Almost exactly a year ago today, I wrote a post looking back on what had been a tough year for investors. The combination of rising interest rates and high inflation in 2022 led to huge downturns in stocks, one of the worst years for bonds in modern financial history, and a significant slowdown in the real estate market.

The U.S. stock market fell 19% in 2022, which was only the 12th time the market finished the year with double-digit losses in the past 95 years.

Needless to say, the vibes weren’t good.

And because gas prices or grocery bills weren’t going down, most people I spoke with anticipated that 2023 would be even worse than 2022.

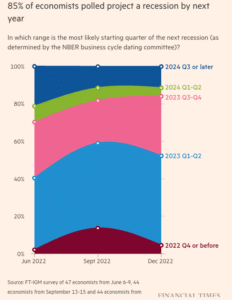

Economists, people paid to study the economy, were even more dire in their predictions. Here’s a poll showing the vast majority of economists expected a recession in 2023:

Or how about this headline from Bloomberg in the fall of 2022:

The first line of the article reads, “A US recession is effectively certain in the next 12 months in new Bloomberg Economics model projections.”

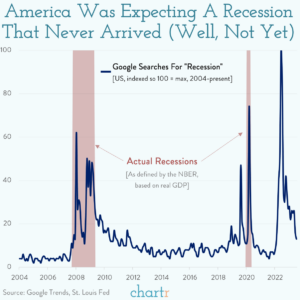

This messaging from the media came through loud and clear. Take a look at this graph which shows Google searches for “recession” hit an all-time high towards the end of last year:

A recession in 2023 was about as consensus an economic take as you can get.

However, in my post last year, I shared some historical data that suggested a more optimistic outlook for 2023.

Since 1928, only 9% of the time have stocks been down one year and then down the next year for consecutive losses. If you get even more specific, in previous years when the market finished with a double-digit downturn, like what happened in 2022, the following year produced a loss just four times. Only 4% of the time.

On average the S&P 500 has gained 15% in years following a negative year.

And as it turned out, 2023 did not fall into one of those 4% outlier years.

The S&P 500 gained a whopping 25% in 2023, rebounding all the way back from last year’s downturn, and is on the verge of hitting a new all-time high.

Now, I point this out not to toot my own horn (although I do hope you kept consistently investing in 2022 when stocks were on sale because you were rewarded with some great returns this past year), but rather to illustrate how unpredictable these things are.

When “everyone” is certain about the way things are going to work out, it usually doesn’t happen that way. “We didn’t see that coming” should be the default outlook when it comes to the stock market and the economy.

We’re still waiting on that recession. Should be any day now…

Turning our attention to this coming year, what does historical data tell us about what happens to the stock market after a gain instead of a loss Should we expect it to flip back to a down year?

Not necessarily. The data is still encouraging. Since 1928, the S&P 500 has been up roughly 55% of the time following a year with a gain. This makes sense considering the market is up around three out of every four years on average. Good stock market returns come in bunches.

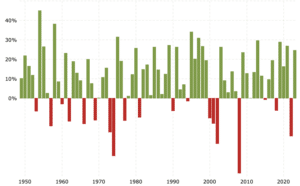

The following graph shows annual S&P 500 returns since 1950:

As you can see, down years are typically followed by a few good years in a row. This historical trend bodes well for 2024.

The last time we saw a negative year (like 2022) followed by a positive year (like 2023) then revert back to a down year (2024?) was in 1960 to 1962.

Does this mean that 2024 is guaranteed to be a great year for the stock market?

No. Of course not.

The stock market could be up or down depending on interest rates, the inflation rate, economic growth, earnings, investor sentiment, or something else completely that no one is even thinking about.

The next big risk is never the one everyone is talking about or planning for.

So what can we expect in 2024?

Well, at the risk of sounding too cliché, it’s probably best to expect the unexpected.

Thanks for reading!