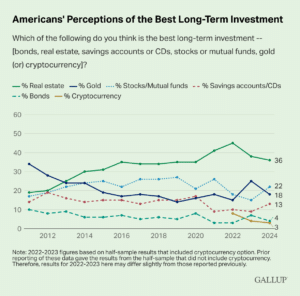

Each year, Gallup surveys hundreds of Americans on what they think is the best long-term investment between stocks, bonds, cash, gold, real estate, or cryptocurrency.

Your mileage may vary on how much stock you put into surveys like this. Still, I think the data makes for an interesting discussion at the very least.

Here are the survey results dating back to 2011:

For the 12th consecutive year, real estate takes the top spot as the perceived best long-term investment. And the gap between real estate and second-place stocks is quite large.

I don’t find this surprising. Anecdotally, pretty much every person I talk to about money or investing tells me they’re passionate about getting into real estate. There’s just something alluring about that brick and mortar.

I would hazard a guess that this recent housing boom coinciding with the respondents of the survey favoring real estate over these other asset classes isn’t a coincidence.

Additionally, more people own real estate than any other type of asset. And people tend to believe that whatever asset class they own is the best type of investment.

As of 2023, around 66% of Americans owned a home. For the bottom 80% of Americans, two-thirds of their wealth is tied up in their primary residence while just 12% resides in other financial assets like stocks or bonds.

It’s difficult to calculate your actual return on real estate because most people underestimate all of the ancillary costs involved like property taxes, insurance, maintenance, upkeep, renovations, and borrowing costs. For the majority of the past century, house prices have barely kept pace with inflation. However, there has been an upward trend in housing returns over time with prices growing at around 6% annually in the past decade or so.

The reason housing is such an important financial asset is it’s often the only investment people put money into each and every month for decades. A mortgage forces people to contribute thousands of dollars to an asset they otherwise may not have.

But that doesn’t mean real estate is the only path to building wealth.

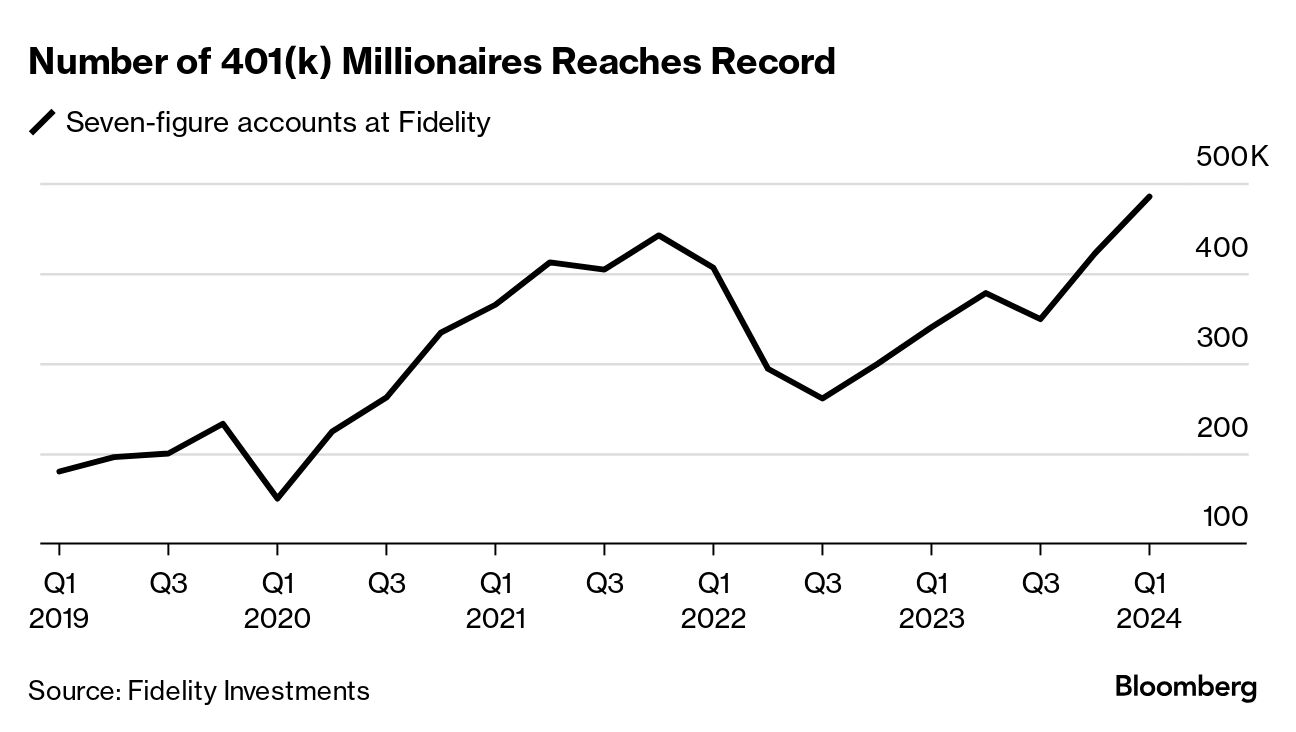

Fidelity Investments shared that the number of 401(k) accounts with a balance of $1 million or more rose to a record 485,000 in the first quarter of 2024:

These accounts make up 2% of the roughly 24 million retirement plans held at Fidelity.

So how have these people been able to achieve a 7-figure balance in their investment accounts?

Well, very much the same way you build equity in a house. These 401(k) millionaires had an average contribution rate of 17% and held their accounts for an average of 26 years.

Considering most mortgages take up far more than 17% of people’s income and $1 million is much larger than the average home value in America, I’d say a 401(k) is a great option for growing your money.

The good news is, unlike they do in a survey, no one is forcing you to pick one asset class to invest in for the rest of your life.

Thanks for reading!

Jake Elm, CFP® is a financial advisor at Dentist Advisors. Jake a graduate of Utah Valley University’s nationally ranked Personal Financial Planning program. As a financial advisor at Dentist Advisors, he provides dentists with fiduciary guidance related to investments, debt, savings, taxes, and insurance. Learn more about Jake.