The only thing on my Twitter feed the past few weeks has been tweets about the collapse of Silicon Valley Bank.

Actually, I take that back. Threads about how ChatGPT will change my life dominate my timeline and they’re growing by the day. So that’s number one, the Silicon Valley Bank collapse is second, and then coming in third place would probably be tweets about whether the Utah Jazz should tank or try to make the playoffs.

I am not particularly interested in writing about ChatGPT—there are plenty of others already doing that. I would love to spit out a thousand words on why the Jazz should try to make the playoffs, but alas, I don’t think that’s what people are here for.

So, I guess I’ll write a few thoughts about the Silicon Valley Bank situation.

For those who aren’t familiar (I didn’t even know Silicon Valley Bank existed until two weeks ago), Silicon Valley Bank or SVB was founded in 1983 and was the premier bank partner for many of the most promising startup companies. Per their own homepage, 88% of Forbes’ 2022 Next Billion Dollar Startups were SVB clients.

SVB went from $49 billion in deposits in 2018 to $189 billion in 2021 as it rode the wave of a venture-funded bull market to become the 16th largest bank in America. Everything was going great for SVB until suddenly it wasn’t.

Like most banks, Silicon Valley Bank kept only a small chunk of its deposits in cash and invested the rest into long-term assets like government-backed mortgage bonds and Treasury debt, which are typically safe investments that provide modest returns. However, in order to combat rapid inflation last year the Federal Reserve began raising interest rates at a historic pace and any undergrad finance major can tell you that when interest rates rise, bond prices tank. So as rates quickly rose, the value of those investments plummeted.

Now, this alone wouldn’t cause a bank to fail but it happened to coincide with a slowdown in funding within the tech startup space. The same concentrated customer base that allowed them to grow so quickly during a bull market left them vulnerable when economic conditions weren’t as favorable.

Start-up funding began to dwindle, they received fewer deposits, and many start-up companies across the country had to withdraw from their accounts to pay employees and rent. To fulfill these requests, the bank had to sell some of its investments at a steep loss.

Once news got out of this huge loss, many in the tech industry became worried about the accessibility of their cash. After a few memos cautioning founders to withdraw their cash circulated around social media, start-ups rushed to pull out their money and things spiraled from there. Like a self-fulfilling prophecy, SVB had $42 billion in withdrawal requests in a single day which caused the bank to collapse.

In the unlikely event that a bank fails, there is this thing called FDIC insurance that protects your money up to $250,000 per person, per registered bank. No matter what happens to the bank, your cash is guaranteed up to that limit. For those who were unable to withdraw their cash in time from SVB, the government actually stepped in and made everyone’s deposits completely whole even beyond the $250,000 FDIC limit.

Rather than focus on the management or mismanagement of the bank’s assets, I’ve been more interested in the reaction to this event.

As I mentioned at the top, I’ve seen a lot of tweets about the closing of SVB all sent with an aura of fear and uncertainty. I’ve seen things like, “Is my money safe?” and “Are we headed for a national banking crisis like 2008?”

I understand people asking if their money is safe at a bank. Banks are supposed to be a safe place to store your cash, and with the news of a bank failure people are being forced to question that widely-held assumption.

The good news is FDIC insurance does exist, even if some people only recently found out about it. Meaning that a couple can have up to $500,000 in cash at a single bank that’s guaranteed, which should be plenty of coverage for most Americans.

But even putting aside the protections that are currently in place, it’s hard to imagine that regulators and politicians would ever willingly let the banking system collapse. Not a single person has lost money in an FDIC-insured bank since these protections were put in place in 1933. And no depositor who had cash over the FDIC limit lost money this time around either.

What does this mean for the economy as a whole? Are we on the verge of a banking crisis?

There will never be a shortage of people eager to tell you that the economy is about to crash, including news and media outlets. But that doesn’t mean it’s going to happen!

A study of 105,000 headlines and 370 million impressions found that each additional negative word in a headline increased the click-through rate by 2.3%. The study showed that headlines containing positive language are significantly less likely to be clicked on. They even compared the effect of negative words across different topics and analysis revealed that people are especially likely to consume political and economic news when it is negative.

“For reasons I have never understood, people like to hear that the world is going to hell.” – Deirdre McCloskey

Media companies thrive on negativity. It’s good for their business. However, it’s usually not best for your own personal finances. While pessimists may sound smart, it’s the optimists who actually end up making money.

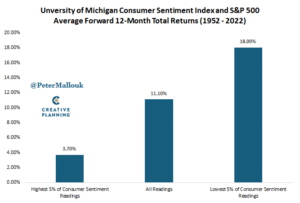

Consumer sentiment about the future of the economy is pretty negative right now. It’s actually been that way for a while now, many people have been calling for a recession for over a year and a half. The good news is people are historically terrible at predicting market performance and returns.

The less positive people have felt about the future, the better the market has performed.

Thanks for reading!