I’ve realized that while I’ve mentioned cryptocurrency and Bitcoin in a few articles in the past, I’ve never really dedicated an entire post to my thoughts and feelings about crypto. Since it’s something that is here to stay and a lot of people have an interest in, I figured I’d give my two cents.

I want to begin by stating that I’m not a crypto expert. Many of you who are reading this will know more than I do about the ins and outs of how blockchain technology works and all the names of the hottest coins. I try to stay as up-to-date as I can, but it’s a new space that’s rapidly changing and evolving all the time.

I also don’t want to define what cryptocurrency is or get into the details of how the blockchain works. I try to keep these posts short. Instead, I want to highlight three different coins that are going to pop off this year that you’ll want to get in on NOW.

Just kidding.

What I actually want to focus on is how crypto might fit into your investment portfolio and wealth-building strategy.

In my mind, there are two separate discussions to have about crypto. One is about the underlying technology and the other is about crypto as an investment.

There are some legitimate use cases for the technology behind crypto that has real value. Bitcoin allows for portable, unseizable wealth. Blockchains could revolutionize the art industry and other industries that require secure record-keeping (i.e. title insurance). DAOs could be the future of online organizations. And these are just a few examples.

Do I think that crypto is going to overturn the traditional financial system, become a worldwide currency, and change our way of life forever? Of that I’m more skeptical.

The other discussion I’m more interested in is the value and returns crypto can provide as an investment within a portfolio—which is the question I think most people have.

So, let’s get into crypto as an investment. As more and more people start to invest in this new asset class, it’s important to set risk and reward expectations.

Bitcoin is the most popular cryptocurrency by far. Even with thousands of other coins being made, Bitcoin still makes up around 50% of the entire crypto market. A big reason why people want to get into Bitcoin is they’ve heard about its miraculous returns over the past decade and want in on the action.

Bitcoin is up well over 9,000% over the past 10 years. Assuming a starting price of $45,000, which is about where it’s at currently, Bitcoin would need to rocket all the way to $4.1 million to repeat that feat over the next decade.

Never say never, but it seems like a stretch that the current $875 billion Bitcoin valuation could shoot up to more than $80 trillion. Just as it is with any individual investment, it’s impossible to determine what future returns will be, but I think it’s reasonable to assume the growth won’t be nearly as high as it’s been this past decade.

With crypto, it’s easier to predict risk than returns. Investing in crypto is not for the faint of heart.

Since 2017 alone, there have been corrections of 33%, 39%, 41%, 30%, 84%, and 62%. This includes a two-day 50% crash at the height of the pandemic along with numerous 20% crashes within a single day.

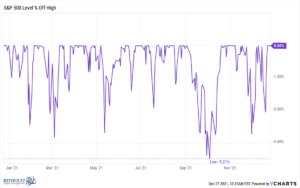

The following chart shows the drawdowns of the U.S. stock market in 2021:

Now compare that with the multiple gut-wrenching drawdowns Bitcoin experienced last year:

Bitcoin was cut in half, went all the way back to new highs, and is now in the midst of a 30% correction all within a year. And it was still up almost 70% last year!

The price movements in other, lesser-known crypto assets are even more violent. You can’t get the insane returns without the insane losses and volatility. With the 24/7/365 nature of the crypto markets, you could go to bed with a calm market and wake up in a bear market.

If you want to invest in crypto you should go in with your eyes wide open about the characteristics of the asset and with a plan. Crypto could outperform stocks or real estate or any other investment, but it’s certainly not guaranteed.

The fact is we’re still early in this space. Crypto is the Wild West. Investors will have to grapple with potential regulations, tax reporting changes, and countries figuring out their views of digital currency. There remains a lot to be figured out. I would guess that the majority of crypto projects that exist today will become worthless and a handful of winners will figure it out.

As is true for any investment, if you’re interested in trying to pick one of the winners, make sure to size your allocation correctly. You wouldn’t want to jeopardize your financial future by having your entire portfolio or net worth tied up in any single investment. This is true for individual stocks, real estate, cryptocurrency, or anything else you’re investing in. Start with just a small portion of your portfolio and go from there.

If crypto booms, a little is all you’ll need. If it doesn’t, a little is all you’ll want.

Thanks for reading!