I’ve written several posts about investing trends and fads that have become popular over the past year or so. A few that come to mind are cryptocurrencies, day trading meme stocks, buying and selling options, and NFTs. My tone has been cautionary as I consider these trends to be fairly risky, especially if you don’t know exactly what you’re getting into and if you’re just trying to make a quick buck.

Because part of my job requires me to stay up to date on what’s happening in the finance and investing world, I think I have a tendency to over emphasize these investing manias by thinking that everyone is getting involved in them.

But that’s simply not the case. The overwhelming majority of people still don’t invest at all, let alone get swept up in these fads.

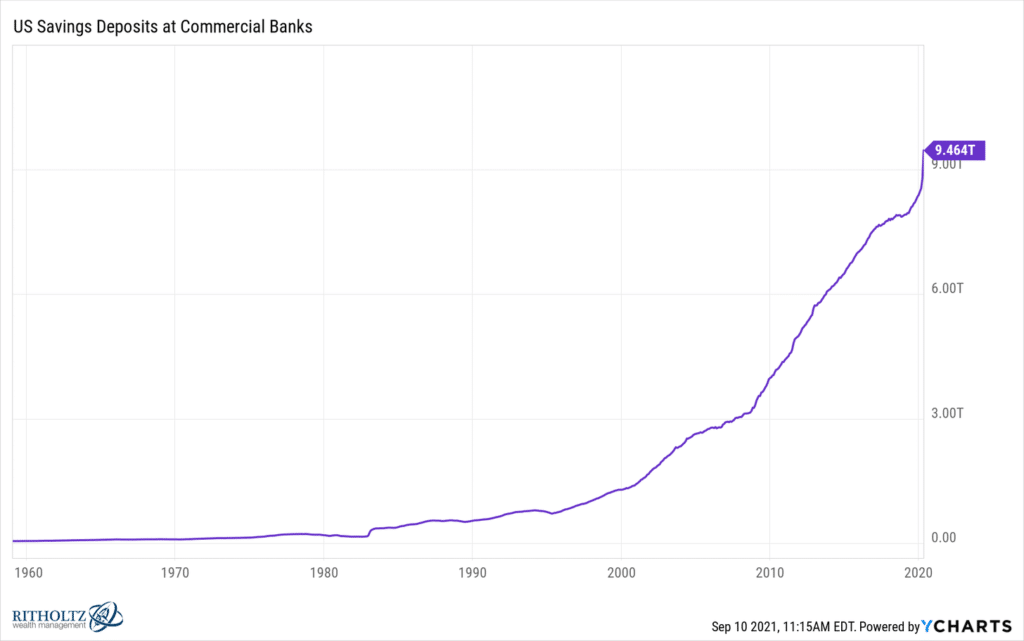

I was reminded that I might be getting caught up in my own investing bubble when I saw the following chart:

Nearly $10 trillion is being held in savings accounts in the U.S. This is over $1 trillion more stashed away in bank accounts than there was before the pandemic in early 2020. Given that the U.S. stock market is worth somewhere around $50 trillion, this amount of money in cash is meaningful.

A 2019 survey found that only 10% of Americans were investing in stocks outside of their workplace retirement accounts. And less than 20% were saving money into a 401(k) or an IRA.

The most popular place, by far, for people to stash away their money is into a savings account. Cash is safe. It’s easy to understand. Investing is volatile and risky. Many people either aren’t familiar or educated with stock market investing and some just don’t have the stomach for risk assets. So, their money sits in a bank. Yet, in order to build wealth, just saving up cash isn’t going to be enough.

Last week I received an email from Betterment, which is where I have my high-yield savings account, informing me that the interest rate on my account was dropping from 0.3% to 0.1%. Savings account yields are tied to the Fed Funds Rate which is currently at 0%, so it makes sense that “high-yield” savings account rates are low right now.

Doing some quick math, it would take 720 years for my money to double at a 0.1% rate of return in my savings account.

I’m all for acting and investing for the long-term, but I don’t think the Hypersleep Pods from Interstellar have been invented yet.

Now, I’m perfectly fine with a measly 0.1% return in my savings account because the purpose of the cash in the account is flexibility and stability, not growth. Cash is an important part of a financial plan and everyone should have enough cash to cover unexpected expenses and any upcoming major purposes.

But having too much money in a savings account that earns basically nothing will keep you from reaching your financial goals. Yes, there are risks associated with investing, but not investing and holding onto a ton of cash can be even riskier.

I love this analogy from finance writer Nick Maggiulli:

“Taking too little risk in your portfolio is like smoking cigarettes, taking too much risk is like doing heroin.

Both will kill you, it’s just a question of how quickly.”

Thanks for reading!