I get this question a lot. Like most questions about life and money, the real answer is: It depends on your situation. Now I’ll take off my Captain Obvious hat and break it down.

Two Sides of The Coin

First, we need to discuss the two sides of all money decisions:

The Rational Approach: Zero emotion—only math, spreadsheets, and probability. The answer is always whatever is financially optimal.

The Reasonable Approach:

Takes into account the fact that you’re a human being. You have emotions and past experiences that impact how you handle money.

The Problem With Dave Ramsey

Before you start yelling, let me say Dave Ramsey has done more for society than I could ever dream of, I realize he’s improved countless lives with his message. With that said, Dave Ramsey has a brand to protect and project. The key to his $210 million net worth is his consistent, unwavering, and sometimes aggressive message for the past 30 years.

A message like this:

“Debt is not a tool; it is a method to make banks wealthy, not you. The borrower truly is a slave to the lender.”

I understand the rigid view. if you’re going to be adverse to debt or overleveraged, I’ll take the former every time. Dave Ramsey is speaking to a general audience. And a huge part of building a brand is being opinionated. But the truth is that “debt is evil” is too simplistic of a message.

As an advisor to dentists, I can safely say debt is a big reason each of them has a killer career. Banks do get wealthy off debt but the debt holder oftentimes does too.

Dave Ramsey isn’t the only one. Benjamin Franklin wrote:

“I’d rather go to bed without dinner than rise in debt.”

Despite what Dave (and old Ben) might tell you, not all debt is bad. Each loan, and the reason for it, is completely different. Saying all debt is bad would be like saying investing is bad because you know someone that lost their life savings on a penny stock.

Debt is a tool. The way you use it matters. I’m not advocating you go rack up a credit card to pay for stuff you can’t afford. But if going into debt helps you build a career that brings huge amounts of wealth and fulfillment, I’m all for it

(Quick side note: I’m not a fan of how expensive education has become over the last several years. It’s a real problem that needs to be addressed. That’s a discussion for another day.)

A Rational Example

Consider this scenario:

You have $100,000 sitting in the bank. You also have a $100,000 loan with a 3% interest rate.

Outside of taking the money to Vegas, you have two options:

1. Pay off the loan. Then make monthly deposits to an investment account equal to the minimum payment.

2. Make the minimum loan payments and invest the $100,000 in a lump sum.

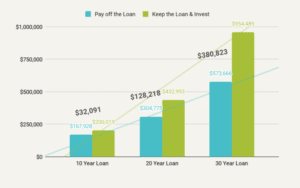

Let’s assume you get an 8% average annual return on your investment over a 10, 20, and 30-year timeframe:

That $380,823 difference over 30 years is called opportunity cost. It’s the price you pay for taking the guaranteed return of debt reduction instead of the ups and downs of growth assets. Dave Ramsey would probably insult you and tell you the numbers don’t matter. Stick to the “Baby Steps” and then build wealth. But unless you review the numbers, you could shortchange your wealth significantly without even knowing it. That doesn’t always mean you’ll always go the way of the spreadsheet. But at least you’ll be able to make a choice with all the cards on the table.

You’re Not Living in a Spreadsheet

The spreadsheet is the rational answer, but not always the reasonable one. The best strategy on paper is worthless if you can’t stick with it in real life. If your debt is keeping you up at night or impacting relationships, then it’s time to throw out the spreadsheet. If the personal cost is too high, I don’t care what the financial payoff might be—it’s not worth it.

Just Give me the Answer!

The truth is that personal finance is more personal than it is finance. All money decisions are about balancing the math and the heart. Often what’s good for your balance sheet will, at times, come with bouts of stress and heartache. Finding harmony between the rational and reasonable is the key to an effective financial plan.

My advice would be to have an accountability partner, get organized, and then make a choice that you can live with.

Here’s to making money matter!