Today’s post is going to be a short one; more of a thought than a fully fleshed-out essay. Which, I’m sure nobody minds during the busy holiday season.

In reference to good writing principles, French philosopher Blaise Pascal once said:

“Sorry for the long letter, I didn’t have time for a short one.”

Unfortunately, this is not one of those times where the brevity of the writing is due to meticulous pruning and revision on my end. I’m just trying to save myself some time this week. However, I still think this subject is interesting and definitely worth thinking about.

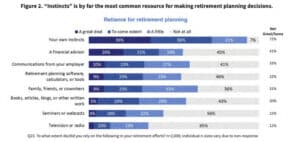

A recent study was conducted asking people what resources they use to help them make big financial decisions. The answers ranged from things like “a financial advisor” or “blogs and articles” to “friends and family.”

But the number one response, by a significant margin, was “instincts.”

Almost three-fourths of people report relying on their own instincts as the main instrument in making financial decisions.

What?!

The primary resource for big financial decisions that will impact the financial future and stability of your family is instincts? A gut feeling? A hunch?

As humans, we do think in terms of instincts and gut feelings in many areas of our lives:

“I’ll know it when I see it.”

“I just knew she was the right one for me. It just felt right.”

“I don’t need parenting books, I’ll just rely on my own instincts.”

So I understand how it’s natural to carry this mentality over to decisions around money. However, doing so often leads to what I like to call random acts of finance.

Shout out to Ryan Isaac who I think was the first to introduce this phrase to me.

In talking with people about their past financial decisions, I hear about decisions surrounding money that were made with no rhyme or reason all the time.

One year someone will use their extra cash to pay off some debt. The next year they’ll use it all on a vacation. Then they’ll get interested in becoming a real estate mogul and putting all of their extra money into investment properties. Then they’ll put some money into Bitcoin because they heard that’s going to the moon.

When I follow up and ask about the “why” behind these decisions, most of the time there isn’t clear intent or a cohesive strategy. It’s just what felt best at the time and what their instincts told them to do.

Personal finance touches so many aspects of your life that it’s imperative to spend some time putting the right financial systems in place.

At the very least, before making big financial or investment decisions, take the time to pause and ask yourself “why.” How does this decision impact your overall financial situation and does it help you get closer to your goals?

Wealth isn’t created with random acts of finance, but rather with intention and consistency.

Thanks for reading!