When having conversations about money, I often get questions that sound something like this:

“Jake, I’ve saved up $1,000. Where should I invest it to get the best return?”

My tendency is to go into full financial advisor mode and ask about their goals, try to understand risk preferences, and discuss diversification and investing strategy. However, I think the most appropriate response would be something along the lines of:

“That’s great! You should focus on saving another $1,000.”

The truth is, your investment returns really won’t matter. For now, at least.

When you’re just starting to invest, you would be far better off saving more money or growing your income than worrying about your investment returns. With smaller amounts of money, the total return you could receive over the course of a year is trivial.

Let’s say you save up $1,000 and put it into a specific stock with an expectation of getting a 10% return over the course of a year ($100). You could spend your entire annual return in one night out at a ballgame with your friends.

Now compare this with your possible future self that has accumulated $2 million in an investment account. A 10% return on that balance would result in a $200,000 gain. For most people, that annual return would be enough to sustain an entire year’s worth of living expenses including season tickets to your favorite sports team.

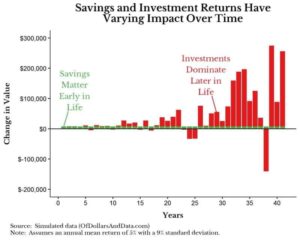

Nick Maggiulli ran an investment simulation showing multiple outcomes for someone saving $7,500 a year for 40 years at a 5% annual return. If you were to plot one random outcome and show how much was saved each year (green bar) compared to how much was gained/lost from investments in each year (red bar) it would look like this:

As you can see, early in an investment life cycle, savings are much larger than investment returns. Then, as you accumulate more assets, your investment returns begin to have a bigger impact on your finances.

By the end of this simulation, you would have saved $300,000 and gained $1.6 million in investment returns. The $1.6 million would represent 45% of your total assets in year 40 with the $300,000 saved making up the other 16%.

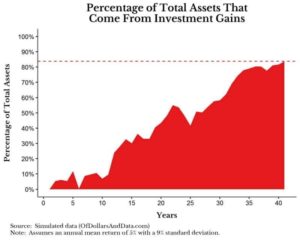

If you were to visualize what percentage of your total assets come from investment gains over time it would look like this:

Early on your wealth is built entirely by how much you save and then somewhere near the middle of your life cycle investment gains become more important.

A good exercise to determine if you should be focusing more on saving or your investment returns is to ask yourself the following:

Which is greater?

Your total assets multiplied by your expected annual return

or

Your expected annual savings

I want to note that this is a spectrum. You should never completely ignore your investments or your savings rate. Both are important but impact your financial situation in different ways depending on where you’re at in life.

I also want to bring up that, in general, how much you save is far more important than your investment returns.

Doubling your investment returns has much less impact on your wealth than doubling your savings rate. For example, 12% annual returns on $1,000 monthly savings gives you a smaller balance after ten years ($210,584) than 6% returns on $2,000 monthly savings ($316,339).

Not to mention that your savings rate is actually within your control. There are professional investors who grind 24/7 to add ten basis points to their returns when there are two or three full percentage points of lifestyle bloat in their finances that can be exploited with way less effort.

Big investment returns are awesome when they can be achieved, and some can achieve them. But the fact that there’s so much effort put into achieving high returns and so little put into savings presents an opportunity for most people.

A high savings rate means having lower expenses than you otherwise could, and having lower expenses means your savings go farther than they would if you spent more.

Thanks for reading!