If you haven’t noticed, houses have been on my mind lately. I wrote about them last week and I’m going to do it again this week. However, instead of writing about the craziness of the current market, I want to focus on a more timeless financial question: Should you pay off your mortgage early?

As with almost all financial questions, the honest answer is … it depends. There’s no one-size-fits-all answer that works for everyone, but hopefullyI can provide a framework for how to think about it.

The context for this question is this: you have some extra money in your budget each month or you’ve stockpiled some extra cash and you’re trying to decide what to do with it.

Paying off your mortgage seems like as good a place as any to put your money, but is it the best place?

Well, it depends on what the alternative is. If you’re deciding between making an extra payment or spending that money on ice cream, the mortgage payment will provide the biggest financial benefit. If the decision is between an extra debt payment or contributing to your 401(k) and getting a matching contribution from your employer, a 100% return on your money from an employer match wins by a mile.

The simplest way to evaluate paying off debt versus another investment is to look at the interest rate on the loan compared to the expected return of the investment. Making an extra debt payment offers a guaranteed return equal to the interest rate. For example, an extra payment toward a loan with a 5% interest rate gives you a 5% return on your investment.*

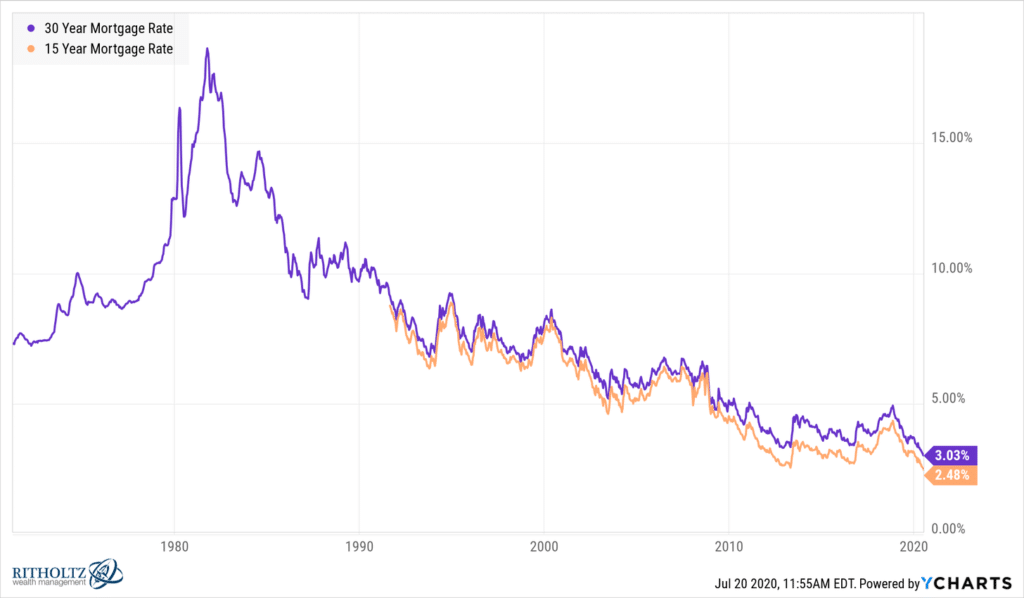

So, let’s take a look at mortgage rates. The following graph shows mortgage rates since 1970:

As you can see, it’s no wonder people were so eager to pay off their houses in the 80s and 90s. A 10%-15% rate is comparable to today’s high-interest credit card rates! You’d be hard-pressed to find an investment that offers a guaranteed 15% return on your money.

However, since the 90s mortgage rates have steadily decreased causing extra mortgage payments to make less and less sense. And today, with rates at 3% or lower, I’m not sure they make any sense.

Let’s say you have a $300,000 mortgage on a 30-year fixed rate loan at 3%, and you make extra payments of $500 every month. You’d save around $64,000 in interest over the life of the loan and shorten the length of the loan by almost 12 years. Not too shabby.

Now, let’s say instead of putting an extra $500 a month toward your mortgage, you invested that money. As I wrote about a few weeks ago, the average long-term return for the U.S. stock market has basically been 10% per year. If you invest $500 a month for 18 years at a 10% annual return you’ll end up with a little more than $273,000, which is a $165,000 gain. Over a 30-year time frame, you’d have $986,000.

The story is the same for any mortgage size or extra payment amount. The stock market has historically offered a much higher return on your investment than your house. Mathematically, it just doesn’t make sense to focus your financial efforts on paying off your mortgage early.

Yet, most people don’t live in a spreadsheet. We all live in the real world where financial decisions are rarely black and white. Our brains favor risk-averse decisions, like a guaranteed return from paying off debt, over the uncertainty of investing.

Some people may not care that paying off their mortgage early isn’t the most optimal use of their money. They just want the peace of mind that comes from getting rid of their debt payments. The emotional return trumps whatever they could get from the financial markets.

The problem with being so focused on paying off your house as soon as possible, apart from lower returns, would be the limited financial flexibility of having all your wealth tied up in your home. Your home shouldn’t be your only investment.

Should you pay off your mortgage early? It depends. Mathematically speaking, probably not. But it may lead to significantly less financial stress in your life which is a worthwhile pursuit.

To be honest, if you’re taking the time to learn about and work through these kinds of financial decisions, you’re already way ahead of the average household—no matter what choice you make in the end.

Thanks for reading!

*Early mortgage payments don’t actually guarantee you a return exactly equal to the interest rate. Since early payments are applied to the last scheduled payments where the least amount of interest is paid, your return will likely be less than your rate. You can read more here.