The first investment account I ever opened was a Robinhood account that I started in college. I opened the account soon after my first personal financial planning classes to get in on the action and learn what investing was all about. Robinhood wasn’t as popular then as it is now, but they were promoting free trading which was unique at the time and sounded great to a college student.

I used some savings and some scholarship money that was supposed to be used for books for the initial deposit. I didn’t really have a plan for the account other than to make as much money as possible. It ended up turning into my “play” account as I opened other accounts for more serious, long-term investing.

I recently took out all of the money from the account to hopefully put a down payment on a house this summer. Although I’m excited to use the money for what I intended, the sentimental side of me was a little sad to cash out my first investment account.

As I withdrew the money, I began to think about what I’ve learned from my Robinhood investing experience the last few years. I’ll probably turn the lessons I’ve learned into a series of blog posts.

Lesson #1: Be careful not to mistake luck for skill

As it turns out, my little account did pretty well. I’m thrilled with the return I was able to get and I even outperformed the mighty S&P 500 during the time I had the account.

While I wish I could say this was because I’m an extremely talented investor, the truth is I simply got lucky.

I will give myself credit for the fact that I did not trade frequently and there were multiple market downswings in which I stayed the course and didn’t sell my positions. But it was mostly luck.

I would hold anywhere from five to eight individual stocks in the account at a time with several mainstays that I never traded. My reasoning for picking the stocks I did was not based on any deep analytical research, rather they were the names everyone was talking about and they seemed like good companies to me.

The thing is, stock analysis hasn’t really mattered all that much as of late.

As of March 23, 96% of the slightly more than 3,000 stocks in the U.S. had a positive total return over the prior 12 months. No other one-year period has come close to that since the end of February 2004.

Knowing what you’re doing hasn’t been necessary to making money in the stock market the last five years or so—and especially this past year. Basically, everything has gone up.

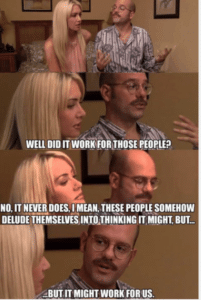

While pretty much any stock you could have picked over this time would have worked out, the long-term success rate for individual stock picking isn’t good. 75% of professional money managers don’t beat their benchmark over a 5-year period and amateur investing success is even less likely. Yet, we still trick ourselves into thinking we can do it; particularly after some initial success.

So, did I have some prolific stock-picking abilities that propelled my success? Or did I just happen to start investing at the right time and was naive enough to pick the big, popular companies that also just so happened to outperform almost everything?

I tend to gravitate toward the latter.

Luck and risk are two sides of the same coin. Had I started investing at any other less ideal time, I could’ve just as easily lost money. Relying on your gut feeling is not a sustainable long-term investing strategy. It may work for a season or two, but eventually, your luck will run out.

Thanks for reading!