Last year was difficult for investors.

Here are just a few of the economic challenges that led to a tough year in the markets:

• The highest inflation in four decades

• Record high gas prices

• War in Ukraine

• Federal Reserve officials publicly rooting for the stock market to fall

• A historic rise in interest rates

• Ponzi schemes and cryptocurrency crashes

• A slowdown in the housing market

• Double-digit losses in both stocks and bonds

The combination of rising interest rates and high inflation led not only to a bear market in stocks, but significantly impacted real estate investing as well. Additionally, it was one of the worst years for bonds in modern financial history.

There has been nowhere to hide.

If you own all tech stocks or recent popular growth stocks, you have been down bad over the past year. However, with a diversified approach to investing things haven’t been nearly as unfortunate. While downturns are never fun, diversified investors have been protected from the all-out crash we’ve seen in certain areas of the market.

As I’m writing this, which is a couple of weeks before it will be published, the U.S. stock market is down around 19% since the start of 2022. Unless there’s a Christmas miracle, the market is going to finish the year with double-digit losses.

If this downturn holds, it will be just the 12th time in the past 95 years this has happened.

While it’s been a tough past year, maybe I can offer some hope in the form of historical trends following a down year in the stock market.

Since 1928, the S&P 500 has been up roughly 55% of the time following a year with a gain. This makes sense considering the market is up around three out of every four years on average. Good stock market returns come in bunches.

But how often is the U.S. stock market down in consecutive years?

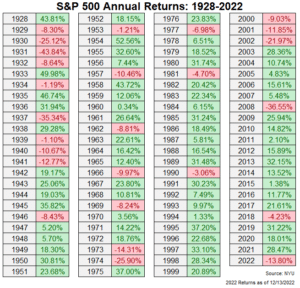

Since 1928, only 9% of the time have stocks been down one year and then down the next year for consecutive losses. As you can see from the following chart, losses cluster at times but not that often:

There were four down years in a row from 1929 to 1932. The market was down three years in a row from 1939 to 1941. It didn’t happen again until back-to-back down years in 1973 and 1974. The last time the stock market had a string of bad years was in the 2000 to 2002 bear market.

If you get even more specific, in previous years when the market finished with a double-digit downturn, like what happened in 2022, the following year produced a loss just four times. Only 4% of the time.

So history would tell us that the odds of experiencing another awful investing year in 2023 are pretty slim.

Now, I feel like I have to state the obvious. Historical data is helpful in understanding how markets work but is not a predictor of what will happen in the future. You can’t predict what’s going to happen in a given year based on what happened in the previous year. Markets aren’t that easy.

It’s not out of the realm of possibility that we’re approaching consecutive down years in the stock market. Most of the time good stuff happens in the markets, but sometimes bad stuff happens too.

You have to be able to survive a lot of bad stuff in the short term to get where you want to go long term.

Good investing comes from the understanding that long-term returns are the only ones that matter.

Thanks for reading!