You’d be hard-pressed to find a better calendar year for the U.S. stock market than what we’ve seen in 2024.

As I’m writing this, the S&P 500 is up just shy of 28% since January 1st.

Through December 4th, the S&P 500 hit 56 new all-time highs. That’s a new high one out of every four trading days and the fifth most of any year since 1929.

The worst drawdown from peak to trough was 8.4% and there have only been three days of 2% declines or worse.

As far as making money in the stock market goes, this year has been about as easy as it gets.

Why do I bring this up?

Well, this outcome wasn’t exactly predicted by the gurus on Wall Street at the beginning of the year. Coming off a market year where the S&P 500 rose 24% in 2023, many people were primed for a correction.

“We’re already at an all-time high, how can we keep this up? Inflation is still high, my gas and groceries still cost an arm and a leg, and there’s an extremely consequential presidential election that will throw a wrench in everything.”

There will always be a reason not to invest. If stocks go up, you’ll worry stocks are overvalued and you won’t want to get in right before they drop again. If stocks go down, your fears are confirmed and you still won’t invest because things aren’t looking good in the economy right now. In both scenarios, you’re still sitting on the sidelines.

And when years like the one we just had happen, waiting for the perfect time to invest can end up costing you quite a bit of money.

If you had $50,000 available to invest at the start of the year, you missed out on a $14,000 gain. If you had $100,000, you missed out on $28,000. So on and so forth.

What’s interesting is that while a 28% year-to-date return is awesome, it’s not out of the ordinary.

Dating back to 1928, the average annual return for the S&P 500 has been a little over 10%. Yet, while 10% is the long-term average, the actual yearly market returns are far more extreme.

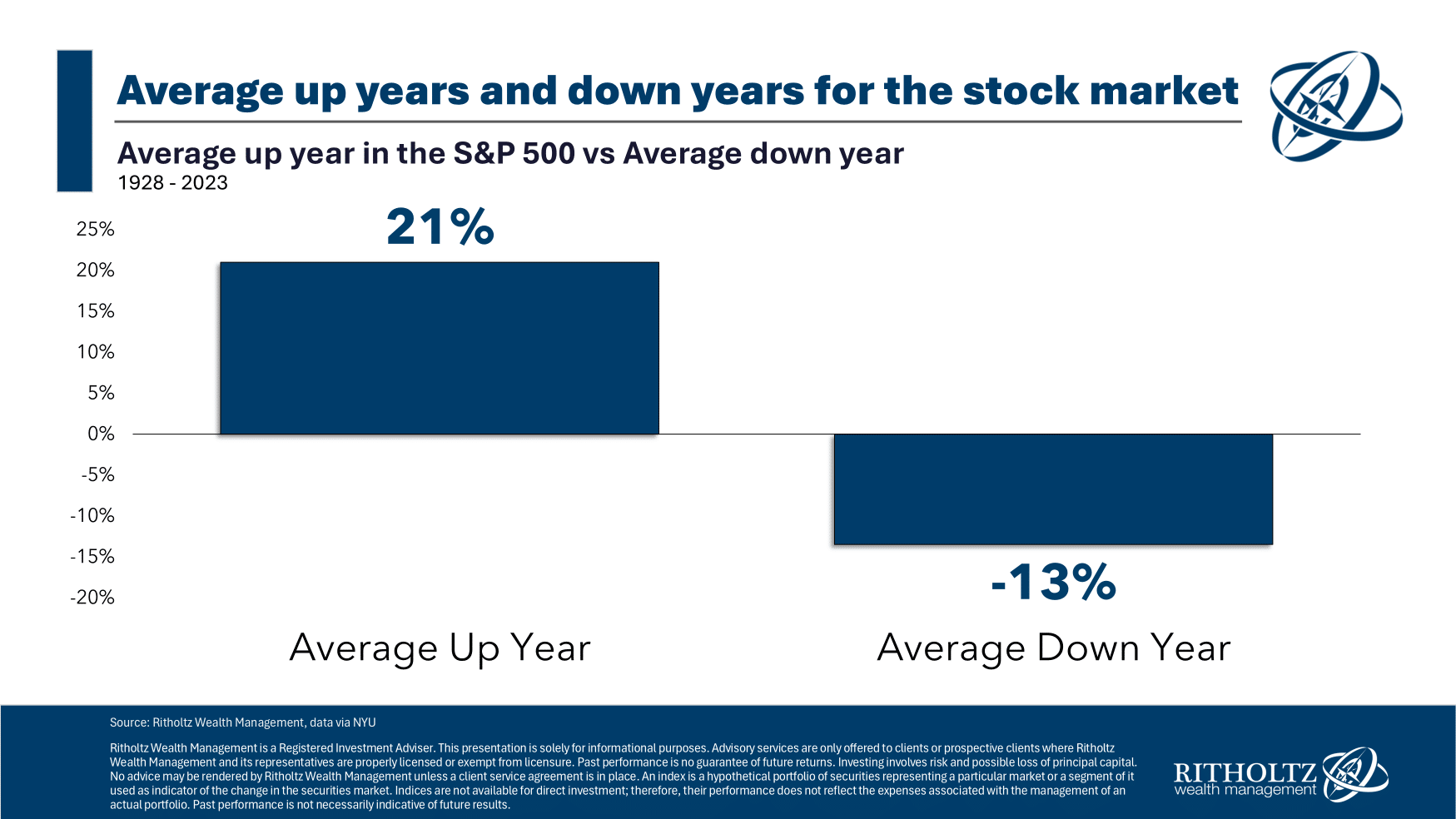

The average gain in an up year has been 21% while the average loss in a down year was -13%:

Gains of 15% or more have occurred in half of all years since 1928.

Additionally, 25 out of the past 96 years have experienced gains of 25% or more. In 18 of those years, the market finished up more than 30%.

Just look at some of the best years over the past decade and a half:

- 2009 +26%

- 2013 +32%

- 2017 +22%

- 2019 +31%

- 2020 +18%

- 2021 +28%

- 2023 +24%

- 2024 +27%

It’s been a crazy run for large-cap U.S. stocks over the past decade.

The point is big calendar-year returns happen more often than you think. But the same goes for double-digit downswings. In 2022 the market finished the year down 18%.

The lesson is to not be scared off by these big swings in the market year to year. They’re normal.

So, since the market has been so good this year does that mean we’re in for a letdown in 2025?

Maybe.

But that’s exactly what people forecasted at the end of last year and look how that turned out.

And I would hate to miss out on another year like this one.

Thanks for reading!

Jake Elm, CFP® is a financial advisor at Dentist Advisors. Jake a graduate of Utah Valley University’s nationally ranked Personal Financial Planning program. As a financial advisor at Dentist Advisors, he provides dentists with fiduciary guidance related to investments, debt, savings, taxes, and insurance. Learn more about Jake.</em