Jason Zweig, long-time investment writer and author of one of the best weekly finance blogs called The Intelligent Investor, was once asked how he defines his job as a finance writer. He said:

“My job is to write the exact same thing between 50 and 100 times a year in such a way that neither my editors nor my readers will ever think I am repeating myself.

That’s because good advice rarely changes, while markets change constantly.”

As I’ve started to write about finance and money on a weekly basis, I’ve come to find that this statement couldn’t be more true. Economic environments and financial markets are always changing, investment trends come and go, new tax laws get passed, and yet through all of it, good financial advice remains relatively unchanged.

So, this week I wanted to gather an assortment of money truths, lessons, and principles that are more important than whatever is happening in the news and “rarely change.”

Most of these statements are not my original thoughts, but are taken from people a lot smarter than I am:

There are no universally right answers that make sense for everyone. Just different shades of gray that work for people’s unique situations and personalities. Financial decisions are all about managing trade-offs. A lot of finance arguments and debates stem from people failing to realize that not everyone has, or wants, the same life as you.

Getting rich and staying rich are different things that require different skills. There are a million ways to get rich, but staying rich requires humility. The irony is that few things squash humility like getting rich in the first place.

Diversification works. “Absolutely no one knows what the stock market is going to do tomorrow, let alone next year. Nor which sector, style, or region will lead and which will lag. Given this absolute uncertainty, the most logical strategy is to invest as broadly as possible.” —Jack Bogle

Get rich quick and get poor quick are opposing sides of the same coin. Earlier this year GameStop stock rose 426% over the course of three months. The stock also fell 62% in a matter of hours, wiping out almost all of those gains.

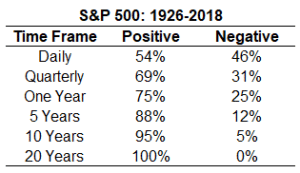

The long game is undefeated. Since 1926, there’s never been a 20-year period where the stock market didn’t generate a positive return.

Good investing isn’t necessarily about making good decisions, it’s about consistently not screwing up. Average returns sustained for an above-average period of time lead to extraordinary returns. Most people can afford to not be a great investor, but you can’t afford to be a bad one.

Approximately 90% of the time the most important thing an investor should do is nothing. “Be more patient” in investing is the “sleep 8 hours” of health. It sounds too simple to take seriously but will probably make a bigger difference than anything else you do.

Financial planning is just as important as investment management. It’s also more within your control. There are investors who work 80 hours a week to add 10 basis points to their returns when there are two or three full percentage points of lifestyle bloat in their finances that can be exploited with way less effort.

Your life is a better benchmark than the S&P 500. Comparing your financial situation to external benchmarks or other people is a great way to feel inadequate and poor. John D. Rockefeller was once asked how much money was enough and said, “Just a little bit more.” Everyone, at every income, tends to feel the same.

No one is impressed with your possessions as much as you are. And spending money to show people how much money you have is the fastest way to have less money.

The Joneses aren’t as rich or as happy as you think they are. It’s pretty much impossible to determine how well someone is doing financially from the outside. Wealth is what you don’t see.

“It’s just money.” A few months ago I was stressed about a big financial decision and as I was telling my father-in-law about my worries and concerns he responded with some simple, timeless advice that helped change my perspective, “It’s just money.” We all know that there are so many things in our lives more important than money, but we forget it too often. It’s nice to be reminded every once in a while.

Thanks for reading!