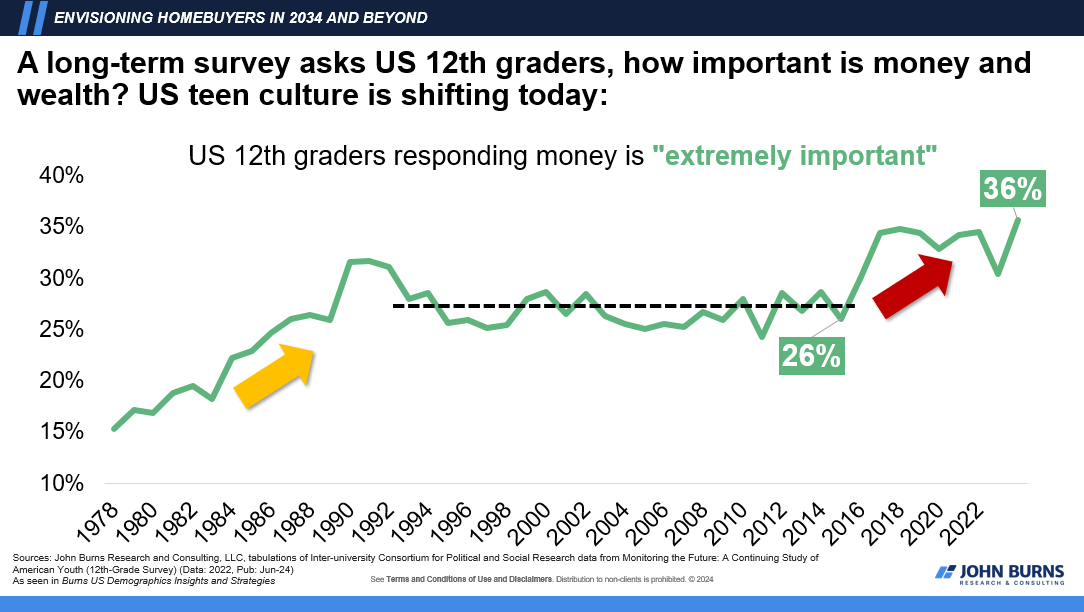

I saw a graph the other day showing that the upcoming generation is more focused on money than any generation we’ve seen in the past. A survey asked 12th graders how important money and wealth are to them, and 36% responded “extremely important.”

For decades it appears teen sentiment about money has remained relatively stagnant. However, over the past decade or so, money has become more and more important.

This makes sense to me. It also aligns with what Derek Thompson has written about before which is how much Americans value work:

“Pew Research Center asked American parents: What accomplishments or values are most important for your children as they become adults?

Nearly nine in 10 parents named financial security or “jobs or careers [our children] enjoy” as their top value.

That was four times more than the share of parents who said it was important for their children to get married or have children; it was even significantly higher than the percentage of parents who said it’s extremely important for their kids to be “honest,” “ethical,” “ambitious,” or “accepting of people who are different.” Despite large differences among ethnicities in some categories, the primacy of career success was one virtue that cut across all groups.”

It feels like if there’s one thing we can agree on as a society these days it’s that money is good, and striving for more of it is aspirational.

Given that money is becoming more important amongst young people, it tracks that they would expect to make a lot of money as well.

In another survey by Axios, they asked people what the minimum income someone needs to make to be considered “financially successful” and Gen Z’s answer was quite a bit higher than other generations:

Almost $600,000!? That’s the minimum Gen Z thinks you need to make each year to be successful?

To help give us some context here, let’s take a look at the data to see how much income Americans actually make.

In 2024, the median individual income in the United States was $50,200.

But assuming that “financially successful” means you’re in the upper echelon of income earners, let’s take a look at the top 10%, 5%, and 1%.

Here are the top individual incomes in the U.S. separated by percentile:

- Top 10% = $150,000

- Top 5% = $201,050

- Top 1% = $430,000

According to the respondents of the survey, to be financially successful you need to be a top 5% income earner. Maybe that’s what the participants had in mind when giving their answers, but I would hope that financial success isn’t solely reserved for 5% of the population.

And while Gen Z threw out an income number that less than 1% of the adult population currently achieves, 71% of Gen Z respondents also said they expected to attain financial success in their lifetimes, more than any other age group.

There seems to be a disconnect there.

Now, some of you may be thinking to yourself, “Well, the only reason they’re responding with huge income numbers is because the cost of everything today is so much more than what the Boomers had to deal with.”

That’s partly true. It does cost more to live today than it did 50 years ago. However, believe it or not, our incomes have grown to match the rising costs.

These are the inflation–adjusted median annual incomes by year:

- 1962 – $30,654

- 1974 – $39,183

- 1984 – $36,702

- 1994 – $39,431

- 2004 – $46,388

- 2014 – $44,450

- 2019 – $48,674

- 2024 – $50,200

There has been progress.

If you want a slightly more detailed view of where you stand, The Pew Research Center has this cool tool that allows you to enter your income and see where you stand both nationally and locally.

Sometimes objective data like this can be good to ground our expectations. Although, will these numbers change how people feel about their own financial situation? Probably not.

In my experience, people don’t really care about how they’re doing compared to the median or the average. What we really care about is how we’re doing compared to our colleagues, neighbors, friends, and family members.

Financial success is all relative.

For better or for worse, the financial goalposts seem to always be moving.

Thanks for reading!

Jake Elm, CFP® is a financial advisor at Dentist Advisors. Jake a graduate of Utah Valley University’s nationally ranked Personal Financial Planning program. As a financial advisor at Dentist Advisors, he provides dentists with fiduciary guidance related to investments, debt, savings, taxes, and insurance. Learn more about Jake.</em