When it comes to investing in the stock market, average expected returns are thrown around a lot. Depending on who you ask, most say you can expect anywhere from 6% to 10% annual long-term returns. Historically, the average annual return for the S&P 500 has been 10%.

However, I’ve talked with a lot of people who say this hasn’t been their experience. They’re not getting these returns that everyone keeps throwing around. They’re frustrated and a little perplexed as to why the stock market isn’t working for them like it seems to be working for others.

I have two quick thoughts on why this happens.

First, they probably haven’t been investing for long enough. While 10% is the historic long-term annual average for the U.S. stock market, the actual yearly returns fluctuate wildly. You don’t start to see consistent, average annual returns until you’ve strung together a couple of decades of investing. Yes, you read that correctly, a couple of decades. A few years doesn’t count as “long-term.”

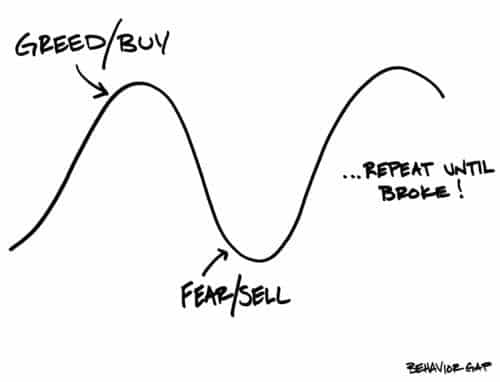

Another common reason for lower returns, but one more difficult to admit to ourselves, is due to what’s known as the behavior gap. The behavior gap, a term coined by financial planner Carl Richards, describes the difference between investment returns and investor returns.

Carl’s theory suggests that many investors earn lower returns than their investments. This gap between the returns that an investment produces and the returns that investors actually earn is caused by poor investor behavior.

As a matter of fact, there’s data to support his theory. According to research by Dalbar, for the 20 year period ending December 31st, 2019, the S&P 500 averaged 6.06% a year. But the average S&P 500 fund investor only earned a market return of 4.25% during that time.

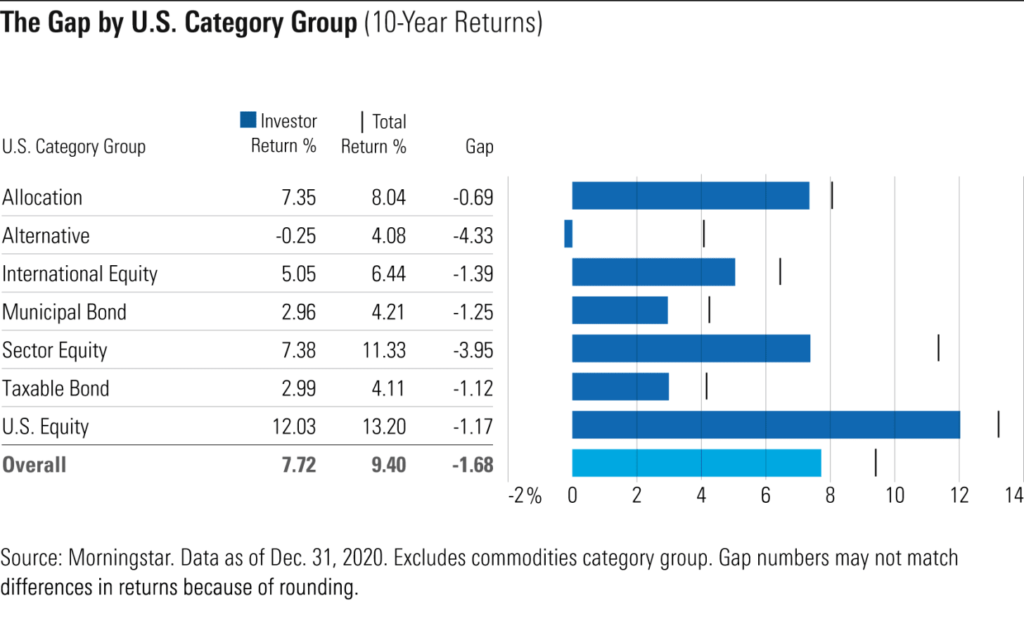

Morningstar runs an annual “Mind the Gap” study where they show investors frequently earn less than the funds they invest in.

Over the last 10 years, investors earned 1.7% less per year than the total returns their investments generated over that span. This is consistent with the gaps measured over the previous four 10-year rolling periods which ranged from 1.6% to 1.8% annually.

I understand that 1% to 2% per year may not sound like much, but over the span of multiple years it really adds up due to the compounding nature of investing.

The main cause of this persistent gap in returns comes from mistimed trades and over-trading.

When the stock market goes up, people experience FOMO and put money in. When it goes down, they get scared and pull their money out. Buying stocks at their highest price and selling at their lowest price is a sure way to underperform the market.

You could eliminate the gap completely by simply investing your money and not touching it. No buying and selling; just holding. But real people rarely invest this way. Money is emotional and emotional reactions cause illogical investment decisions.

“Investors are neither rational or irrational. They’re human.” — Jason Zweig

In short, it’s likely the problem isn’t the stock market or your investments; it’s your behavior.

Successful long-term investing has more to do with how you behave than your skill or what you know. It’s a very simple point, but shouldn’t be confused as easy. Changing behavior is extremely difficult. As Carl Richards says:

“We often resist simple solutions because they require us to change our behavior.”

Thanks for reading!