As I wrote about a couple of months ago, if there’s a group of people who have a reason to complain about current economic conditions, it’s the first-time homebuyer.

There has been a real estate boom since the pandemic, and despite a steep increase in interest rates, it hasn’t shown any signs of slowing down.

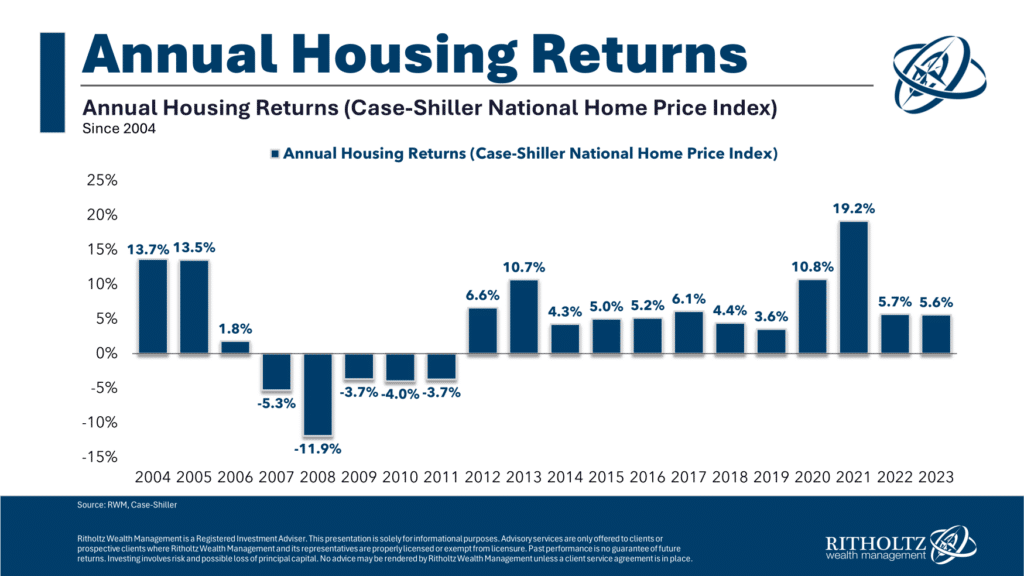

Ben Carlson created this awesome graph showing U.S. housing price returns over the past 20 years:

If you bought a house in the 2010s, you hit the jackpot. Not only did house prices see a historic rise, but interest rates fell during that decade, allowing existing homeowners to refinance at historically low rates. That’s a great combination if you already own a home, but not so great if you don’t.

Even with mortgage rates skyrocketing over the last few years, which would typically lower the home values, house prices have remained stubbornly high.

Why? Well, there are simply not enough homes for sale compared to the number of people who want to buy a home.

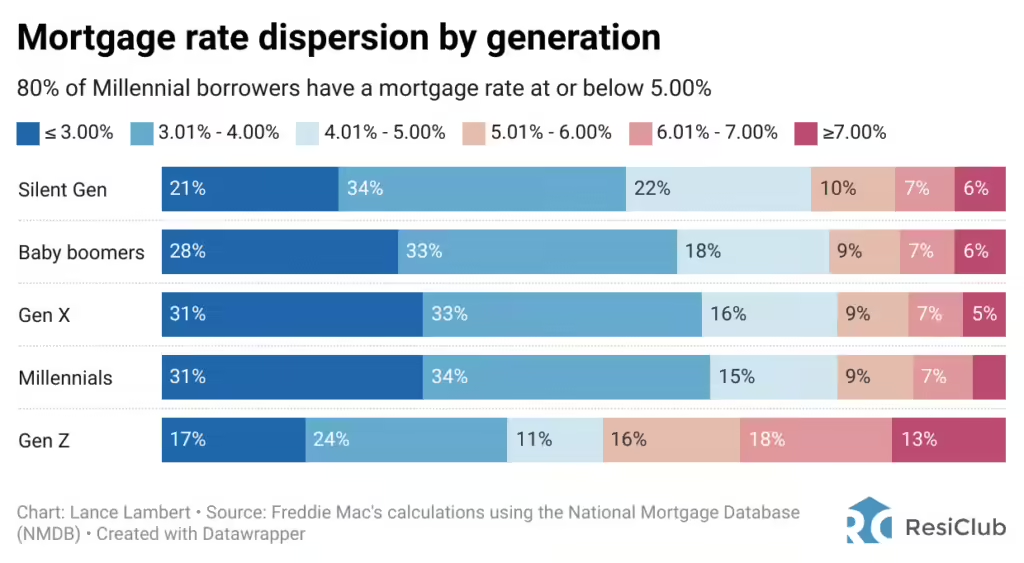

A lot of that has to do with the fact that 80% of millennials have a mortgage rate under 5% and don’t want to sell their home only to incur higher housing costs. Almost a third of Boomers, Gen X, and millennials have rates under 3%:

For those looking to buy a house right now, it’s a tricky situation. The cost of buying a home is as high as it’s ever been.

However, that doesn’t mean that you shouldn’t buy a house right now. It all depends on your situation and needs. Buying a house is often much more of a lifestyle decision than a financial one.

For those wondering if should buy a house right now or even if they can afford one, the following principles will help guide you in your decision:

Keep your monthly mortgage payments under 25% of your gross income

For example, if your annual gross income is $100,000, your mortgage payment shouldn’t exceed $2,083 per month.

Being “house poor” means that your housing expenses account for a large portion of your monthly budget. These housing expenses include mortgage payments, property taxes, insurance, and utilities. Being locked into a monthly payment that’s too high will put a lot of stress on your finances. You’ll likely have to cut spending in other areas and typically, the first thing to go after adding too big of a mortgage payment is savings.

Keeping your monthly housing costs under 25% of your gross income will allow room in your budget to keep saving and spending comfortably.

Don’t use all of your cash for a down payment

A key financial principle is to have at least three months of living expenses set aside in a checking or savings account. This money should be put away to be used for emergencies or an unexpected expense. Don’t dip into that emergency fund for your down payment.

If you have to use all of your savings on a down payment to get the monthly payment to fit your budget, it might be too big of a house.

Don’t stop saving

Even with the recent housing boom, long-term home appreciation isn’t very impressive after factoring in inflation. Rarely do people sell their house and use the equity they’ve built to fund other financial goals. The equity will most likely be rolled into another home because you’ll always need somewhere to live. So, your mortgage payments should not replace long-term savings. Maintain your savings rate regardless of your housing costs.

If your monthly payments cause you to lower your long-term savings, it might be too big of a house.

Now, I realize it might be difficult to check all three of these boxes in the current housing market. They’re called rules of thumb for a reason, if you can stick to them you’ll generally be in great shape, but each person needs to make an educated decision based on their own finances and goals.

House-buying isn’t a black-and-white financial decision; it’s a lifestyle choice.

But aren’t all financial decisions lifestyle decisions as well? What’s the point of making a smart financial move if it doesn’t directly benefit your life?

Thanks for reading!

Jake Elm, CFP® is a financial advisor at Dentist Advisors. Jake a graduate of Utah Valley University’s nationally ranked Personal Financial Planning program. As a financial advisor at Dentist Advisors, he provides dentists with fiduciary guidance related to investments, debt, savings, taxes, and insurance. Learn more about Jake.