I’ve been getting quite a few questions about the stock market and the economy recently, which makes sense as stocks have taken a tumble and many are worried the economy is heading toward a recession. This seems to be at the top of people’s minds.

So, here are a few charts about the stock market and the economy that I’ve found interesting and have been pondering lately:

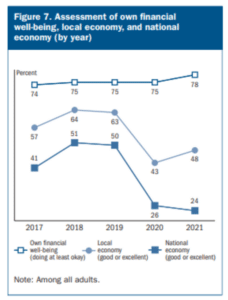

While a lot of people report being concerned about the financial well-being of the national economy, surprisingly, an equal amount of people also report being content with their individual financial situation:

This “Everything kind of sucks right now, but I guess I’m personally doing alright” sentiment appears to be a common feeling at the moment. People like to hate things at a national and abstract level but tend to be more optimistic about their own situation.

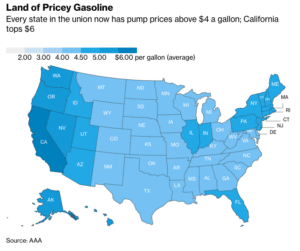

Something that almost no one is optimistic about right now is inflation. In a recent survey of Americans, inflation topped the list of biggest problems facing the country today and no other concern came close. For the first time ever, gasoline is now above $4 in every state:

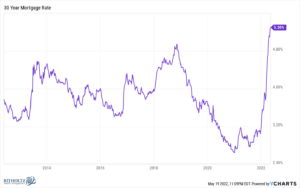

Not only have gas prices gone up, but mortgage rates have skyrocketed this year as well. The speed of this rate increase combined with the rise in home prices over the past two years makes this an extremely difficult environment for first-time homebuyers:

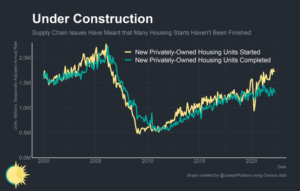

Because there has been such high demand, the number of houses under construction has jumped these past 18 months to meet that demand. However, due to supply chain issues and labor shortages, homebuilders can’t finish the houses they’re starting:

Since this housing boom, I’ve been doubtful that home prices would drop, or even stall anytime soon simply due to there not being enough homes for sale. Although, if supply chain issues can get sorted out to allow these new homes to be finished that would flood the market with supply. And with mortgage rates rising so sharply, which could impact demand, I’m open to the idea that house prices could take a step back at some point.

Sales of newly built homes fell 16.6% in April, their biggest monthly drop since 2013.

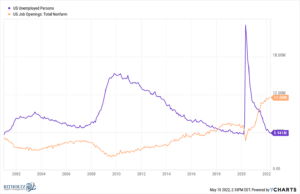

Despite feeling like the prices for stuff are going up every day, one reason people may have reported feeling confident about their personal financial situation is that the labor market is currently very strong. There are almost 6 million more job openings than unemployed people:

Basically this entire century, there have been more people unemployed than jobs available. Now we have a record number of job openings and not enough people to fill them. This piece of data doesn’t shout “recession” to me.

Also, remember when people were worried about robots taking everyone’s jobs in the future?

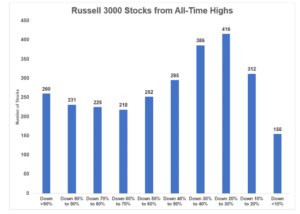

For those looking for an indicator of an upcoming recession, the stock market hasn’t exactly been reassuring this year. The Russell 3000 (an index made up of almost every U.S. stock) is down 18% from all-time highs. But look at how many individual stocks are down much more than the overall index:

While the stock market is in correction territory, many stocks are in a depression. Nearly 1 in 5 stocks are down 80% from their highs.

One quick comment I wanted to make is just because an individual stock is down 50% does not mean that it’s a fantastic buying opportunity and will bounce back. More than 40% of stocks in the U.S. since 1980 fell 70% from their peak and never reached those levels again.

Unfortunately, having a long-term mindset doesn’t always work with individual stocks. A basket of stocks can benefit from creative destruction, individual stocks do not.

No one has the ability to predict what comes next with the economy, inflation, or the stock market. The U.S. economy is so dynamic that a handful of charts can’t tell us what will happen. But hopefully, they give you some food for thought.

My Twitter feed suggests that the majority of people feel pessimistic at the moment which reminds me of a quote from Michael Batnick:

“Good things tend to happen when everyone is expecting the worst.”

Economic contractions are a feature not a bug of our economic system. Recessions don’t always have to mean the world is coming to an end. In fact, I can’t remember the last time that happened.

Thanks for reading!