My wife is a huge Taylor Swift fan. Now, I know it seems like everyone is a huge Taylor Swift fan these days, but I remember her raving about Taylor Swift songs when we were just kids in junior high school together. And at that point, she’d only released an album or two. You could say my wife’s an OG Swiftie.

So when Taylor Swift announced she’d be going on tour for the first time in five years, there was no way my wife was going to miss it. She and a group of friends fought the craziness of everyone trying to get tickets the second they were available and came away with tickets to her concert in L.A.

The only problem is the L.A. concert isn’t until August of this year—the last stop of the tour. And since every girl on Tik Tok and Instagram is apparently a Taylor Swift fan now, my wife didn’t want to have the entire concert spoiled for her with the flood of videos that were sure to ensue with the tour starting up.

Not wanting to wait until August, she casually browsed the resale market to see if there was any way she could go before August. Two weeks ago, she ended up finding a decent deal on some tickets a few days before the concert and asked me if I wanted to go on an impromptu trip to Las Vegas.

Having two seven-month-old boys, we haven’t had a ton of time to ourselves in quite a while. So after enlisting our parents to help with the kids, we decided to go have a fun weekend together.

As you can imagine, tickets to see the most popular artist in the world are not exactly cheap. More than once I thought to myself, “Should we be doing this? Is this the best use of our money right now? What if we just stayed home and went out to dinner instead? It would be significantly less expensive.”

During a conversation, one of my friends even joked about the cost saying, “Oh my. That’s crazy. I can maybe understand going once for that price… but twice??”

Maybe he was right. After all, life continues to get more and more expensive. The amount of diapers and formula we go through each week is absurd. We could take the concert money and put it into our investment accounts to grow and compound for our future. We could use it to make an extra payment to our mortgage—that’s what Dave Ramsey would tell us to do.

But after hearing my friend’s incredulity and fighting with my own frugality, the thought occurred to me, “If spending a weekend together as a couple watching a live show of my wife’s favorite singer on the planet isn’t worthy of our hard-earned dollars, then what is?”

Every dollar we make will eventually be spent. We can either spend it now, spend it later, or pass it on to someone else to spend. The act of saving is simply deferring spending to the future. And I do think it’s possible to be saving too much money if you’re prioritizing future spending (saving) to the complete detriment of current spending.

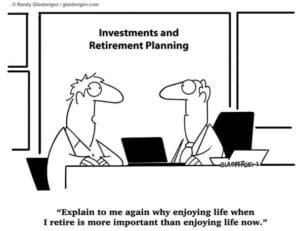

I reference this comic all the time when it comes to balancing saving versus spending:

Of course, I do not want to discourage saving and preparing for the future. You have to do it. But I do see people who are so stressed about saving and increasing their net worth that they forget to enjoy life today.

If spending money comes easily to you, it’s likely that saving and investing will be difficult for you. However, on the flip side, something that’s not talked about as often is if saving and investing come easily to you, it’s likely that spending will be difficult for you.

It’s a mindset that is hard to turn off. People think that if they could just reach a certain net worth or income number, their behavior and anxiety around money will magically change. However, that’s usually not the case. It’s hard to undo decades of financial habits. There are plenty of people who are comfortably retired and still can’t bring themselves to order dessert.

There’s a big difference between delayed gratification and no gratification at all.

Spending is like a muscle. If you don’t go out and exercise every once in a while you’ll forget how to use it.

Studies have found that money can indeed increase happiness if it is spent the right way. The key is to align your spending with what’s most important to you. If you really like Taylor Swift, spend the money to go see Taylor Swift. Value-aligned spending was shown to be a stronger indicator of happiness than how much someone spends or even an individual’s total income.

Spending money on something that makes a positive impact on your life can very much be classified as a smart financial decision and good financial planning in my book.

As Mr. Carson from the show Downton Abbey once remarked:

“The business of life is the acquisition of memories. In the end, that’s all there is.”

Thanks for reading!