I drive a 2012 Volkswagen Jetta. It just might be the least glamorous car on planet Earth. Mine is even painted silver, the most boring of all car colors.

But you know what? I’m okay with that.

I’m not a car person. All I really want from my vehicles is to get me safely from A to B. And for the past 11 years, my little Jetta has more or less accomplished that task.

Possibly my favorite aspect of the car is it’s allowed me to not have a car payment for over a decade—which is quite nice.

If it let me, I would drive it for another 11 years. But I have a sneaking suspicion that as the number on the odometer keeps getting bigger and bigger, it’s bound to break down on me sooner than later.

So in preparation, I’ve been browsing different cars, checking their prices, and anticipating what monthly payments would look like. And I have a few thoughts on cars I wanted to share.

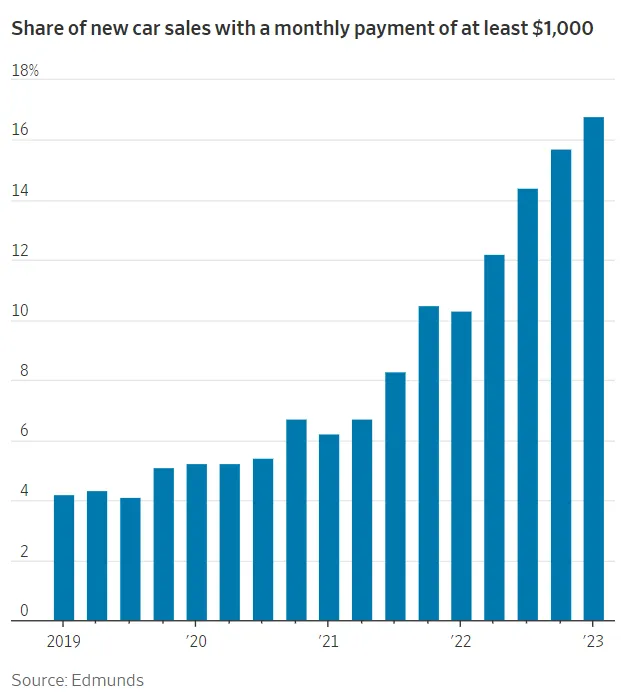

Last spring, I shared a graph showing the share of new car sales with a monthly payment of $1,000 or more. Here it is again:

You can see the upward trend.

Almost one in five new vehicles purchased in the first half of 2023 came with monthly payments of $1,000 or more.

From a survey by Schroders, the percentage of Americans nearing retirement age (60-67) who said they have enough money saved was only 24%.

These two completely unrelated and separate data points can’t be correlated somehow… right?

Well actually…

Since the cost of transportation is typically the second biggest fixed cost in people’s budgets behind housing, how much you choose to spend on a car will have a pretty big impact on your ability to save and invest for retirement.

So how much can a car payment affect your retirement?

Let’s do some quick math.

The Ford F-150 has been the best-selling car every year for 41 years in a row. Anecdotally, I can confirm that data is correct. Maybe it’s just because I live in Utah, but every time I go out for a drive I see a ton of trucks on the road.

You can buy a new Ford F-150 for $70,000. Assuming you didn’t put anything down, financing a $70,000 truck at 6% over 5 years would be a monthly payment of $1,353. And that doesn’t include gas, insurance, and maintenance.

Now let’s say instead of buying a nice, new truck you decided to go the boring route and get, I don’t know, a Volkswagen Jetta. Financing a 2023 Jetta for $22,000 at 6% over 5 years would be a monthly payment of $425.

By simply choosing to buy a cheaper car you could save $928 a month.

Let’s say you blew some of those savings on eating out more with your friends and invested the other $800.

If you put that $800 into the stock market every month for 30 years and earned 8% on your investments, at the end of 30 years you’d have $1,087,518.

That’s over a million dollars in retirement savings just by driving a lower-priced car over time.

I don’t like to do this exercise with every little purchase we make. We should be able to enjoy our money, not just save and invest it. But saving money is hard. And it’s usually not your daily coffee, or eating too much McDonald’s, or getting guac on your burrito that inhibits your ability to save.

More often than not, not being able to save comes down to large fixed expenses, like a car payment.

As I’ve already mentioned, I’m not a car person. Some people love cars way more than I do, and I don’t want to tell people what they should or shouldn’t spend their money on.

Personal finance is all about managing trade-offs. You might not spend a lot on clothes or vacations, and you decide to put more money toward a nicer ride. Or maybe you make enough money where car payments aren’t a big dent in your budget.

But if you’re struggling financially and not able to save as much as you’d like for your future, there’s a fairly simple remedy. Driving an inexpensive car is one of the biggest levers you can pull to free yourself up financially.

Thanks for reading!

This article was originally featured on “Money Talks” Substack.

Jake Elm, CFP® is a financial advisor at Dentist Advisors. Jake a graduate of Utah Valley University’s nationally ranked Personal Financial Planning program. As a financial advisor at Dentist Advisors, he provides dentists with fiduciary guidance related to investments, debt, savings, taxes, and insurance. Learn more about Jake.