

My last comment about the asset allocation quilt is we have no idea what it’s going to look like this coming year. The point of the chart is to show that there hasn’t been a predictable pattern over the years.

Sometimes one asset class will perform great for one year and then plummet the next. Other times, an asset class will perform well for a few years in a row. One year commodities will be the top-performing asset and then be the worst the very next year. Or maybe an asset class stays in the middle for an extended period of time.

There is no rhyme or reason to asset class performance from one year to the next. Or even one decade to the next.

So, how do you prepare for this?

Well, the cool thing about investing is there are many ways to go about it. You don’t have to try and pick the biggest winners year to year.

Instead, you can admit you can’t predict the future and simply buy a globally diversified basket of stocks.

A well-diversified portfolio means there will always be a portion of your investments that are disappointing. But while you may never hit a grand slam, diversification also protects you from striking out. Which is the key to successful investing and building wealth over time.

Thanks for reading!