I was playing golf the other day and had an awesome five-hole stretch to finish my round. I scored three birdies and two pars, and could have even had another birdie had I made an easy 4-foot putt. If you had dropped in on my round and watched me play for just those five holes, you might think I’m quite a good golfer.

However, unfortunately for me, a golf round consists of 18 holes—not just five. Over the course of the previous 13 holes, I hit plenty of bad shots and recorded more bogeys than I care to share. If you had followed me around during this section of my round, you wouldn’t think much of my golfing ability.

At the end of the day, even with my Tiger Woods-esque run of five holes, my overall score after 18 holes ended up being pretty average.

This happens in the stock market too.

Just as your 18-hole score is all that really matters in golf, long-term returns are the only ones that matter despite the short-term ups and downs along the way.

Last year the U.S. stock market was down 18% from January to December. I remember having many conversations with people who were distraught with the returns they were seeing in their portfolios. The decline caused plenty of people to question if they should even be putting their money in the stock market.

Fast forward to this year and the S&P 500 is up around 17% since January. Now, my conversations have changed from people distrusting the stock market to wishing they would have invested more money in the market last year. All the in the span of a few short months.

This rollercoaster of returns especially applies to individual stocks. In a recent blog post, Ben Carlson shared some charts that illustrate this point.

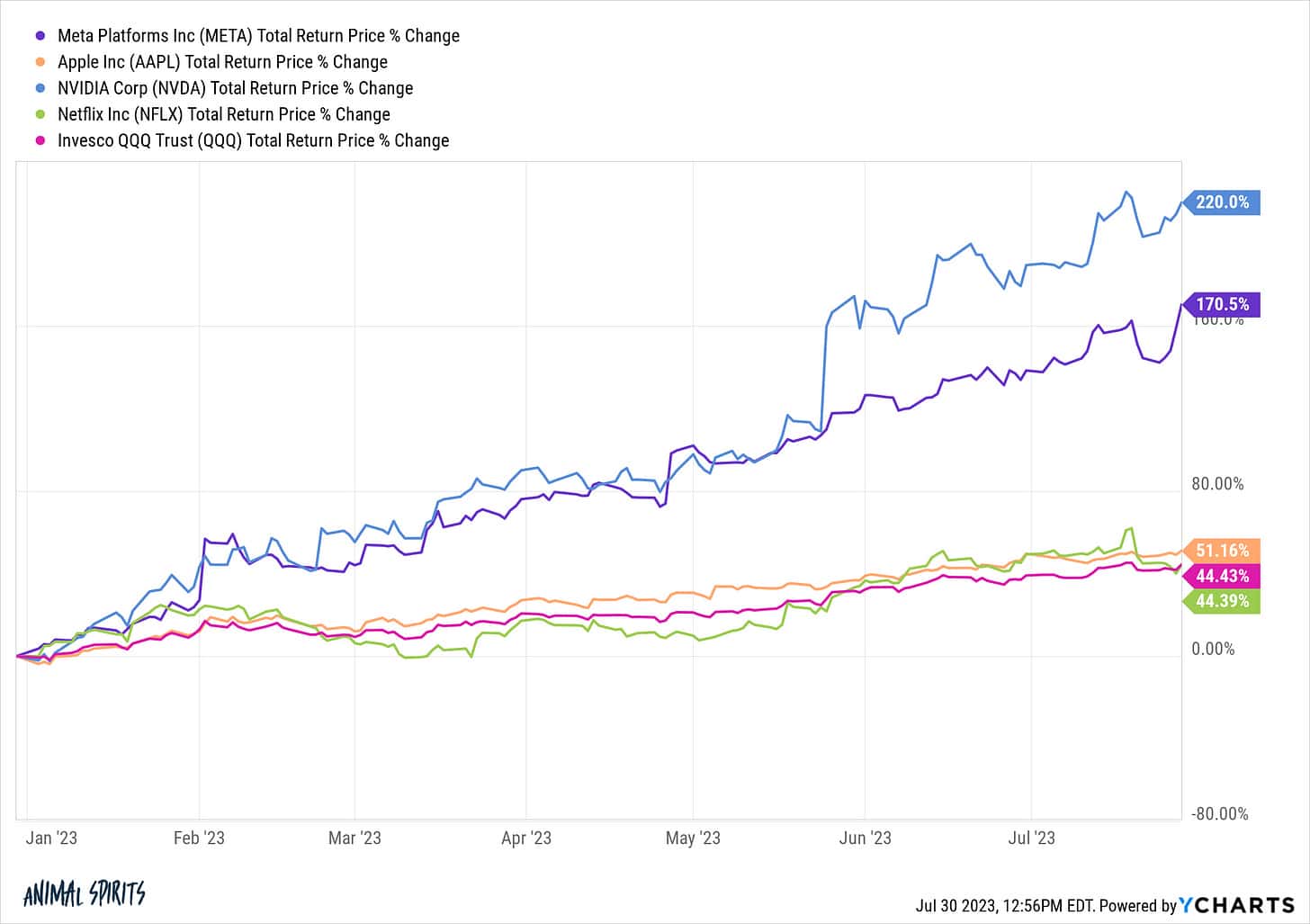

Here are the year-to-date returns for a handful of big tech stocks and the tech-heavy Nasdaq 100 this year:

Not too bad, right?

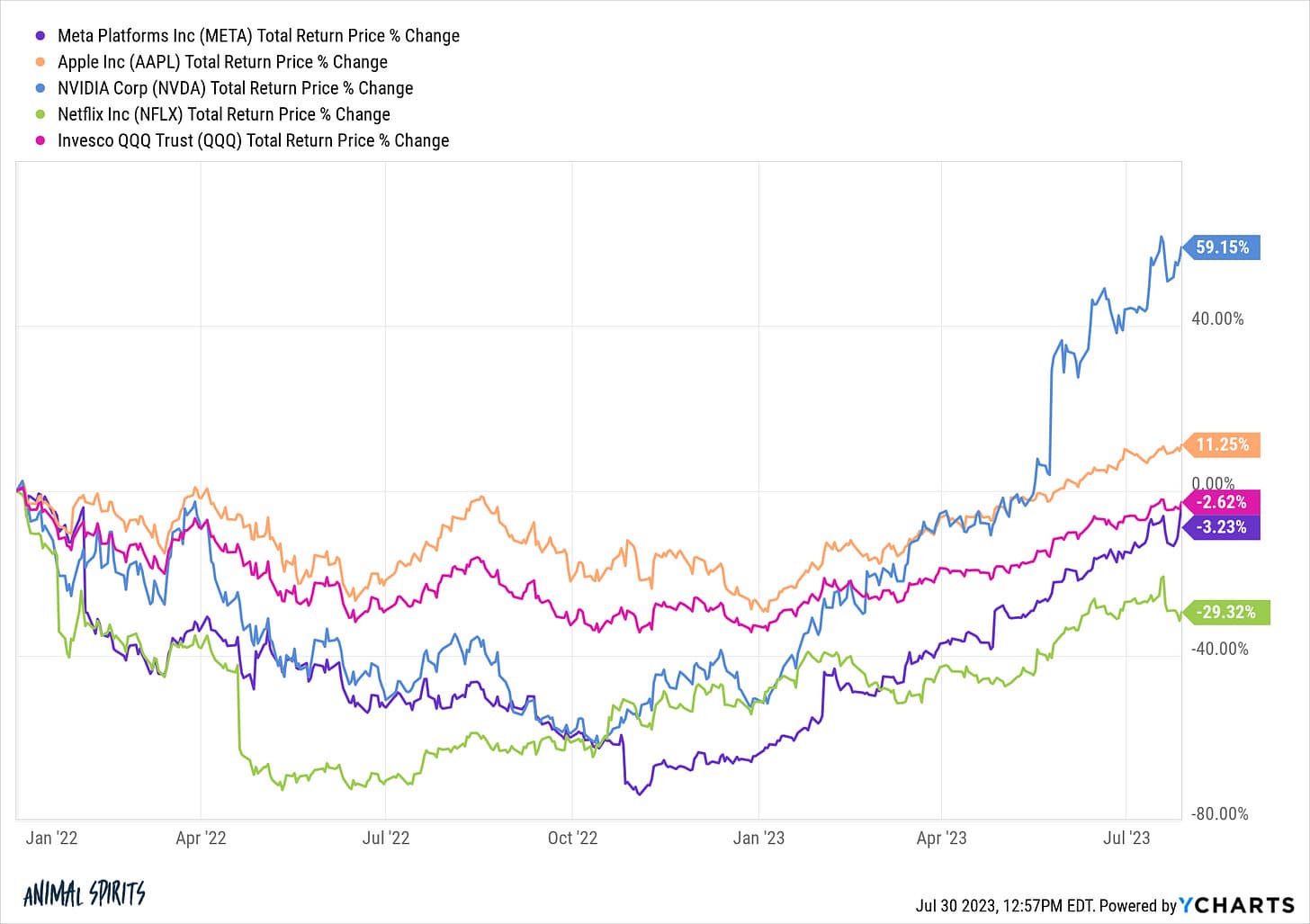

Well, here are those same stocks’ returns from last year:

Two different timeframes, two different stories.

Now, here are the returns when you combined 2022 and 2023:

The returns don’t look nearly as extreme. Some of the stocks that have shot up in 2023 are still down since the start of 2022, with Nvidia being the obvious exception here.

One of the few dependable features of investing in the stock market is that it’s cyclical. There is no one strategy or segment of the market that works all of the time.

Sometimes, the only reason the stock market goes up is because it previously went down.

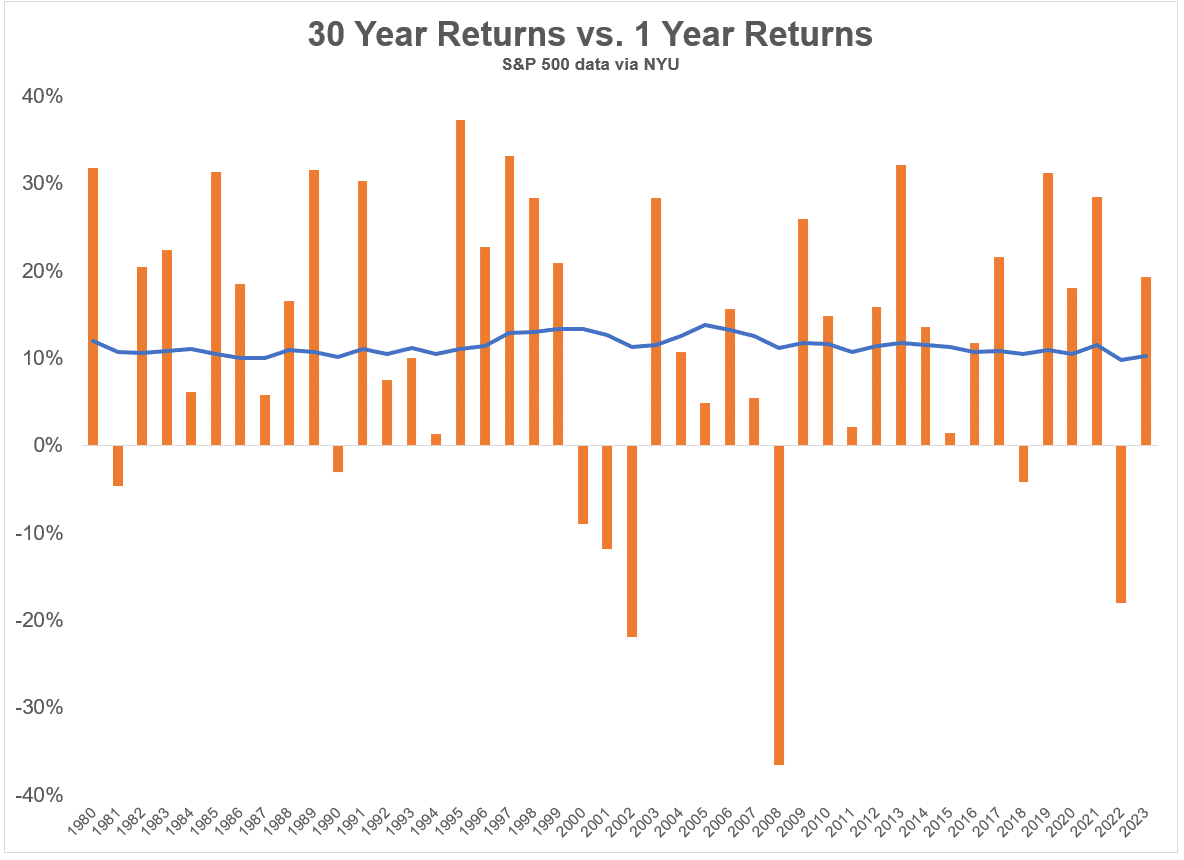

And from year to year, those swings can be severe. Ben also shared the following graph which shows the rolling 30-year returns of the S&P 500 (the blue line) compared to the annual return each year (the orange bars):

As you can see, annual stock market returns are all over the place. Whereas the long-term rolling 30-year returns are very consistent.

The year-to-year returns of the stock market will continue to go up and down and provide plenty of excitement and discouragement in the future. But if you’re a long-term investor, yearly returns won’t have much impact on your long-term results. And in the end, your long-term returns are all that matter.

Thanks for reading!