There doesn’t seem to be a lot of people buying houses right now. At least, not as many as usual. Home sales are down 20% since last August. And according to Redfin, just 1% of U.S. homes changed hands in the first half of 2023—the lowest turnover rate in more than a decade.

A big reason for the drop in home sales is mortgage rates have skyrocketed. In 2021 you could get a 3% interest rate on your mortgage and now the average 30-year fixed mortgage is around 7.5%.

In 2021, a $500,000 house with a 30-year mortgage at 3% would cost $2,108 per month.

In 2023, that exact same house with a 7.5% mortgage rate would cost $3,496 per month. That’s a 65% increase in cost for the same house.

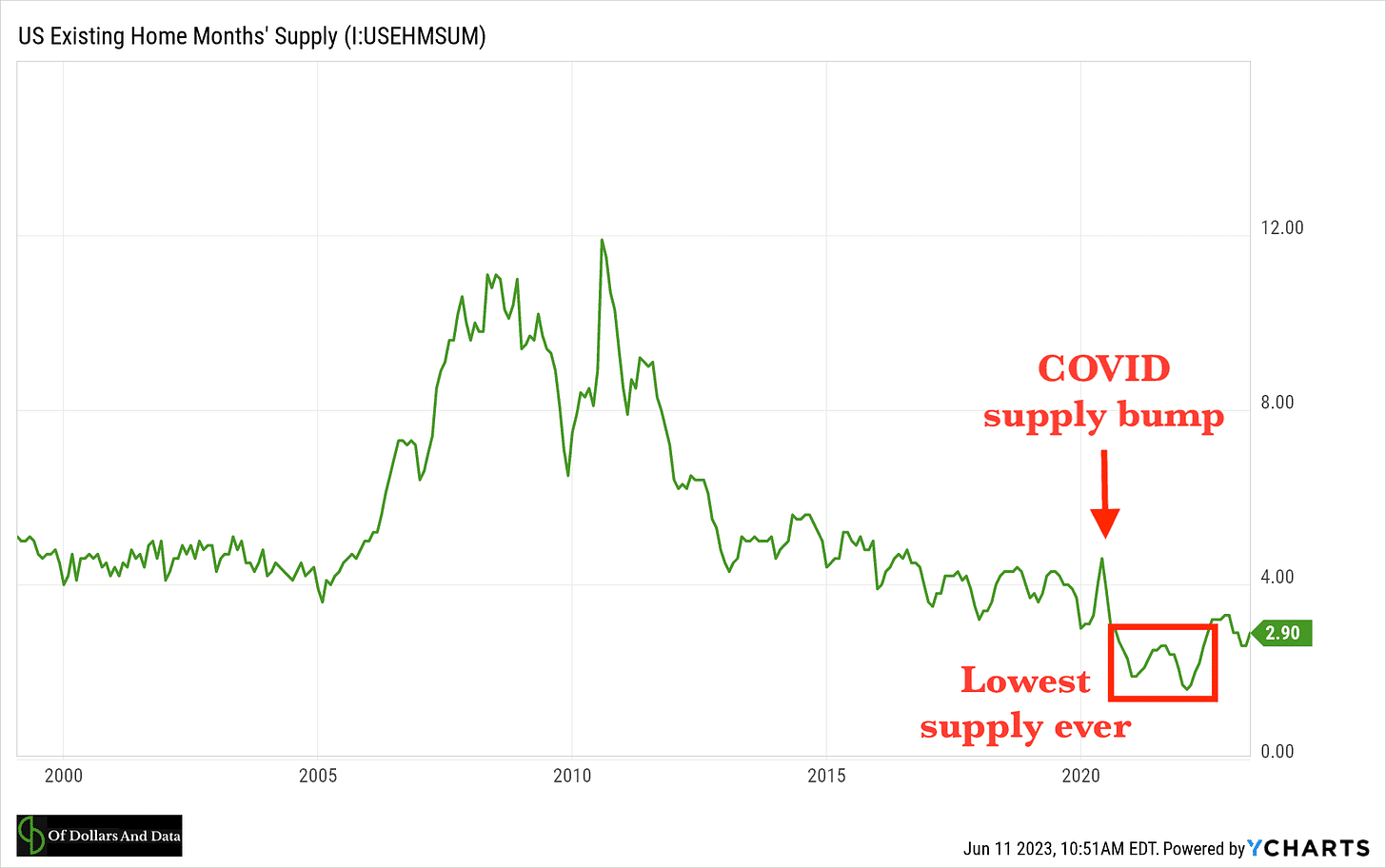

Typically, when interest rates rise house prices will go down. However, with so many existing homeowners locked into a 3% mortgage, they’re extremely hesitant to sell and voluntarily double their interest rate. This means fewer homes for sale which has allowed prices to stay high despite the steep rise in mortgage rates.

Because of all this, we’re currently at a time where buying a house is as expensive as it’s ever been:

With that being said, is it a bad time to buy a house right now?

No, not necessarily. Buying a house is a complicated, emotional decision that usually ends up being much more of a lifestyle decision than a financial one.

What if your family is growing and you simply need more room? What if you need to move for a job that will provide better opportunities in the future? What if there’s an opportunity to move closer to family or to a city you’ve always wanted to live in? The right time to buy a house will depend on each person’s unique circumstances and where they’re at in life.

So, for those brave souls looking to buy in this difficult housing environment, here are a few rules of thumb to help you figure out how much you should spend on a home.

Before I dive in, I feel like I need to add a disclaimer that these are rules of thumb, not ironclad guidelines that if you don’t follow exactly you’ll end up in financial ruin. You can and should adapt each of these to your specific situation.

Keep your monthly mortgage payments under 25% of your gross income

For example, if your annual gross income is $100,000, your mortgage payment shouldn’t exceed $2,083 per month.

Being “house poor” means that your housing expenses account for a large portion of your monthly budget. These housing expenses include mortgage payments, property taxes, insurance, and utilities. Being locked into a monthly payment that’s too high will put a lot of stress on your finances. You’ll likely have to cut spending in other areas and typically the first thing to go after adding too big of a mortgage payment is your savings.

Keeping your monthly housing costs under 25% of your gross income will allow room in your budget to keep saving and spending comfortably.

As an aside, I’ve talked with quite a few people recently who think that mortgage rates are guaranteed to drop in the future so they’re fine taking on a higher monthly payment now with plans of refinancing to a lower rate down the road. I would highly discourage this line of thinking. Interest rates are unpredictable and there’s no guarantee we’ll ever see rates as low as we did a couple of years ago.

Don’t use all of your cash for a down payment

A key financial principle is to have at least three months of living expenses set aside in a checking or savings account. This money that’s set aside to be used for emergencies or unexpected expenses. I would recommend not dipping into that emergency fund for your down payment.

If you have to use all of your savings on a down payment to get the monthly payment to fit your budget, that might be a sign it’s too big of a house.

Don’t stop saving

Despite the insane growth of house prices over the past few years, historically speaking, homes have barely outpaced inflation over the long run. While a home is certainly an asset, rarely do people sell their house and use the equity they’ve built to fund other financial goals. The equity will most likely be rolled into another home because you’ll always need somewhere to live. So, your mortgage payments should not replace long-term savings. Maintain your savings rate regardless of your housing costs.

If your monthly payments cause you to lower your long-term savings, that might be a sign it’s too big of a house.

If you can stick to these three rules of thumb, you should be in great shape. Although, in my experience because of the emotional nature of the purchase, you’re likely to break most, if not all, of the financial rules you’ve set for yourself. Buying a house isn’t a black-and-white financial decision; it’s a lifestyle choice.

However, a simple and extremely effective way to have more money and build wealth faster is to spend less on housing. That means buying a house you can actually afford.

Thanks for reading!