This past week I was able to slip away for a weekend in the mountains with my family. Here are a couple of hastily captured iPhone pictures to prove it:

Getting away, even just for a few days, provides a great opportunity to reset and unwind from the hustle and bustle of day-to-day life. To quote a few lines from the song Let It Go from Frozen:

“It’s funny how some distance makes everything feel small, and the fears that once controlled me can’t get to me at all.”

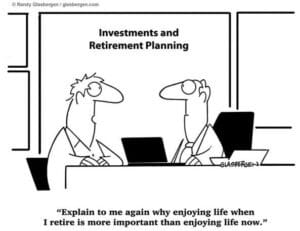

So coming off a few days spent with family in the mountains, I wanted to share some thoughts on balancing saving vs. spending and the need to enjoy some of your money now.

Ronald Read’s story is a personal finance blogger’s dream.

Read worked as a gas station attendant for 25 years and as a janitor at JCPenney for 17 years. He bought a two-bedroom house at 38 and lived there for the rest of his life until he died a few years ago at age 92. Those who knew him said his life was about as low-key as they come. His only indulgence was eating breakfast at the local coffee shop.

What makes Read’s story unique is by the time he passed away, he had accumulated an $8 million fortune through a combination of frugal living and a buy-and-hold investment philosophy. Almost 3 million Americans died in 2014 but fewer than 4,000 of them had a net worth of over $8 million. Ronald Read was one of them.

His lawyer said, “You’d never know the man was a millionaire. The last time he came here he parked far away in a spot where there were no meters so he could save the coins.”

On the other end of the spectrum from Ronald Read is Bill Perkins. Perkins made millions as an energy trader on Wall Street and his spending philosophy is quite the opposite of Read’s. In his book Die With Zero, Perkins tells how he decided to make it his life’s mission to spend or give away all his money before he dies.

He describes his spending strategy as follows:

“Invest in experiences that yield long-lasting memories, always bear in mind that everyone’s health declines with age, give your money to your children before you die instead of saving for their inheritance, and learn to balance current enjoyment with later gratification.”

While these are two extreme examples of differing spending philosophies, I think there are lessons from both.

Ronald Read’s story is an incredible example of the benefits of living below your means and compound interest in the stock market. His results were spectacular. The reason he’s a personal finance expert’s dream is because most people assume the only way to get ahead is through frugality. In the finance community, spending lavishly is often frowned upon.

Obviously, there are many who simply spend too much and don’t save any money at all. It’d be easier to find someone like that than a Ronald Read. However, there’s a big difference between delayed gratification and no gratification at all.

In my favorite new show of 2022, The Bear (yes, you should watch it), there’s a scene where cousins Carmy and Richie are waxing philosophical in an alley behind their family-owned restaurant while on a break.

Carmy asks his cousin Richie, “Is there a name for that thing where you’re afraid of something good happening ‘cause you think something bad’s gonna happen?”

Richie ponders for a second and then responds, “I don’t know…life.”

There’s actually a psychological term for what Carmy was describing and it’s called anticipated regret. There’s nothing wrong with being risk averse at times but if you’re always risk averse you’re going to miss out on life. This principle also applies to spending vs. saving.

Remember, every dollar you make will eventually be spent. You can either spend it now, spend it later, or pass it on to someone else to spend. Saving is just deferring spending to the future. And prioritizing future spending to the complete detriment of current spending doesn’t make a lot of sense.

There needs to be a balance between saving responsibly for the future while still enjoying life today. Now, finding that balance is extremely difficult and I don’t think I know anyone who’s mastered it completely. Having a good balance probably means going through times when you wish you were saving more and times when you wish you were spending more.

It’s important to save and invest because those savings will compound and supply more experiences in the future. Savings provide a level of comfort and security so you don’t saddle your future self with unnecessary stress.

It’s also important to spend money now on the things you love because time is precious. There’s no point in creating wealth if you don’t use it to provide some enjoyment in life. As long as you’re putting away money for the future you should also focus on enjoying the present.

Personal finance gurus love to spend-shame you into saving every last penny but the truth is there can be room for both saving and spending, frugality and extravagance, delayed gratification and enjoyment.

It’s all about finding the right balance.

Thanks for reading!Coming off a few days in the mountains, I wanted to share some thoughts on balancing saving vs. spending and the need to enjoy some of your money now.