For as long as I can remember, becoming a millionaire has been the cultural gold standard for building wealth. Most people dream of being a millionaire at some point in their lives because it’s synonymous with financial success and security.

But is that still true? Is a million dollars still worth what it was in the past?

Before we get into some numbers, the definition of a millionaire is someone who has a net worth of $1,000,000 or more. As a reminder, your net worth is all of your assets minus all of your liabilities (i.e. debts).

Looking back, the number of people with a $1 million net worth has definitely grown.

Before the Civil War, fewer than a dozen millionaires existed in the United States. Then just a couple of decades later in 1892, the New York Tribune published a list of 4,047 millionaires. In the 100 years and some change since, that number has exploded.

As of 2023, there are now 21,951,000 millionaires in the United States. Meaning almost 9% of U.S. adults are millionaires. And of all the millionaires in the world, nearly 40% are from the United States.

In the year 2001, having $1 million would have put you in the top 7% of households in America. In 2021, having $1 million puts you in the top 12% of households.

To be in the top 1% today you’d need a net worth of over $11 million.

Due to inflation, you’d need $1,800,000 in today’s dollars to maintain the same buying power of $1,000,000 in the year 2000.

As you can see from the data, $1 million today is not worth as much today as it has in decades past.

But that doesn’t mean it’s worth nothing. Given that the median net worth in the U.S. is $121,000, one million dollars is still a significant amount of money.

I also think it’s important to note that the above numbers include a primary residence in the net worth calculation. However, rarely do people use the equity in their homes to fund their retirement or other financial goals.

So excluding equity in a house, I wanted to take a look at how much a $1,000,000 investment portfolio is worth.

The widely accepted 4% retirement planning rule suggests that you can take 4% from your investment portfolio each year, and if invested properly, should still be able to maintain the balance of your portfolio over time.

Using this rule of thumb, a $1 million portfolio would kick off $40,000 each year for you to spend in retirement.

If we add in the current average Social Security benefit of $2,500 per month, you would have $70,000 of income each year. Not to mention a large nest egg for unexpected expenses.

Is that enough to retire on? Well, it depends on the person.

The Bureau of Labor Statistics tracks average consumer spending by age:

With the average spending of people ages 65 and older at around $52,000 annually, I think $70,000 each year in income would be sufficient.

What does it take to build a $1,000,000 investment portfolio? That also depends on how much you save and when you start.

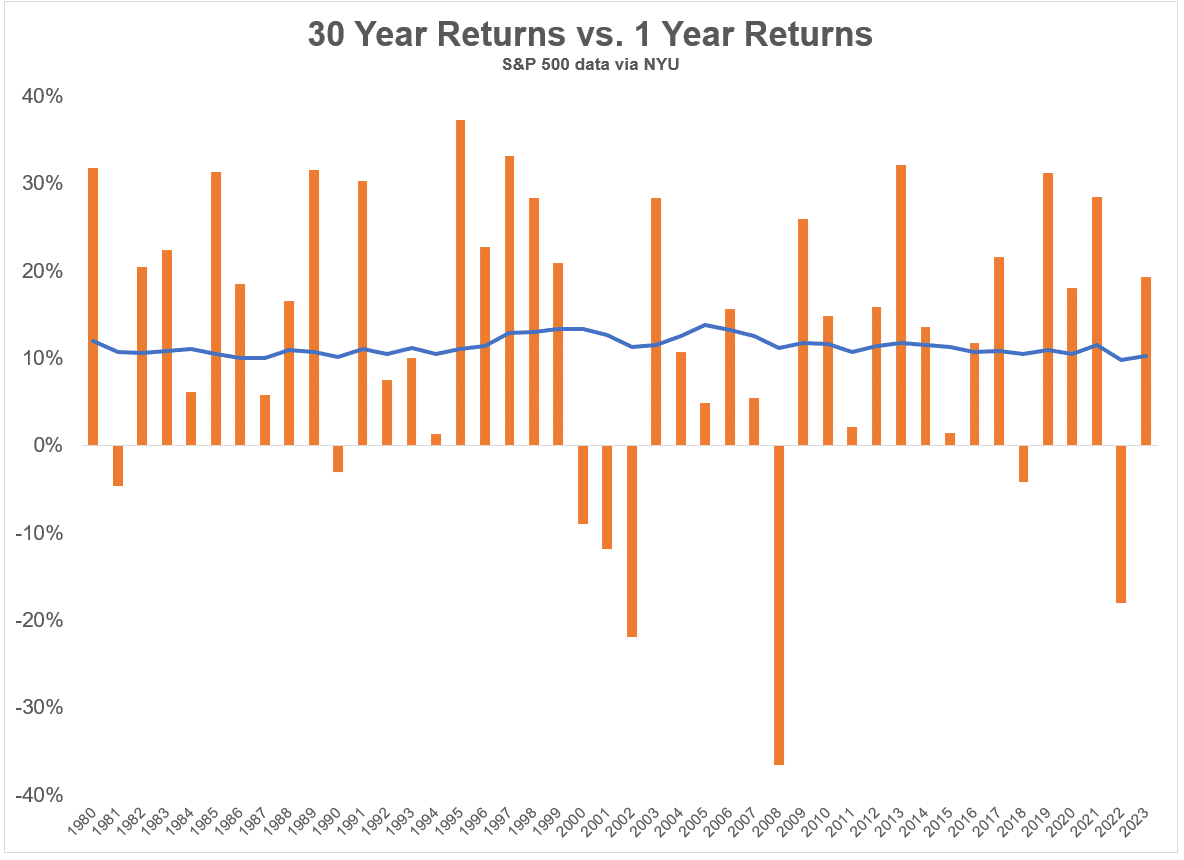

Using historical U.S. market returns (long-term returns have basically been 10% per year), here is what you would have to save and invest to accumulate a $1 million portfolio:

• $190 per month for 40 years

• $510 per month for 30 years

• $1,475 per month for 20 years

• $5,300 per month for 10 years

You don’t have to save much if you start investing early.

I want to end with a few important observations about millionaires.

Only 31% of millionaires averaged $100,000 in salary a year over the course of their career, and one-third never made six figures in any single working year of their career.

The average millionaire age is 57 years old.

It takes the typical self-made millionaire over 30 years to obtain their wealth. Less than 1% of them do it before age 40. Different from what most financial media will tell you, building wealth takes time. It’s a marathon, not a sprint.

There’s nothing intrinsically special about hitting the $1 million mark. Most people will never get there, nor will they need to, while for others it won’t be enough to keep up with their lifestyles.

I’m sure a few decades from now $1 million will be worth even less than what it is today, yet it seems like that number will always act as a benchmark for a lot of people. If you’ve managed to save up $1 million, you’re doing something right.

Thanks for reading!