Over the past handful of weeks, there seems to be an increasing number of people who believe that a recession is on the horizon. Inflation is showing no signs of stopping, gas prices are still high, federal interest rates have risen sharply, and the housing market is getting crazier and crazier by the day. I wrote about how the yield curve inverted a few weeks ago, plus there’s an ongoing war so I can understand why many are bearish right now.

Google revealed that search interest in “food prices” and “housing prices” reached 10-year highs this month. And searches for “how to prepare for a recession” have nearly tripled in the last few weeks in the U.S.

A recent investor sentiment survey showed that individual investors’ outlook on the future of the stock market is the lowest it’s been since 1992.

I even spoke with someone the other day who assured me that we’d see a recession before the year is out.

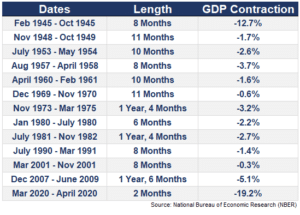

Is that person right? Obviously, I have no idea. There could be a recession this year or next year or four years from now. What we do know is that we will have a recession at some point. Since World War II, there have been 13 recessions in the U.S.:

This means that, on average, a recession has occurred once every 5.9 years.

So, if you do think a recession is imminent, the natural next question is how do you prepare for one?

If economic activity is going to drop due to decreased consumer spending, which leads to less revenue for businesses and therefore lower business valuations, then it makes sense to cash out of your stocks before their prices fall. Right?

Well, not really. That’s a difficult game to play.

Dalbar, a company that studies investor behavior, found that over the past 30 years the average annual return for people who had invested in the S&P 500 was 5.04%. Meanwhile, the average annual return for the S&P 500 itself was almost 10% over that same time period. What was the reason for the massive discrepancy?

The study found that the majority of underperformance by investors happened during a handful of market crises in which people cashed out of their stocks because the market was crashing.

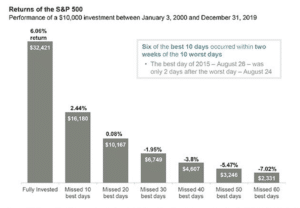

The problem with getting out of the stock market is you then have to figure out when you’re going to get back in. And if you miss out on just a few of the best performing days in the market, it can kill your overall investment performance:

During a 20-year time period, there are about 5,060 trading days. You can go from tripling your money to having much less than you started with by just missing 30 days out of 5,060.

Now you may be thinking, “Yeah, but isn’t it relatively easy to not miss the best days? If I’m cashing out when the stock market is crashing, how likely am I to miss out on one of those best days?”

As it turns out, pretty likely. Seven of the ten worst days were followed the next day by a top-10 performing day. The best-performing day in 2015 was only two days after the worst day.

The majority of your investment returns are built on just a few good days or weeks of market performance. The only way to guarantee that you’ll be able to take advantage of the best days is to stay invested and stick around during the worst days.

Going back to that investor sentiment survey that showed investors are currently as bearish as they’ve been since 1992, well, the S&P 500 is up 1,872% since 1992. It was still a pretty good time to buy.

Peter Lynch (legendary investor) once said:

“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves.”

The same is true of recessions.

So if cashing out of the stock market or moving your investments around isn’t the best way to prepare for a recession, then how do you prepare?

The same way you prepare your personal finances for anything else.

Give yourself a margin of safety with a high savings rate and an emergency fund. Pay your bills on time and keep a good credit score. Be diversified with your investments and don’t put all of your eggs into one basket. Don’t take on too much debt. Avoid lifestyle creep by keeping your personal spending in check.

The thing is, you should be doing these things regularly anyway, not just when you think there could be a recession coming.

Regardless of if or when a nationwide recession could hit, you could easily have your own personal recession at any time. Even when the overall economy is strong. Maybe you lose your job. Maybe your local economy starts to struggle. Maybe you get divorced. Maybe you incur a large unexpected expense. Or you could simply make a poor financial decision that costs you a lot of money.

The point is you don’t prepare for a recession by figuring out the exact start and end dates of the next slowdown in the economy. You prepare by building a financial plan that can survive a wide range of outcomes. You should always keep your financial situation prepared for any curveball life will inevitably throw at you.

Thanks for reading!