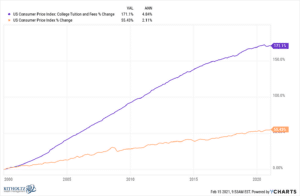

Since the turn of the century, the cost of college in the U.S. has risen at nearly 2.5x the rate of inflation:

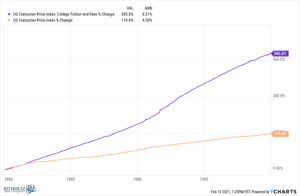

Prices rose even faster through the 1980s and 1990s:

Now, it’s important to note that these numbers aren’t actually as bad as they seem. That’s because not everyone pays the full sticker price when attending college. There are grants, scholarships, financial aid, and in-state tuition that factor in here. Typically only the wealthiest families end up paying full price.

After accounting for all grants, financial aid, and tax benefits, the average increase in the net cost of tuition since 1990 goes from $6,680 to $8,390 per year. So instead of the sticker price growth of almost 120% above inflation, the net price is just 26% above the normal inflation rate.

Regardless, college is still expensive and a major expense that’s top of mind for most parents. If you have young children, there is so much time between now and when they will go to college that it’s almost impossible to map out exactly how much it will cost. However, you can alleviate the burden and stress of college costs by saving early and often, if possible.

But merely putting money into a savings account isn’t the most efficient way to go about preparing for college. It would require thousands a month in cash savings as opposed to a few hundred a month if you were to invest that money instead.

For example, if you project tuition to be $200,000 for four years of undergrad, that would require you to save about $1,110 per month for 15 years to get there. Not an easy task and one that would cut into your own retirement funds.

If you were to invest your money, you could reach $200,000 over 15 years by only putting away $650 per month assuming a 7% annual rate of return.

That being said, here’s a brief rundown of a few different types of investment account options you can utilize for college savings.

529 Plan

529 college savings plans are the most common way people save for their kids’ education because of the tax advantages available for the account.

You contribute after-tax money to the account and any investment growth can be withdrawn tax-free if used for educational expenses such as tuition, room and board, and supplies. Here’s an example:

Using the same numbers from above, if you were to contribute $650 a month for 15 years into a 529 plan, you’d have around $196,000 assuming a 7% annual return. Of that $196,000, about $79,000 would be investment gains that, if used for education expenses, would NOT be subject to capital gains tax upon withdrawal. So, depending on your income, you’d save anywhere from $11,850 to $15,800 in taxes—not to mention any state tax deduction received along the way.

There are no annual contribution limits; however, if you contribute more than $16,000 per year that triggers gift tax consequences.

A 529 plan is administered at the state level, meaning you sign up through a state-funded program. Each state has its own plan, but you can utilize any state’s plan regardless of where you live. Certain states also have state income tax deductions available depending on how much you contribute each year.

The potential downside of a 529 plan is the funds are only meant for education expenses. If you withdraw the earnings in the account for any non-education-related expenses then you’ll have to pay ordinary income tax on that amount plus a 10% penalty.

Brokerage Account

Instead of using a tax-advantaged 529 account for college savings, you could simply use a brokerage account. A brokerage account is a regular investment account that doesn’t offer any special tax benefit (outside of beneficial capital gains rates applied to investment growth) but offers the most flexibility.

The account is in the parents’ name(s) so you have complete control over the funds, you have access to a wider variety of investment options compared to a 529 plan, and there is no penalty if you use the money for non-education-related expenses.

In fact, you can use the money for whatever you’d like. The money can be used to buy a car when they turn 16, for a wedding, or help with other expenses. And if your child gets a scholarship and doesn’t need as much for college as you thought, then you could even use that money for your own retirement goals.

The potential downside is you won’t have access to the tax deductions a 529 plan provides. But some people will willingly pay the taxes in exchange for the flexibility the account offers. And if your income is below a certain threshold ($83,350 for married couples filing jointly in 2022) you can take out your investment growth without paying any capital gains tax anyway.

Minor Roth IRA

A Minor Roth IRA provides all the benefits of a regular Roth IRA but is geared toward children under the age of 18.

While Minor Roth IRAs are typically used to jumpstart children’s retirement savings, they can be used to pay for college costs. Any investment gains inside a Roth IRA can be withdrawn tax-free if used for education expenses—the exact tax benefit a 529 plan offers.

The big caveat for Minor Roth IRAs is in order to open and contribute to one, your child has to have earned income. So this is an option best suited for business owners who can place their kids on the payroll.

Also, when the minor reaches the age of majority, either 18 or 21 in most states, the assets must be transferred to a new Roth IRA in their name where they’ll have complete control of the account.

If you do have the option of opening a Minor Roth IRA for your child, I would prefer using a separate type of account for college savings and not touching the Roth IRA funds so that they can be used for their retirement. Miraculous compounding can happen inside an account that has a 60-year time horizon.

There are more options, but these three are some of the most common and efficient. As I mentioned earlier, more important than which account you choose is that you choose one and start saving sooner rather than later if you can.

This leads me to the last point I want to make. Generally, you should never prioritize your children’s college fund over saving for your own retirement. If you sacrifice your retirement to put your kids through college and end up woefully unprepared when you stop working, they will probably have to take care of you anyways which is likely a larger burden than college expenses.

I say generally because parents want the absolute best for their kids and sometimes it’s hard to tell a parent to look out for their own well-being over their child’s. If nothing else, there should be a balance between your own savings and your kid’s college fund. Still, the majority of your savings should go towards your own retirement.

If you don’t quite accumulate as big of a college fund as you would’ve liked to, you can always supplement any savings shortfall with current income, which will hopefully be higher by the time your kids are ready to leave the nest.

And remember that student loans aren’t the end of the world. You can help them pay back their loans as you get older and in a better financial situation.

As with planning for most things that are a few decades away that involve a lot of variables, just start, be consistent, and you might be surprised where you end up.

Thanks for reading!