Here are some charts and statistics that don’t necessarily have anything to do with each other, but have recently caught my attention:

#1

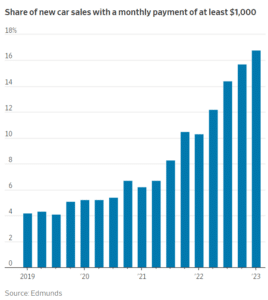

Look at the share of new car sales with a monthly payment of $1,000 or more:

Almost one in five new vehicles purchased in the first three months of the year came with monthly payments of $1,000 or more.

From a recent survey by Schroders, the percentage of Americans nearing retirement age (60-67) who said they have enough money saved was just 24%.

These two completely unrelated and separate data points can’t be tied together somehow… right?

#2

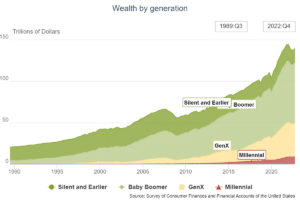

The following chart shows the trendline of total wealth held by each generation since 1990:

Boomers currently hold the bulk of net worth in the U.S. with over $73 trillion, Gen X comes in second with more than $40 trillion, and millennials bring up the rear with $8 trillion.

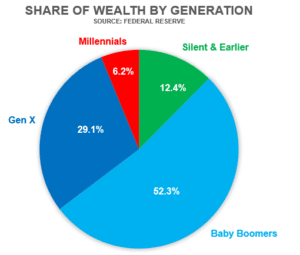

Here’s a breakdown by percentage:

As you can see, boomers own the majority of the wealth in this country. This makes sense as wealth tends to be positively correlated with age. They’ve simply had more time to save and invest and grow their wealth.

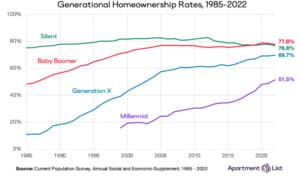

Before the younger generations get worked up, there’s data to show that millennials are actually doing just fine compared to previous generations based on where they’re at in their life and career stage.

What’s interesting to me about this info is there’s no real precedent for this boomer generation. Retirement is still a relatively new concept and there’s never been a demographic this big with this much wealth living this long.

The Wall Street Journal published a stat showing that by 2030 more than one in five Americans will be over age 65.

One hundred years ago, the average American died at age 51. Now, the average American is retiring at age 62. In the year 1870, for those who lived past age 65, the labor force participation ratio for males was close to 90%. Today it’s less than 20%.

#3

Speaking of baby boomers, according to the National Association of Realtors, boomers were the largest share of homebuyers last year for the first time since 2012— accounting for 39% of all home purchases.

There were more homes purchased with all cash last year than by first-time homebuyers.

I would assume the driving factor behind this data is the persistence of high house prices. From a monthly payment perspective, buying a house is as unaffordable as it’s ever been.

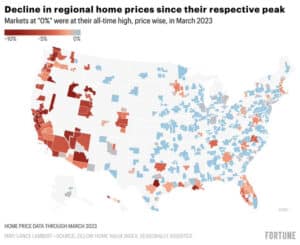

With the surge in house prices the past few years and with mortgage rates going from 3% to 7%, you would expect prices to fall to account for these added costs but that hasn’t happened as much as some people would like.

Lance Lambert notes that 55% of the 400 biggest housing markets in the country are either back to new all-time high price points or close to it.

Because so many homeowners are locked into 3% mortgage rates they’re unwilling to sell and double their rate by getting into a new home. So of the homes that are listed, 30.6% are brand new, which comes with a big price tag.

With a whole bunch of millennials still wanting to buy houses, demand is still exceeding supply creating a floor for prices.

#4

Let’s end with a non-finance-related chart:

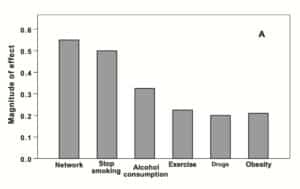

As it turns out, friends are good for you.

“By far the biggest medical surprise of the past decade has been the extraordinary number of studies showing that the single biggest predictor of your psychological and physical health and wellbeing is simply the number and quality of close friendships you have.

By comparison, all the traditional factors that your doctor usually worries about on your behalf make only modest contributions.” — Robin Dunbar

Thanks for reading!