How Do I Get a Podcast?

A Podcast is a like a radio/TV show but can be accessed via the internet any time you want. There are two ways to can get the Dentist Money Show.

- Watch/listen to it on our website via a web browser (Safari or Chrome) on your mobile device by visiting our podcast page.

-

Download it automatically to your phone or tablet each week using one of the following apps.

- For iPhones or iPads, use the Apple Podcasts app. You can get this app via the App Store (it comes pre-installed on newer devices). Once installed just search for "Dentist Money" and then click the "subscribe" button.

- For Android phones and tablets, we suggest using the Stitcher app. You can get this app by visiting the Google Play Store. Once installed, search for "Dentist Money" and then click the plus icon (+) to add it to your favorites list.

If you need any help, feel free to contact us for support.

Subscribe to the Dentist Money™ Show for free

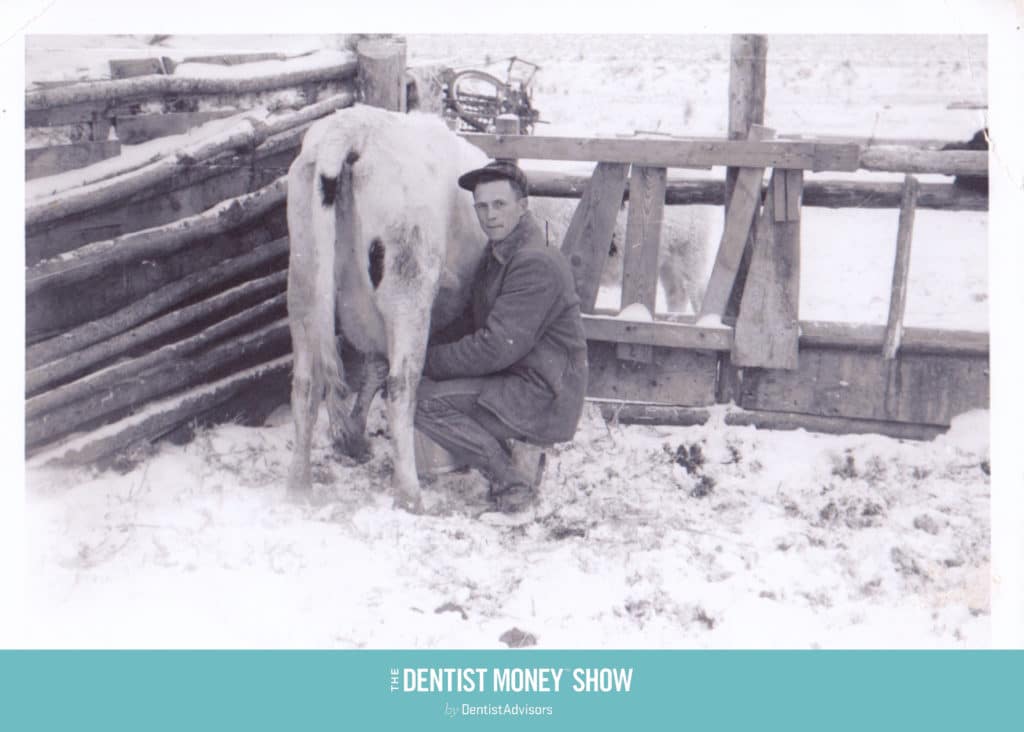

What do cows have to do with staying calm in volatile markets? You’re about to find out.

On this episode of Dentist Money™ Reese and Ryan provide coaching to help you keep your emotions in check when there’s turbulence in the markets. Creating wealth over the long haul takes patience and a solid focus on your overall goals. That’s easier said than done. Reese shares how you should really look at stocks based on his ranching experience as a youth. It’s an analogy that will change your perspective during fluctuating markets.

Podcast Transcript:

Reese Harper: Welcome to another episode of the Dentist Money Show. I’m your host, Reese Harper. I recently had the chance to put together one of my favorite episodes with Sir Ryan Isaac. It was about one of my first jobs in the cow business. I think you’ll find a lot of insights about how the stock market works, how it’s actually a lot similar to purchasing cows than you probably thought.

Reese Harper: Make sure and visit us at dennisadvisors.com and check out our education library, you’ll find a lot of videos, podcasts, and new articles that we’re releasing every week. Also, when you go to the website, don’t forget to book a free consultation, clicking the book free consultation button where you’ll be paired with one of our dental specific financial advisors on a day that works for you. We book appointments on off days, lunches, even on some Saturdays. Just check out the calendar and find a time that’s convenient. Call us anytime 833-DDS-plan. You can also text us at the same number.

Reese Harper: Don’t forget to submit your financial questions on our free Facebook group at dentistadvisors.com/group we take the questions from the Facebook group and use them in the podcast. Thanks again for listening and enjoy the show.

Speaker: Consultant advisor or conduct your own due diligence when making financial decisions. General principles discussed during this program do not constitute personal advice. This program is furnished by Dentist Advisors or registered investment adviser. This is Dentist Money. Now here’s your host, Reese Harper.

Reese Harper: Welcome to the Dentist Money Show where we help dentists make smart financial decisions. I’m your host Reese Harper here with my trusty old cohost, Sir Ryan Isaac.

Ryan Isaac: Here back being trustee, always trustee. Is that a real word, by the way?

Jenni Colborn: I think so.

Ryan Isaac: How do you be trustee?

Jenni Colborn: Let’s see.

Ryan Isaac: Is it similar to trustworthy or is it like reliable?

Jenni Colborn: It’s in the dictionary for having served for a long time and regarded as reliable or faithful.

Reese Harper: Whoa, she just picked that up. She’s must be…

Ryan Isaac: She memorized it.

Reese Harper: Did she Google that?

Jenni Colborn: Also be used as a noun, a prisoner who was given special privileges or responsibilities-

Ryan Isaac: I’m a trustee.

Jenni Colborn: … in return for good behavior.

Reese Harper: Well interesting. It’s also a proper noun, an old friend of mine from high school, ol’ trustee.

Ryan Isaac: I wish I knew you in high school, you broke a lot of bones and did some crazy stuff in high school in Idaho.

Reese Harper: Well, speaking of which-

Ryan Isaac: Yes.

Reese Harper: … I think we should-

Ryan Isaac: You have an Idaho story.

Reese Harper: … talk about my, one of my first jobs.

Ryan Isaac: Well before this comes into this, here’s what I want to bring up, are some questions that we’ve been getting recently.

Reese Harper: Oh!

Ryan Isaac: Right? We’ve been getting market related questions recently. I guess it’s-

Reese Harper: I’ve been getting a lot of texts too.

Ryan Isaac: A lot of texts. Younger clients are texting.

Reese Harper: Yeah. A lot of texts coming in.

Ryan Isaac: So there’s kind of this thing where when markets are feeling steady or they’re just, there’s not much volatility, they’re not, they’re just maybe she’s always going up. Maybe that’s what it is. You know, we try to remind people how things aren’t always going to look like this. I know that pressure too, because when people are excited about their portfolios going up over the course of a few years.

Reese Harper: Yeah.

Ryan Isaac: The pressure starts building where you’re just like constantly, every time someone says that you’re like, “Yeah, but look, there’s going to be years you’re going to be really mad.”

Reese Harper: Yeah. There are some like 20 plus percent returns there for a pretty extended stretch?

Ryan Isaac: Yeah.

Reese Harper: And equities where people were pretty stoked out of their minds?

Ryan Isaac: If they noticed. I mean, that’s the other thing about that too. When it’s going well, far fewer people notice that it’s going well, than when it goes even slightly bad, a lot of people notice that.

Reese Harper: Yeah and we don’t want to go back to people and be like, “Hey look it, you’re killing it right now.”

Ryan Isaac: Yeah, you don’t remind… That’s weird.

Reese Harper: That’s weird.

Ryan Isaac: Yeah.

Reese Harper: Because it’s not, you know… As part of our investment philosophy, we take, we don’t take credit for the upside, because that is capitalism.

Ryan Isaac: we’re owning markets and well you’re doing what markets…

Reese Harper: Markets do what they do. Now we’re pretty skilled…

Ryan Isaac: Market’s going to market.

Reese Harper: We’re pretty skilled at capturing returns that markets can offer you.

Ryan Isaac: Yes.

Reese Harper: But you’ll notice some financial advisors will take credit for their returns, and some financial advisors-

Ryan Isaac: Which is scary.

Reese Harper: … especially on Facebook groups, that you probably have seen in the last week, they like to take credit for the returns they earn. And typically what… The more, I guess, financial education you get, they caution you in doing that, in graduate school, and they say things like, “Well, we have to look at the cause of those returns. Were those returns directly correlated to skill, or was that a particular market segment that you happen to be owning at the [crosstalk] time.

Ryan Isaac: And you just owned it.

Reese Harper: And you actually underperformed the market that you’re owning. For example, someone says I made 30% last year, and let’s say eight years ago, and they happen to be owning gold. Right? Well gold may have been up 54% during that period, but you are claiming success having been up 30, when in reality you just lost 20% compared to what a blind man would have done in the GLD index.

Ryan Isaac: Yeah.

Reese Harper: The gold index.

Ryan Isaac: Yeah.

Reese Harper: But you take credit for that.

Ryan Isaac: Yeah. Can’t do that.

Reese Harper: And in academic circles they would frown on that and would say, “we don’t talk about returns in terms of, “What did I get, what did you get?”, yada yada yada. They talk in terms of, “What market exposure did you have, what type of market was it, was it a commodity market, a gold market.”

Ryan Isaac: It’s explainable there’s a reason for it.

Reese Harper: And then skill would have been a measurable quantifiable difference between the market performance and your out performance. Now if you out performed a market, but you took four times the amount of risk to do that, meaning, “I was in the US stock market, but I actually almost lost everything based on the trade that I had placed, but I ended up doing twice as good as the US market.”, well that’s not necessarily better. You just took way more risk and…

Ryan Isaac: That’s a whole other topic. People forget to equate those two things. That the higher the return has to be there to compensate for the higher risk.

Reese Harper: Yeah. So it’s a little side track, but I just… I get…

Ryan Isaac: These are the conversations we’re having.

Reese Harper: These are conversations we’re having, we don’t like to tell clients that we are responsible for something.

Ryan Isaac: Because we’re not.

Reese Harper: We like to talk about their portfolio, what it’s exposed to, and how that has-

Ryan Isaac: And what it did.

Reese Harper: … been moving this year.

Ryan Isaac: Yeah. So when things are good we try to remind people it’s not always going to be good, that’s not how markets work, they move in cycles. But when things go bad you start hearing different feedback.

Reese Harper: Well when things go good, and you tell people that though, don’t they say, to me they always say, “I know, I know things aren’t-

Ryan Isaac: Totally.

Reese Harper: … always going to be this good, we’re going to go through some bad times too. There’s going to be some down cycles.”

Ryan Isaac: “And when we do I’ll buy more, I understand I’ll be buying things on sale.”

Reese Harper: “I’m never going to react emotionally, I’m not going to let this market throw me around.”

Ryan Isaac: Yeah.

Reese Harper: Now I’m saying that because I know it is so hard, and me and Ryan have seen this now through… directly in our careers through at least a significant rescission, a real estate crisis, I’ve seen it through several, we’ll call… I wouldn’t say there’s been any other recessions in the last 15 years.

Ryan Isaac: Near bear… Like bear markets, and near bear markets over a few years.

Reese Harper: Yeah, we’ve only had like… I’ve had about a 15 year stretch now of experiencing peoples emotions directly of money I’ve been managing. And there’s been… Once or twice a year there’s a significant move that does cause people to react emotionally.

Ryan Isaac: Yeah, even if it’s like one day, because you’ve seen those too, flash crashes and just weird little things that happen for a day or two.

Reese Harper: Yeah, and extended periods of time with low returns in big asset classes like emerging markets right now, developed markets, Europe, asia, these markets are… they just haven’t performed well, and there’s… people are not… they’re not happy with the returns they’ve gotten in the last chunk of time. Especially last year, I mean last year was a really tough year for those markets. We have these emotions, we see clients react a certain way that when people say, “I’m not going to react, I won’t be worried about my account when it goes down.”

Ryan Isaac: “Yeah, I know how this works.” Yeah.

Reese Harper: If you’ve never been there, at least once, I promise you will have a really hard time not reacting. If you’ve never been there at least once. If you’ve been through it once a significant once, like ’07, ’08, ’09 would be a good example of, “I’ve been there.” Right? Massive climb, massive decline. Most of the… If this is your second time through this, and you learned some of the ways to kind of handle volatility and emotions that first crisis, I think you will be better this time around. It just takes a couple of cycles and good education. I think it takes education and it takes…

Ryan Isaac: Experience.

Reese Harper: Experience.

Ryan Isaac: You have to live through certain things. I always think about this like parenting, like your kids, you’re oldest is like 13 now?

Reese Harper: Mm-hmm (affirmative).

Ryan Isaac: Like mine is. Do you remember when your kid’s like two or three and they have some kind of behavioral thing, or they’re like in a… have some kind of new habit, you know? As a new parent you freak out because you’ve never seen it before, you’re like, “My kid’s life is off track, they’re doing this thing.” Then if you’ve seen it now for like 13 years.

Reese Harper: You’re like, “Nevermind, it’s fine.”

Ryan Isaac: You’re like, “I don’t know this kind of just happens all the time, and it’s probably going to be okay.” You know? It is, you have to go through certain things so-

Reese Harper: So no one says they’re going to freak out.

Ryan Isaac: No.

Reese Harper: Let’s say… let’s just talk about some of the things that have come in recently to you and me, actual-

Ryan Isaac: Yeah.

Reese Harper: … you know.

Ryan Isaac: And for context where we’re sitting today, markets from their peak about a year ago, where they’re sitting today are down, like what, nine percent? And we’re certainly not… We’re not sitting in an ’08-

Reese Harper: No.

Ryan Isaac: … period of time. We’re talking about US markets are down like nine percent right now.

Reese Harper: Yeah.

Ryan Isaac: So.

Reese Harper: And we haven’t really gotten any comments in the last few days though, this was coming in-

Ryan Isaac: December, like a month ago, when we were down closer to 16, 17%.

Reese Harper: Yeah, end of year, all right?

Ryan Isaac: End of year 18. So when things happen like that, then you start getting… They trickle in at first, they test the water, they’ll be like… you’ll get a text on Friday night it’s like, “Hey, crazy market week huh?”

Reese Harper: Yeah.

Ryan Isaac: “Crazy week in the markets.”

Reese Harper: And you know it’s not an actual question, it’s just like they’re kind of trying to test the waters. “Is he going to say anything? Do you think this was crazy?”

Ryan Isaac: “You going to laugh this off?”

Reese Harper: and it’s like. I’m not… To me I just feel empathy for this, because it is scary, and I think people don’t want to feel dumb, like they’re the people that feel emotional. Because they know… I mean we pound on this drum pretty hard, and so I don’t think people want to feel bad…

Ryan Isaac: Yeah, being the one that’s actually being emotional when they’ve been told not to be emotional. Which, by the way, is not possible. You will… We’re just emotional creatures that’s fine, that’s a normal thing.

Reese Harper: Yeah, and I think… These are just some of the types of comments that came in though. I got… These are specifically, I’m quoting text and emails and phone calls here. One is, “Man I’ve saved a ton of money this year, but the market just basically wiped it all out.”

Ryan Isaac: Yeah, that hurts, if that’s true.

Reese Harper: Okay? That’s one of the comments. Second, another person, “My entire years worth of savings that I put away just disappeared.” Okay? Third, “I would have been better off not investing money at all this year.”

Ryan Isaac: Yeah.

Reese Harper: Fourth, “I’m going to stop investing until things get better, please turn off my auto-drafts.” All right? And then the last one, “I’m just going to stay in cash and ride this out.”

Ryan Isaac: Well see.

Reese Harper: I like that, I love “riding it out”.

Ryan Isaac: Smooths right out.

Reese Harper: Yeah, you know, that’s a sketchy ride, sitting there watching and just wondering, “When do I get back on that wild thing that I hate.”

Ryan Isaac: Whole other topic for a show yeah.

Reese Harper: It’s a horse that you don’t want to ride, it’s a wild Brumby, we’ve talked about this and you’re just-

Ryan Isaac: I thought you were going to say bronco. Brumby?

Reese Harper: Yeah, Brumby and Australian wild untamed mare that has to be roped and bred and you know, and reeled in by-

Ryan Isaac: That’s right, now I recall, no, now I recall.

Reese Harper: You know from Man From Snowy River and such, jump off the cliff. So you don’t want to get back on this horse, because it’s not a friendly horse. It nips at you, it bites your toe, it kind of bites your arm, it doesn’t respond well to any directions that you get.

Ryan Isaac: Any brumby, yeah the brumby is…

Reese Harper: It doesn’t even eat normal food, it needs sage brush to live. I mean it’s a very wild horse, so if you try to get back on…

Ryan Isaac: It’s just not a good time to ever get back…

Reese Harper: It’s never fun.

Ryan Isaac: Yeah.

Reese Harper: It’s a wild horse that can’t be tamed.

Ryan Isaac: It’s not a party pony, it’s not going to come kneel down and let you just saddle up.

Reese Harper: No, this ain’t no petting zoo.

Ryan Isaac: Yeah, this ain’t no petting zoo.

Reese Harper: And so anyway we get these kind of comments. Did you get any that… If I go hey, and could pull from your hat of things that I’ve said in your brain right now, is there one or two that stuck, sticks out of a comment where you’re like, “I heard this one.”

Ryan Isaac: I think the comment was something I said to you a couple weeks ago, end of December 2018, that December was probably, in 10 years of this career, maybe the most stressful month of my whole life.

Reese Harper: Really?

Ryan Isaac: Yeah.

Reese Harper: Yeah, I think I can relate, it was a heavy… it was tough.

Ryan Isaac: And the crazy thing is, it’s not because markets were doing something they don’t normally do. On average for the last century, US markets drop, at some point a year, 10% on average every 11 months. And we’re not talking about some crazy thing, it’s just, I guess, at this point I’ve got a lot of people at work… There’s a lot of emotional human beings, normal people, around the country who have my cellphone. And I love that life, but that adds up when a lot of those people have my cellphone and feel they got to express, they got to vent a little bit.

Reese Harper: Yeah.

Ryan Isaac: You know?

Reese Harper: It’s interesting, you know, we love this job, and we love working with the clients.

Ryan Isaac: Yep.

Reese Harper: But that isn’t… It’s an emotional…

Ryan Isaac: It’s very emotional.

Reese Harper: … responsibility that you voluntarily take on to help people work through how their feeling during periods of time like this.

Ryan Isaac: Yeah, and what I was going to say, some of the comments you’re talking about here, some of them are, like you said, they’re feeler questions, they’re just putting this out, “I’m going to make a statement and see what Reese says. Or I’m going to say something that might not even be true, but it feels really emotional and I want to vent and say it, and I want to see what Reese says.” Is Reese the flight attendant that’s panicking in the turbulence? Are you heading for your seatbelt and your seat belt too, because you looked at that person, you’re like, “Oh crap they’re freaking out too.” Or is it like, “Is he fine, what’s he going to say?”

Reese Harper: One, some of the challenge is… I think that there’s a major… everyone assumes that their financial advisor, at some point, is making an absolute killing and that somehow they’re getting screwed.

Ryan Isaac: It’s the way patients feel about dentists, we hear this from dentists too, patients think, and staffs of dentists think, “that dentist is the… He’s got money just falling out of his pockets left and right, he doesn’t even care anymore.”

Reese Harper: Yeah, he doesn’t even care, he’s no loaded.

Ryan Isaac: So loaded it doesn’t even matter anymore.

Reese Harper: And the fact that… see we get paid like it… For us, it’s really complicated, we feel like our fee structure is the best fee structure that you could possibly pick, it’s that more subjective, we think it’s the most rational, we think it encourages the most competency on the other end of the phone, when you hire someone you’re going to make sure that you have the right intensives in place. But we get paid to manage money, all right? And we’re giving advice about money, and the payment mechanism is the money that we’re managing. I mean, it’s an emotional journey for people when they already have skepticism about the fact that you’re a financial person, and you’re getting paid by me to manage my money, and my money’s going down, and you’re still getting paid.

Ryan Isaac: And you’re loaded.

Reese Harper: And you’re loaded. You’re just killing it.

Ryan Isaac: Someone tell my wife that.

Reese Harper: Anyway it’s a very emotional thing. So here’s what I worry about and the point of today is, we want to explain that some of these comments that we heard, “Man I saved a ton of money, but the market basically wiped it out.” “Man, my entire years worth of savings just disappeared.” “All of this would have been better if I wouldn’t have invested money ar all this year.” “I got to stop investing till things get better.” These are very common themes that are happening all the time, that we here. And I think it reflects a very fundamental misunderstanding of how investments actually work. Because these comments reflect an understand… an inaccurate understanding of what actually happened in the last 12 months.

Ryan Isaac: Yeah.

Reese Harper: A very inaccurate understanding.

Ryan Isaac: Yep.

Reese Harper: And we’re going to start by telling…

Ryan Isaac: Oh yes.

Reese Harper: … a very good story.

Ryan Isaac: Your roots.

Reese Harper: This is a story that I think everyone will be able to relate to. All right?

Ryan Isaac: Yeah.

Reese Harper: So-

Ryan Isaac: Our Manhattan audience right now on the edge of their seats, they’re going to really get close to this story.

Reese Harper: The guys in Florida and Miami.

Ryan Isaac: There’s some ranching in Florida.

Reese Harper: There really is?

Ryan Isaac: There’s some ranching in Florida.

Reese Harper: So one of the first jobs I had growing up was, we’ll call it, a ranch hand. I would say I was a fairly compensated ranch hand. I was paid in bread, a warm pillow, underneath a blanket of stars…

Ryan Isaac: And pail of chunky milk.

Reese Harper: … and in the woods. All right?

Ryan Isaac: Okay.

Reese Harper: But I worked at my grandpa’s cattle ranch.

Ryan Isaac: Did you wear chaps ever?

Reese Harper: Oh yeah, but they weren’t classic John Wayne style orange county chaps, in Hollywood. These are like dirty old rubber pieced of rubber.

Ryan Isaac: They were like tough, Carhartt.

Reese Harper: No they’re like irrigation chaps, they’re not even cool. They’re just like protect your pants from all of the…

Ryan Isaac: Barbs and birds and spurs.

Reese Harper: … the manure and the spurs and such.

Jenni Colborn: Is there a picture of this that we can…

Ryan Isaac: Do we have chap pictures?

Reese Harper: Dude they didn’t have like… we didn’t have cellphones back then.

Ryan Isaac: You had cameras.

Jenni Colborn: There were no cameras back then.

Reese Harper: I literally don’t even know if I have evidence that this job even ever existed because it was when I was 14.

Ryan Isaac: There’s no documentation.

Reese Harper: It’s like my grandpa didn’t have a camera.

Ryan Isaac: Yeah that’s weird.

Reese Harper: I mean his truck was like 50 years old.

Ryan Isaac: “Son, get the camera out of its case.”

Reese Harper: It’s time to take a picture. Like we don’t do that, there’s too much work to do, there’s no time for pictures. Pictures existed maybe once every five years when you go into town in this…

Ryan Isaac: You go to Sears.

Reese Harper: … professional studio, it’s black and white, grandpa puts on his bolo tie…

Ryan Isaac: Yeah, and his cowboy hat.

Reese Harper: … and puts his hand on your shoulder and everyone stares-

Jenni Colborn: Stands behind you.

Reese Harper: Yeah.

Ryan Isaac: Yeah.

Reese Harper: Yeah. It’s like…

Jenni Colborn: Son.

Reese Harper: … now it’s like now it’s time…

Ryan Isaac: Mom’s in a chair.

Reese Harper: … for a formal picture.

Ryan Isaac: Mom’s in a velvet chair.

Reese Harper: And I loved this job okay?

Ryan Isaac: Okay all right, back to it.

Reese Harper: But my job was basically taking care of the cow’s daily needs. All right? Which consists of mainly eating.

Ryan Isaac: How many cows?

Reese Harper: All… well it’s only eating basically.

Ryan Isaac: Yeah.

Reese Harper: So you just feed them.

Ryan Isaac: Like hundreds of cows?

Reese Harper: That’s their daily needs

Ryan Isaac: Yeah. And this is like…

Reese Harper: At least probably like… I don’t know if there’s three or four hundred or somewhere in that range there wasn’t 1000.

Ryan Isaac: And is this like one of those operations where I picture a huge facility and they’re all in like little tiny corrals and like…

Reese Harper: No no no this wasn’t…

Ryan Isaac: … they’re like free range.

Reese Harper: This is a different type of facility here, this is a free range cow. So my grandpa lived on the Snake River, and he had 100 acres of property…

Ryan Isaac: And they wander, and they feed, and they feed, and they herd, and they…

Reese Harper: They herd they go to grass, but they didn’t have enough grass so you have to bring them hay and throw it out.

Ryan Isaac: Now because I don’t know much about the cow business, these are all like dairy… it’s dairy, or were some of them going to be sold for meat later?

Reese Harper: Well every-

Ryan Isaac: Or all of it… they all are?

Reese Harper: Well cows eventually get sold for meat later, some are raised for meat…

Ryan Isaac: Oh okay.

Reese Harper: … early in their lives, some are used…

Ryan Isaac: Dual purpose.

Reese Harper: … for dairy cows.

Ryan Isaac: Okay, okay.

Reese Harper: There’s… Dairy’s different than meat ranches, so there’s… just to clarify.

Ryan Isaac: And you were on what?

Reese Harper: Well this was a beef ranch.

Ryan Isaac: This is a beef ranch.

Reese Harper: But dairy’s a little more common, up in Idaho.

Ryan Isaac: Ranch hand on the beef ranch wearing unattractive chaps and a few hundred.

Reese Harper: Yep. And so…

Ryan Isaac: Okay.

Reese Harper: … what I learned… I saw my grandpa… I mean I did some good stuff on the ranch, okay?

Ryan Isaac: Yeah.

Reese Harper: I did a little bit of… I fed, I watered, I saw him kind of… every time he had a little bit of extra money he would buy another couple of cows, and he would continue to build his herd.

Ryan Isaac: Okay.

Reese Harper: So you’d buy a calf, or a really infant cow and let them graze on your property and you can sell them for more money down the road.

Ryan Isaac: Okay.

Reese Harper: Another job that I had was more related to dairy, and in a dairy business you’re milking cows and selling the milk to make money. Right?

Ryan Isaac: Okay.

Reese Harper: So it just depends on what kind of ranch you’re on.

Ryan Isaac: And so you just accumulate cows to produce milk.

Reese Harper: Either way the cows are your assets. Right? And once you get enough cows, like on the dairy farm once you get enough cows you can produce milk…

Ryan Isaac: Milk’s your business.

Reese Harper: Milk’s your business.

Ryan Isaac: You’re in the milk business.

Reese Harper: And one of the little known facts is you’re actually… you make a lot of money selling the cows once they’ve produced all the milk they can produce, they get sold off for meat, more hamburger sort of meat. Sorry about all you vegans out there.

Ryan Isaac: Yeah, I know [crosstalk].

Reese Harper: Like we do have a strong vegan audience.

Ryan Isaac: I think we do.

Jenni Colborn: I’m hurting a little bit right now and I’m not even a vegan.

Ryan Isaac: Yeah, a little depressed.

Reese Harper: There is a time where cows get eaten if you didn’t realize that.

Ryan Isaac: It is a reality, it’s the world we live in.

Reese Harper: So what’s interesting is every time you have a little extra money you just add some cows you your herd. Right? Get enough and you kind of become financially independent because, you have a big enough asset there to kick off enough milk to where you can just live and you don’t have to buy more cows anymore. Because now if you’ve got enough milk kicking off you can kind of like… It’s like paying off a big rental property, or having a big dental practice.

Ryan Isaac: Finally, yeah.

Reese Harper: So that’s kind of the thing that… that’s the background to this. I was thinking the other day, why do people, in the stock market kind of thing, that we talked about earlier, why do they say, “I saved a bunch of money, but the market totally wiped me out.” Right?

Ryan Isaac: As if they don’t own anything anymore.

Reese Harper: Yeah, and let me just go through this really slowly because this is critical. Let’s say you wake up in the morning and you have 250,000 dollars in your bank account as a dentist, or in your investment account. So you have a little investment account there. Every month you’re going to put 5,000 dollars into this account, so the first of the month you’ve got 250, you put in five grand. And a few days later and you look at your account, you wake up and the account’s 240 thousand dollars.

Ryan Isaac: Yeah, it’s not 255.

Reese Harper: It’s not 255 like you thought it would be, it’s down to 240. What are the thoughts that are going through your head.

Ryan Isaac: Well there goes my savings and then some, and you’ll get that text.

Reese Harper: Yes, “I just put in money into my account, and it’s gone.”

Ryan Isaac: And then some.

Reese Harper: “And why, I hate this thing, this is the worst thing ever…

Ryan Isaac: What’s the point?

Reese Harper: … why am I doing this? All I’m doing is throwing money away, it’s disappearing every time I put money into this account.”

Ryan Isaac: Yeah.

Reese Harper: Now if we take a different example and we say, you’re the old ranch hand. All right? And you’re going to take 5,000 dollars every month, basically, and you’re going to buy cows. So instead of buying stocks, in the stock market, or shares of a mutual fund, you’re going to buy cows. You’re going to buy 5 per month.

Ryan Isaac: Heifers, is that what you call them?

Reese Harper: You’d probably… if you’re in the dairy business I would say you’d buy a springer.

Ryan Isaac: Okay.

Reese Harper: Which is the name for a heifer that is going to have a baby, because those are the earliest in their life and they have the longest cut, or we’ll call it, a milk cycle.

Ryan Isaac: Okay.

Reese Harper: So you buy a little springer heifer.

Ryan Isaac: A springer heifer.

Reese Harper: You bring the springer in…

Ryan Isaac: Referring to spring time, it’s like early.

Reese Harper: Well a springer’s like it’s going to kick off a cow, it’s going to kick out a little cow.

Ryan Isaac: I’m learning so much about the ranch hand business. Might be my second career.

Reese Harper: So every month I’m going to buy a cow, and the cow’s prices vary.

Ryan Isaac: Yeah.

Reese Harper: They range anywhere from like, 650 bucks to maybe, that’d be really cheap, and then maybe average price would be 1000 dollars and then it might be 1500 dollars, that’s the range. It could be… it’s a… almost a…

Ryan Isaac: They can like double in price though?

Reese Harper: [crosstalk] 100% swing.

Ryan Isaac: Oh yeah.

Reese Harper: Right? In price.

Ryan Isaac: Okay.

Reese Harper: In over a period of years.

Ryan Isaac: Okay.

Reese Harper: It’s usually not within one year you’d see that, but you’ll see 10 or 20% swings in a year, you could see a 50% swing in a year.

Ryan Isaac: Interesting, okay/

Reese Harper: But it’s all based on supply and demand of milk, like how much does Washington produce, how much does Idaho produce, how much quantity’s out there?

Ryan Isaac: Okay.

Reese Harper: And so you see this swing in price of these cows, and you know that your only goal is you’re going to buy 5 cows a month, for like… you need to get to 1000 cows, because if you get to 1000 cows you’re like loaded.

Ryan Isaac: So if you have 1000 total cows one day, that kicks off enough milk…

Reese Harper: To where you never have to work again.

Ryan Isaac: I don’t have to work again, it pays my bills, and I’m done. And so to get there I just got to buy as few cows a month.

Reese Harper: Five a month.

Ryan Isaac: Okay.

Reese Harper: And I’d be able to do it in less than 20 years, it’s probably, you know, 17 years.

Ryan Isaac: Okay.

Reese Harper: I’m going to be able to get to this retirement point, I’m just going to do it by buying cows.

Ryan Isaac: I kind of like this because that’s an average savings, five grand a month, five cattle, five cow.

Reese Harper: Yeah just think about it.

Ryan Isaac: Five springer.

Reese Harper: Five springer and they’re Holsteins, you know.

Ryan Isaac: I’m writing these down.

Reese Harper: Those are black and white cows, it’s a Holstein, okay? It’s your classic American cow.

Ryan Isaac: Okay.

Reese Harper: So every month when you buy them they’re going to be at different prices.

Ryan Isaac: Mm-hmm (affirmative).

Reese Harper: And so you’re not worried about that because you’re going to be able to… you’re just going to say, “Look, I’m not going to just only try to buy it when they’re cheap, I’m just going to know that over time I’m going to average, buying all these cows, my goal is really about getting to 1000 cows.” It’s not like getting my lowest possible price per cow.

Ryan Isaac: Every time you buy a cow.

Reese Harper: Every time I buy a cow, because it’s like kind of a pain to do and-

Ryan Isaac: Or skip buying cows when it’s higher than average.

Reese Harper: Yeah, I’m just going to buy them every month, and so you just going to do that. And every month you buy five cows and by the time 20 years passes, you got more than enough and you’re financially independent.

Ryan Isaac: Okay.

Reese Harper: Now, let’s say, a shout out to my brother-in-law, Harrison, who works on a…

Ryan Isaac: That’s who a…

Reese Harper: … dairy ranch, or a dairy, it’s not a ranch. I don’t even know enough to really know, but I asked him a couple questions about some pricing, and he gave me some insider information about the cattle business. That I thought was quite insightful.

Ryan Isaac: Harrison.

Reese Harper: Yeah, he’s a stud.

Ryan Isaac: Kay, cool.

Reese Harper: So anyway, I was just asking him, I was like, “you know…” I just asked him a few questions about this, we had some kind of interesting thoughts about how much cows you might need to make this work, and what’s a reasonable size ranch to really make this happen. I think 1000 would be plenty.

Ryan Isaac: Okay.

Reese Harper: You’d be pretty loaded at 1000 cows.

Ryan Isaac: You would, you’d be kicking off a lot of dairy.

Reese Harper: Yeah.

Ryan Isaac: Okay.

Reese Harper: But let’s just say that this happens, and one morning you wake up, you got 220 cows. Now you’re a fourth or a fifth of the way there. You got to buy five more this month, which would put you at 225 cows.

Ryan Isaac: Okay.

Reese Harper: And then Harrison comes back out and chats with you after you bought that fifth cow, because it’s January and he wants to do a little bit of cattle inventory.

Ryan Isaac: Okay.

Reese Harper: He looks at the whole ranch and he says, “you know, the price of cows… I know you’re trying to get to 1000, let’s see how much of a value of all the cows you’ve got right now.”

Ryan Isaac: Okay a little… a little valuation…

Reese Harper: A little valuation of all the cows.

Ryan Isaac: … of your current cow worth. What’s that called, it’s like your net cattle worth?

Reese Harper: Your cow worth.

Ryan Isaac: Your cow worth?

Reese Harper: Yeah.

Ryan Isaac: Okay.

Reese Harper: I don’t know, I actually don’t… we don’t know.

Ryan Isaac: We’ll coin something latter.

Reese Harper: But let’s say it’s the same amount of money, imagine, of this cash example, in the bank, I gave you earlier.

Ryan Isaac: Okay.

Reese Harper: Let’s say you have 250 thousand dollars of cows at the beginning of the month.

Ryan Isaac: Okay.

Reese Harper: That’s means that you have… And you have 220 cows.

Ryan Isaac: Kay.

Reese Harper: Your average price for cow at this point 1,136 dollars.

Ryan Isaac: Okay.

Reese Harper: That’s what it cost… that’s what’s you’ve averaged…

Ryan Isaac: On average that’s what you’ve paid for every cow.

Reese Harper: You have 250 thousand dollars worth of cows.

Ryan Isaac: Some a bit cheaper, some a little bit more expensive, but that’s the average what you’ve paid.

Reese Harper: And you’ve just bought 5 more.

Ryan Isaac: Okay.

Reese Harper: So now you’re at 225.

Ryan Isaac: Kay.

Reese Harper: But Harrison comes back and says, “I know that your average price was 1,136, but the proverbial cow manure hit the proverbial fan.

Ryan Isaac: Yeah, as it does.

Reese Harper: And…

Ryan Isaac: Cow pies.

Reese Harper: Yeah, it’s… the price of cows is down a little bit.”

Ryan Isaac: Okay.

Reese Harper: “It’s down to 1090 a cow.” So it’s not 1136 a cow.

Ryan Isaac: It’s like 100 bucks off now.

Reese Harper: Yeah, the cow prices have gone down.

Ryan Isaac: Okay. Which is normal you’re saying…

Reese Harper: Very normal.

Ryan Isaac: … happens pretty commonly.

Reese Harper: And you’re like, “cool all right, I just bought five more cows, that’s cool, I’m just going to go back to work.”

Ryan Isaac: Yeah.

Reese Harper: You’re not going to go… you don’t think about it more than that, you just move on because you just bought five more cows, five more cows closer to your goal, you know that the price of cows vary and you’ll be okay.

Ryan Isaac: Here’s the thing though-

Reese Harper: But…

Ryan Isaac: Okay. I have a question-

Reese Harper: But, you’re actual value of all your stuff combined, he gives you a little summery, and it says, it’s actually worth 240 thousand dollars right now.

Ryan Isaac: I was going to say that, because on one had you’re like, “Oh, I just bought my five cows this month for 100 bucks cheaper, but on the other hand my whole herd now…”

Reese Harper: I only have 240 thousand dollars worth of cows.

Ryan Isaac: But I had 250 last month, yeah.

Reese Harper: So, and I put in 5000 more, I just put in, you know, 5000 dollars worth of cows, and my value of all my cows is down 10 grand?

Ryan Isaac: But because you can physically see these large farm animals, black and white springers, sitting there, you don’t really think that way. You think, “I’ve got five more than I did last month, this is cool.”

Reese Harper: Yeah.

Ryan Isaac: It’s different.

Reese Harper: And I just don’t feel like you feel like you’re… did you… My question for you, in this cow example is, did you’re money just disappear? Did the five cows you just bought…

Ryan Isaac: And the new valuation, yeah.

Reese Harper: … disappear?

Ryan Isaac: Oh, yeah.

Reese Harper: They didn’t.

Ryan Isaac: Of course not.

Reese Harper: They’re sitting there.

Ryan Isaac: Yeah.

Reese Harper: I have my cows, I have 255 cows, I don’t have 250, and I’m fine with that. I just know they’re all worth a little less now.

Ryan Isaac: And you’re a little closer to your goal.

Reese Harper: Yeah.

Ryan Isaac: Of having like this massive-

Reese Harper: Because I just bought five more cows at a cheaper price, during this month, which is nice. It brings my average cow price down.

Ryan Isaac: Yeah,

Reese Harper: And I know that as long as I continue to buy cows every month, I’m going to get to that thousand herd, and I’m going to be in great shape. It’s a tangible concrete, kind of, measurable goal.

Ryan Isaac: You’re main go is 20 years from now it’s a critical mass of 1000 head of cattle.

Reese Harper: Yes.

Ryan Isaac: As they say.

Reese Harper: Now did your entire year’s worth of cow savings disappear right there? Because you lost 15 grand, that’s like 15 cow purchases.

Ryan Isaac: Yeah, but they didn’t just wonder off into the greater pastures.

Reese Harper: Did they all disappear? Maybe another question. Would you have been better off not investing any money at all this year in cows.

Ryan Isaac: No, because you would have put off your goal of 1000 cows by a whole year.

Reese Harper: And you probably just used the money for something else.

Ryan Isaac: Yeah, you would have spent it.

Reese Harper: You’d spend it on a vacation, I don’t know.

Ryan Isaac: Yeah.

Reese Harper: Would you have had the discipline to keep that money and say, “when cow prices go down I’ll use all the money to buy more cows.” Or would it kind of get more scary if cow prices keep going down, you get news about white milk’s bad for us, and dairy’s horrible, and people are having increased heart disease because of milk, and your cows have mad cow disease, and you’re worried that those cows are going to pass it on to the… and their neighbors cows are all dying and then taxes on milk is going up.

Ryan Isaac: So let’s just like wait it out.

Reese Harper: And Hawaii just launches a new cow dairy, and now they’re producing millions of gallons of milk and increasing the market supply, and you’re worried.

Ryan Isaac: Prices go down.

Reese Harper: Would you continue to buy cows consistently, month after month, if you kind of just held back and said, “I’m just going to wait until cow prices are”-

Ryan Isaac: I’m going to listen to the news and see what’s happening, see what people are saying.

Reese Harper: Yeah in the stock market example, “I’m just going to stay in cash and ride this out.” Are you really going to do that? Or is it just better to say, “you know what? This is a plan I can actually execute.”

Ryan Isaac: And I love that quote from…

Reese Harper: The way mechanically this is working, in your investment account, is you’re actually buying cows, every month, at different prices, and if you see the whole value of your account go down by more than what you have saved in a year, that does not mean that your money disappeared any more…

Ryan Isaac: You still own tangible things.

Reese Harper: … any more than it means that over a year the 60 cows you just bought over a year, the five a month that you just bought.

Ryan Isaac: They just wandered off.

Reese Harper: Or disappeared, they didn’t disappear.

Ryan Isaac: Oh, abducted.

Reese Harper: They didn’t disappear.

Jenni Colborn: I get it, I like it.

Ryan Isaac: Abducted.

Reese Harper: In fact there’s a really good case for thinking of, I think your investment portfolio more like this tangible example, and I think it’s very pragmatic.

Ryan Isaac: Yes, okay, so a few questions come to mind. So, one of them, one principle would be this question that, did you really lose your money? So you get that text, you know, “I just lost my money.”

Reese Harper: Mm-hmm (affirmative).

Ryan Isaac: So the… you just summarized though, the recap is not only no, but you actually still hold tangible things, you still have these tangible things that have value. Less value than they did a couple weeks ago, but they’ll have more value later than they do today as well.

Reese Harper: Yeah.

Ryan Isaac: So principle number one, no you did not lose your money.

Reese Harper: No.

Ryan Isaac: I actually just had this conversation about a month ago about… it was a conversation about getting out of the market with a portfolio. The comments were similar, it was like, “The markets down, I’ve lost the money, I’m just going to take it out.” Now there were taxable capital gain kind of a situation in the account too. When the person was talking through this they were saying, at first they were saying, “Well the markets down I lost my money.” But then as we talked through it and we thought, if we get out of this account what we’re going to do is sell every thing, now that it is down, you’re going to pay tax which is a guaranteed lose of money because you’re going to pay the tax on it, then you’re going to hold it to do something with it later.

One scenario you didn’t really lose money, felt like it but you did not lose the money if you keep the money in the account, you hold these tangible shares of little pieces of companies everywhere. But if you do sell it, you pay the capital gain tax of the government, then you did guarantee lose money because you just paid your tax, it’s gone. Okay so principle number one, no you did not lose the money, you still have the cows.

Reese Harper: Yeah

Ryan Isaac: Principle number two then, would be, the benefits of this kind of idea… obviously stocks are better than cows, would you say that?

Reese Harper: I think stocks are… I mean… it’s much more diversified.

Ryan Isaac: I don’t want to offend the ranch hand in you. Just say stocks are better than cows.

Reese Harper: If your specialty is cows, and you know the cow business, I don’t have a probably with you building wealth that way.

Ryan Isaac: Get your thousand.

Reese Harper: Maybe the… Cows are in… Are stocks better than cows? Stocks are more diverse, stocks are… like a share of the united states stock market, that is over 3000 companies it’s much more diverse, it prices very quickly and liquid.

Ryan Isaac: Which we’re going to talk about as another point [crosstalk].

Reese Harper: There’s a lot of benefits to it, but are stocks better than cows? I’d say stocks are the most… the highest returning asset class for the amount of risk that you’re taking, I’d say it’s a higher returning asset class than cows, generally yes.

Ryan Isaac: Okay.

Reese Harper: That being said, people earn their money in the business that they operate in. So I’d say, dentists make their money in dentistry, the question is, if you could accumulate more dental practices and that… you viewed your accumulation of shares that way, and that was going to encourage you to do it, and you had the temperament to do it, and you wanted to do it. That’s a good way to accumulate wealth. If you love real estate, and you want to accumulate properties, and that’s going to be the way mentally you can get passed this hurdle…

The thing I want to kind of highlight is, any physical thing that you’re going to accumulate, you just need to realize that it will change in price, and the more consistent you are with accumulating it the better off you’re going to be. Whether that’s a dental practice or a piece of real estate, or stocks, or cows, you just… The difference is, people don’t think of stocks, and that’s what the point of the podcast is today, they don’t think of stocks as a physical accumulation of something, they think of it as like… and this is really crystal clear to me in the last 60 days, man, more than ever when I read peoples comments on forums and emails that I get.

Ryan Isaac: That could be bad for your health.

Reese Harper: Because I think, like last night, I saw someone say, “Buy and hold.” I saw… like buy and hold which is… There’s a whole debate on what buy and hold should be, like what we’re talking about is… I think buy and hold’s actually is a fine term, it’s not perfectly…

Ryan Isaac: A little jading? Yeah.

Reese Harper: … explained though. But you buy and hold real estate, you buy and hold a dental practice, you buy and hold, that’s the normal thing to do to grow your wealth is buying-

Ryan Isaac: That’s how investments actually work, you stick to it.

Reese Harper: Yeah, you buy and you hold things.

Ryan Isaac: Yeah,

Reese Harper: Now speculation is when you’re an options trader, and you’re forecasting, and you’re looking at your Fibonacci sequence, and you’re trying to understand your candle stick charts, and you’re guessing at speculating the direction markets going to move. It’s just like betting on the Superbowl. I don’t view betting on the Superbowl as an investment, it’s just a speculative move with my money. And that’s fine if you want to do that with a small portion of your assets. But online what you’ll see is a lot of people rip on buy and hold like…

Ryan Isaac: Like that’s the dummies way.

Reese Harper: … “Well you’re going to buy and hold? You idiot it’s… it’s all about… you’re just using faith, and hope, and it’s a prayer that the US economy does well.” It’s actually really not that, at all. It’s the physical summation of all real assets, you know, property, physical value goods, trademarks, patents, real things summed up into something you can physically buy and say, “But I have a stake in this, and a claim on it.”, and these assets are more diversified, and they have a higher expected return than other asset classes.

Ryan Isaac: And I don’t have to spend my time on it, and I get instant liquidity…

Reese Harper: I like that.

Ryan Isaac: … instant transparency.

Reese Harper: What people think of it as is, it’s more like the little leprechaun guy, that like…

Ryan Isaac: Lucky charms?

Reese Harper: … he’s got his pot of gold at the end of the rainbow, it’s kind of just like… to me it feels like for most people the stock market lives in a fictional land of hope of some kind.

Ryan Isaac: Yeah and as if…

Reese Harper: It’s not a tangible asset.

Ryan Isaac: And as if their portfolios are just this bucket of money that it’s like this gambling game. Like I don’t know is it up or is it down, should I take it out or leave it in. Not like I own something.

Reese Harper: No.

Ryan Isaac: Yeah.

Reese Harper: These physical shares are things you actually have, a stake to, just like you would if you were buying a cow every month.

Ryan Isaac: The thing that’s interesting, I think there’s some cognitive dissonance here because, on one hand you’ll hear people say things like, “The future of the stock market worries me, I’m just going to focus on my business.” You know?

Reese Harper: Yeah.

Ryan Isaac: But the disconnect there for me is, if there’s faith in this dental practice that there’s a future for it. You know like, “My collections will be higher 20 years from now than they are today.”, or “I’ll have more locations than I do today.” There’s this faith that I’ve got a business that will grow and be more profitable in the future than it is today, it’s going to grow. Well that’s all the stock market is too, it’s 14,000 little dental practices all over the world with individual owners who are as concerned as you are about their little businesses too, and their big businesses, to make them grow and be profitable, and continue to innovate and disrupt, and have value in the world. It’s the same protection.

Reese Harper: I’d hate to break it to you, but most of them have better staff than we do, and they’ve got better teams, and they have better financing…

Ryan Isaac: Smarter people.

Reese Harper: … and they’ve got a better strategy, and they’ve proven that because that’s why they’ve been able to go public, and that’s why they’ve been able to establish themselves as very innovative organizations. Now that doesn’t mean that you shouldn’t bank on yourself, I’d say you can bank on yourself with the bulk of your money. I love to see dentists reinvest in their practice and expand and grow.

Ryan Isaac: If that’s your personality and the path you want to go down…

Reese Harper: It’s awesome.

Ryan Isaac: … for sure.

Yep.

Reese Harper: But I mean, this thing that you are worried about investing in, it’s literally…

Ryan Isaac: Like it’s not going to have any future value ever again, and it’s just going to go away.

Reese Harper: Yeah, it’s literally a physical representation of…

Ryan Isaac: The same thing you’re doing every day.

Reese Harper: … the same thing you’re doing every day. And that you have faith in, in your own business. It’s just we haven’t done a really great job in this country of getting financial education down in an understandable way to people, to where they actually believe that. Because I really believe nine people out of 10 believe that the stock market is like a roulette wheel.

Ryan Isaac: Mm-hmm (affirmative)

Reese Harper: That’s what it is, it’s like…

Ryan Isaac: It feels like a gamble.

Reese Harper: … it’s just betting on the Superbowl.

Ryan Isaac: But it’s weird because dentists, they spend their time in their practice, they have control over it, they have expertise over it. So that feels different saying there is a future 20 years from now in my private business, but somehow there’s not a future that’s going to be more valuable than today in all these publicly traded companies around the world.

Reese Harper: Yeah.

Ryan Isaac: And that’s just…

Reese Harper: Yeah.

Ryan Isaac: Anyway I think we nailed this angelology over the head a few times.

Reese Harper: No, I think it’s fair, the one last thing I wanted to say is, some of the hate, all right, comes from the fact that this asset class is just so transparent.

Ryan Isaac: Yeah.

Reese Harper: Right? A lot of it is just because it’s happens to be priced every second of the day.

Ryan Isaac: Yeah, and the more mature you become as an investor, the more grateful you’ll be for that transparency. If you…

Reese Harper: So don’t hate the transparency.

Ryan Isaac: Yeah, if you really understood that… If you really calculated the ROI on every asset that you own, with integrity, meaning the real estate that you own, the business that you own, every investment that you own, if you take that and say, “Do I spend any time on this asset, does my real estate cost me any time, does my business cost me any time?” And you take just the profits that you yield from these assets, and you really value your time at a reasonable level and say, “What is all of this costing me to do this?” Especially all you out there who are trading actively right now at 10 hours a week or 15 hours a week and trying to anticipate the future of economics and stock prices. And you’re trying to make bets that we’re saying on this podcast are not worth making. If you’re trying to do that are you really valuing your time at all? Any time you pick up a hammer to start doing your job, that decreases the amount of return that you’re going to get from that asset. Because you’re physically…

Reese Harper: You’re trading time for it.

Ryan Isaac: … trading time for that. And I think a lot of investments that people feel really, really comfortable with, whether it’s cows, real estate…

Reese Harper: Because they spend time in it.

Ryan Isaac: They spend a lot of time in it, and they put a lot of effort into it, and they feel a lot closer to it.

Reese Harper: It’s that sense of control.

Ryan Isaac: And that is understandable, I’ve put way more money into my business than I have into the stock market, personally, and I don’t think there’s anything wrong with that. I just don’t think I… I don’t view my investments-

Reese Harper: But you didn’t do that because you thought the stock market wasn’t going to be worth anything 20 years from now.

Ryan Isaac: No. My stock markets investments that I have, which are significant, are part of my net worth. I don’t feel emotional about them at all, and I don’t feel like they’re worse than cows.

Reese Harper: Yeah.

Ryan Isaac: I don’t feel like my business is better, I feel like there’s a possibility that all of the ambition and hope and future faith I have in my business, may not pan out the way I think it might. I’m really grateful that I have this other, very large, diversified, pool of companies, with smart people in different marketS…

Reese Harper: And I trade your portfolio’s for you, you don’t even spend any time on them. I rebalanced them, okay.

Ryan Isaac: It’s like, I’m really grateful that there is a very high expected return that I place on my market investments, because I know that it’s the collective effort of thousands of people that are just going to drive that forward, and if one business fails, another ones going to come in and take its place. There’s an expected return I have for that that is… gives me a lot of confidence. I don’t worry about my future.

Reese Harper: It’s because it’s millions of people just like you with the same mentality that you shared about your business that are doing the same things in their own businesses all over the world.

Ryan Isaac: But doesn’t mean it will be the highest returning asset that you could ever invest in, your own business will actually be the highest returning place.

Reese Harper: Well, it’s not because what you said earlier, it doesn’t have the highest amount of risk, that’s why.

Ryan Isaac: Yeah it’s a significant risk in your own business.

Reese Harper: But it doesn’t feel that way because you spend 50 hours a week in it and you have expertise in it. Yeah, it’s a significant risk, and it feels not as risky because you’re more familiar with it, touch it and feel it.

Ryan Isaac: Familiarity bias.

Reese Harper: Yeah.

Ryan Isaac: Genius.

Reese Harper: So I just like the idea of people using the stock market the way it should be used. We’re not advocating for the stock market as the epitome of all investments here. All we’re saying is, don’t think of it as a gambling event that is a pot of money that either goes up or down, and you don’t have control over that. It’s a physical accumulation of shares, every time you make a purchase. You have a stake, and a claim on something that you’re actually physically buying, the same way you would if you bought a piece of real estate, and it went down, bought a practice, and the collections declined, I just think it’s really important, and I don’t think people fully embrace that. They might listen to this podcast and go, “Yeah I knew that, I knew that.” But do you behave the same way?

Ryan Isaac: That’s the test of human behavior for sure, when you actually go through it.

Reese Harper: I know you’ll behave that way when you buy a dental practice, and you’ll feel very careful about it.

Ryan Isaac: Yeah, because you’d never sell it six months later when the office manager quits and it floods. Oh there’s some problems, and the value just went down. I’m just going to dump this thing. You’d take losses for three years to make that thing work. I mean how many times do you have that conversation.

Reese Harper: You’ll work Saturdays.

Ryan Isaac: You will. How many times do you have that conversation like, “I just bought the second location the thing is a dump, I’m going to lose money for two years on it.”

Reese Harper: Yeah.

Ryan Isaac: No one walks away from that, and they’re going to spend 40 hours a week trying to fix it.

Reese Harper: Yeah. I just think that the stock market is much more like that then it it’s a random guessing game, remember that.

Ryan Isaac: To close things out, I reached out to one of our clients who is very successful dentist who actually does own quite a bit of cattle himself.

Reese Harper: Mm-hmm (affirmative) okay.

Ryan Isaac: And I said, “Do you have any cattle quotes for me?” I can just give you a little shout out here. And my favorite… He sent me quite a few, and my favorite one is he said, I think this is timeless wisdom we can end with this here, he just says, “Don’t squat with your spurs on.” I don’t know what that’s supposed to mean, but I take that to heart, and I’m going to think about it. I believe your rubber chaps would protect you from it though, if you squatted with your spurs on but with your rubber chaps, I think you’d be okay.

Reese Harper: I want to share one from my favorite foodie.

Ryan Isaac: Okay, who’s the favorite foodie.

Reese Harper: Gordon Ramsey, chef Gordon Ramsey.

Ryan Isaac: He’s your favorite foodie?

Jenni Colborn: I like Gordon Ramsey, I met Gordon Ramsey once.

Reese Harper: You did?

Jenni Colborn: I did.

Ryan Isaac: Jay train net it.

Reese Harper: Okay, here’s my favorite cow quote from Gordon Ramsey…

Ryan Isaac: Okay.

Reese Harper: … “I don’t like looking back, I’m always constantly looking forward. I’m not the one to sort of sit and cry over spilled milk. I’m too busy looking for the next cow.”

Ryan Isaac: Mm-hmm (affirmative) mm-hmm (affirmative)…

Reese Harper: It’s good.

Ryan Isaac: … I got Gordon Ramsey.

Reese Harper: Yeah he’s looking for the next cow.

Ryan Isaac: All right everybody.

Reese Harper: Move forward find your next cow.

Ryan Isaac: And don’t squat with your spurs on.

Reese Harper: I like it.

Ryan Isaac: Wear your chaps. All right thanks everyone for listening. A couple invitations for you today, we’d love to hear from you, and we’d love… If you want to talk about your own cow strategy, direct one O one, one on one, we could say it’d be cow one O one, but direct one on one to a financial advisor who only works with dentists, you can call us, you could schedule a time on our calendar, something that’s convenient for you, a day off, a lunch break, a Saturday.

Reese Harper: 833-DDS-Plan.

Ryan Isaac: Go there, go to dentist advisors.com, schedule something, talk to one of our advisors about your cow own plan, all right? Or go post a question in our Facebook group. It’s dentistadvisors.com/group we’ve got great discussions and pools and questions going on, Reese and I jump in there every week and answer questions, we take questions from the podcast in there too, so that’s dentisadvisors.com/group love to see you in there, thanks for listening.

Reese Harper: Carry on.

Behavioral Finance