The housing market continues to be interesting to me. As most people are aware, over the past couple of years the housing market has been scalding hot. At the peak of the boom towards the end of last year, house prices had increased by over 20% in the span of a year, which was the largest one-year spike in the U.S. on record.

The good news for frustrated homebuyers is the housing market has begun to finally slow down in recent months. The rate at which prices are growing dropped by 2% in June, the biggest single-month slowdown since the 1970s. Home sales also dropped 5.9% in July compared to June, marking the sixth month in a row that sales have declined.

However, the bad news is even with prices slowing down, housing hasn’t suddenly become more affordable. In fact, that part has gotten worse due to mortgage rates skyrocketing this year.

Monthly mortgage payments have spiked with rates jumping over 2% in six months:

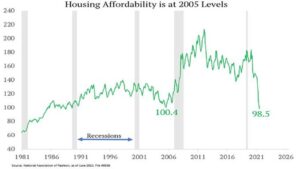

While the cost of getting into a home has lessened from the craziness of 2020 and 2021, rising mortgage rates have made housing even more unaffordable than it was then. Mortgage rates were around 3% during the pandemic and are currently sitting at over 5%—causing a sharp decline in affordability:

This environment continues to be difficult for first-time homebuyers, for whom I have a lot of sympathy.

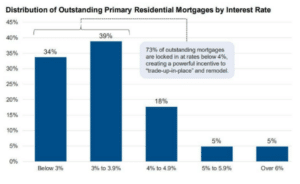

But this also proposes an interesting dilemma for those who already own a house with a 3% mortgage rate and need/want to move in the near future. They would therefore be forced to trade an extremely low rate for a significantly higher one.

These higher rates are making people reluctant to put up their houses for sale, which means fewer homes to choose from, which allows prices to stay high.

This is a choice millions of homeowners will likely face in the years ahead. Nearly three-quarters of all homeowners have mortgage rates of 4% or less:

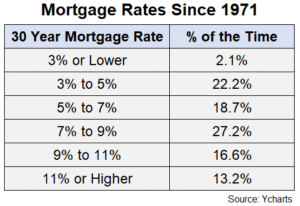

It’s possible we could see mortgage rates go much lower over the next few years, but it’s not a foregone conclusion. What if a 3% mortgage rate is the lowest we’ll see for decades? For some context, even rates in the 5% range are low by historical standards.

So, it’s understandable why people would be hesitant to give up an extraordinary mortgage rate. The most painful part about buying a new house at the moment is obviously the higher monthly payment.

Let’s assume you have a $500,000 house with a 20% down payment. At 3% that’s a monthly payment of a little more than $1,680 a month.

If you were to look at that same house with a 5.75% mortgage rate, you’re now looking at a payment of more than $2,330. That’s $650 a month ($7,800 a year) in extra payments for the same house. And that’s not assuming that any new house you buy now will likely cost quite a bit more than your current one—which means higher property taxes and upkeep as well.

So if you need/want to move, there are a few options:

• You simply buy the bigger house. The higher monthly payment will sting, but it’s possible you’ll be able to refinance down the road if/when rates come back down. Although, there’s no guarantee you’ll see 2.75% ever again.

• You could stay and renovate your current home. Most homeowners are sitting on a decent amount of home equity right now. It won’t be cheap, but you could possibly add a bedroom, update the kitchen, or even have kids suck it up and sleep in the same room. It all depends on how much room you want.

• You could look at other forms of financing. You could try an adjustable-rate mortgage (ARM) which will lock in a lower rate for a few years and then adjust to higher rates in the future. You would be betting on lower rates in the future which is a roll of the dice.

Unfortunately, all of these options will lead to high costs one way or another.

This is why a home is the most emotional asset people own. The spreadsheet answer would tell you to stick it out with the low mortgage rate, but buying a house is a complicated, emotional decision that usually ends up being more of a lifestyle decision rather than a financial one.

What if your family is growing and you just don’t have room anymore? What if you need to move for a job that will provide better opportunities in the future? Sometimes we have to make painful financial decisions for the benefit of family and overall happiness.

Again, this is more of a lifestyle decision than a financial one. But aren’t all financial decisions lifestyle decisions as well? What’s the point of making a smart financial move if it doesn’t directly benefit your life?

Thanks for reading!