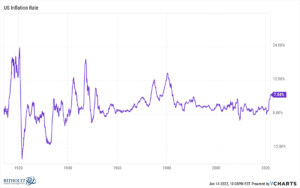

In the last couple of weeks, the U.S. inflation rate hit its highest level in 40 years at more than 7%:

This data has been all over the news and social media of late. No one likes to see the prices of the stuff they buy go up. It doesn’t matter if you’ve recently received a raise or a check from the government. It doesn’t matter if your house value is up 25% over the past year. It doesn’t matter if your investment portfolio is at all-time highs. Complaining about paying $0.50 more for a gallon of gas is something that unites everyone.

It’s also something we haven’t had to deal with in a long time. If you look at the chart, inflation has basically been close to zero for most of the last decade. And we haven’t seen an inflation spike like this since the 1970s.

Inflation has been so rampant that it even added an extra game to the NFL season.

Because it’s been such a hot topic of discussion, I wanted to give a few short thoughts on inflation.

Inflation is not consistent.

Seeing that big 7% number can cause some uneasiness and stress when we’ve been taught to expect average annual inflation of around 2-3%. However, I think it’s important to remember that inflation is volatile from year to year. Meaning, the U.S. inflation rate is never consistently 3% per year.

There are years of low inflation and years of high inflation. One way of thinking about the high inflation this past year is as catch-up for some lower levels of inflation the past decade. Even taking into account the giant spike of 7% last year, the average annual inflation rate for the past ten years is still only 2.15%.

Is 7% inflation here to stay for the next few years? Who knows. Historically speaking, inflation doesn’t move in a straight line in either direction for long. There will be peaks and valleys and everything in between in the years ahead.

We each have our own personal inflation rate.

The U.S. inflation rate is derived from the Consumer Price Index (CPI) which measures the average change in prices over time that consumers pay for a basket of goods and services. It’s simply an average and doesn’t mean that the price of everything has risen 7% across the board.

Inflation is a personal economic indicator. We all feel it differently and no one actually has a personal inflation rate that matches the aggregate average.

Take gas prices as an example. The national average was $2.35 a gallon a year ago and is around $3.30 a gallon today. If you have a job that requires you to be physically present and you have a long commute every day, you’ve really felt this increase in gas prices. Your personal spending has significantly increased compared to the person who works from home and hardly drives anywhere.

Meat has seen a similar rise in prices. Bacon prices have increased 17% and veal is up 22%. If you’re a vegetarian or a vegan, meat prices going up doesn’t really affect you. However, you’re really feeling the impact if you’re currently doing the keto diet.

Used car prices are up around 37% over the last year! It’s been a tough year for people in search of a new car. If you’ve had a car you’re happy with and haven’t needed to buy, then you wouldn’t have even noticed that car prices have shot up.

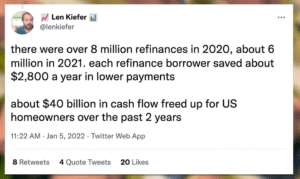

These past two years have been awesome if you’re a homeowner. Depending on where you live, house prices have increased anywhere from 20% to 30%. Not only has your house gone up in value but mortgage rates have continually gone down as well.

Len Kiefer, an economist from Freddie Mac, shared some stats on how much savings refinancing has given households these past two years:

But what if you’re someone who is in the market for your first house? If you’re renting while still looking for that first house and re-upped your lease in recent months it’s likely your rent payments have gone up. With the low supply of houses for sale, it’s common to have diligently saved for over a year for a down payment and be in no better position to get into a house because prices have risen so quickly.

Inflation impacts each of us differently depending on our circumstances and stages of life. We all like to believe intelligence or hard work determines financial success or failure, but our personal inflation rate is often determined by timing and luck as much as anything.

Stocks remain a good hedge against inflation.

The S&P 500 was up more than 25% last year; more than keeping pace with inflation.

Stock market returns can take your savings and keep them competitive with the prices in today’s economy.

When prices in various areas of the economy are running wild, it’s comforting to know that you have investments keeping pace.

The S&P 500 has compounded at about 14% per year for the last ten years. That rate of return would turn an initial $100,000 investment into $370,000 if left alone. Inversely, if you’d have put $100,000 in a bank account ten years ago you’d still just have $100,000 today.

As prices go up, your money has to go up too. That’s why you invest.

Thanks for reading!