I’ve been getting an incredible amount of questions about I-Bonds. Are they running commercials during halftime of NFL games? Whoever is on the I-Bond PR team is doing a fantastic job.

Because of the amount of questions about I-Bonds, I figured it would be useful to write a brief explanation of what they are and how they work, followed by a general investing point I’d like to make.

U.S. Treasury Series I Bonds, commonly known as I-Bonds, are a government-backed investment that rises and falls with inflation. The recent buzz stems from the fact that inflation has been at its highest level in about 40 years and so these bonds have been offering a really high, guaranteed rate of return.

Every six months new rates are set for the bonds depending on a fixed rate and the current inflation rate. Since inflation has been running rampant, the I-Bond rate over the past six months (May to October 31st) has been a whopping 9.62%.

Sounds great, right? Why doesn’t everyone put all of their retirement savings into I-Bonds? Well, there are a few caveats.

First, you can only buy up to $10,000 worth of I-Bonds per person, per year. You buy them online through the U.S. Treasury website or you can buy an additional $5,000 in paper I-Bonds that must be purchased through your federal tax return.

The other important stipulation is you can’t cash out or redeem your I-Bond for at least one year. On top of that, if you need the money and cash out the investment before you’ve held it for five years, you’ll forfeit the last three months of interest.

When inflation eventually starts falling from the 40-year highs we’ve seen this year, I-bond rates will go down as well. For example, the rate was at 9.62% over the past six months but recently fell to 6.89%. So if you purchased $10,000 in I-Bonds right now you’d lock in a 6.89% return for the next six months. At the end of that period, you’d have made $344, and then the rate would reset again.

Historically, I-Bond rates hover anywhere between 1% and 4%, keeping in line with average long-term inflation rates. Generally, people invest their money with the goal of outpacing inflation over time, so I-Bonds aren’t the best long-term solution if that is your aim.

With the recent high rates of I-Bonds, they can be a good place to park some money if you have extra cash that you won’t need in the near future and are looking for some high, short-term returns.

However, they are not a silver-bullet investment product that will propel you into retirement. This I-Bond craze got me thinking about the general investing point I wanted to make, which is that nothing lasts forever when it comes to the markets.

One of the few dependable features of investing in the stock market is that it’s cyclical.

Let’s look at a few recent examples. For the better part of the 2010’s it felt like technology stocks were untouchable. They were growing like crazy and it seemed like there was no way these companies would ever lose again. And yet, the majority of the big tech names have been getting crushed over the past year:

I’m reminded of a saying I’ve heard which is, “Nothing fails quite like success in the stock market.”

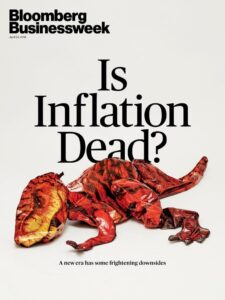

Take a look at this magazine cover from 2019:

For much of the last decade it did feel like inflation was dead. The Federal Reserve kept interest rates at 0% for more than six years and inflation was almost nonexistent in the 2010s.

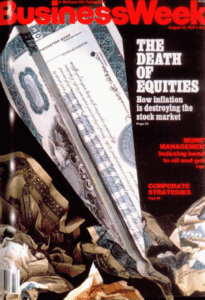

Or how about this magazine cover from 1979 which was published just prior to one of the best bull market runs of all time through the 80s and 90s:

As it turns out, equities (stocks) weren’t dead in 1979 any more than inflation was dead in 2019—they were just dormant for a while. That’s how markets work. Everything is cyclical.

Markets are cyclical because humans control the markets and humans are irrational. Investors go back and forth between fear and greed, speculation and conservatism, and patience and panic. People are always looking for something novel.

In 2021, Robinhood’s trading platform crashed because too many people were trying to buy meme stocks.

In 2022, the Treasury Direct website crashed because too many people were trying to buy I-Bonds.

These things come and go. The markets are cyclical. And nothing lasts forever.

Thanks for reading!