Going all the way back to 1930, the average annual return for the U.S. stock market has been right at 10%.

We’re closing in on a full century of solid stock market data to lean back on.

Although I have heard people question whether it makes sense to rely on market returns from the 1930s or 1950s, because so much has changed since then. The economy has changed. The companies that make up the stock market have changed. It’s all different.

We’ve transitioned from railroad companies to tech companies.

You don’t even need to go back multiple decades; the advent of the internet has transformed the economy to be drastically different today than it was even in the year 2000.

Not only have there been changes to businesses and the economy, but we’ve also seen our fair share of crises this century. We’ve dealt with the Dot-com bubble and crash, 9/11, Iraq War, Great Financial Crisis, housing crash, Covid-19, Liberation Day, etc.

Yet, despite all of these challenges and changes, stock market returns have stayed consistent.

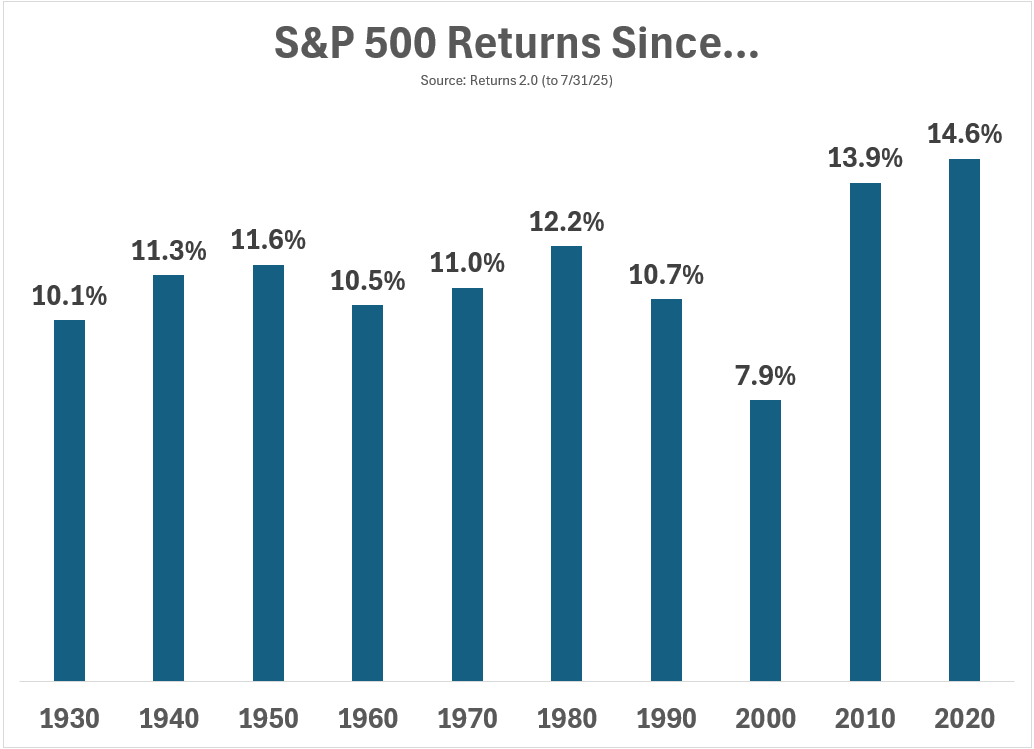

Here’s a chart from Ben Carlson showing S&P 500 returns from the start of each decade until today:

As you can see, returns have even gotten better in recent decades. Part of that has to do with the fact that it’s easier to invest in the stock market now, and more money flowing into stocks means higher valuations.

We’ve seen higher (2010 and 2020) and lower (2000) returns over shorter time frames, but in the long run, returns have been pretty consistent.

Now you might be thinking to yourself, “Well, a 10% yearly return doesn’t seem all that exciting.”

Sure, a 10% return over the course of one year likely won’t do much to change your financial situation. However, if you can be a disciplined investor and stack multiple years of 10% returns together, that’s when the magic of compound interest starts to work in your favor.

Let’s say ten years ago, in 2015, you put $10,000 into the S&P 500. If you held on and kept your money invested, you would have achieved a 13.4% annual return. A little more than that 10% long-term average, but still nothing crazy.

Your initial investment would have nearly tripled to be worth $37,924 today. While that 13.4% may not feel groundbreaking, after ten years, it adds up to a 279% total return.

A $10,000 investment made in 2005 (20 years ago) would be worth $79,779 today. That’s a 10.6% average annual return, but a 697% total return.

Going back one more decade, a $10,000 investment made in 1995 would be worth $238,749 today. A 10.9% annualized return, which adds up to a massive 2,287% total return.

I can guarantee there will be more changes to the market and the economy moving forward (hello A.I.). There will also be more upheavals, recessions, and political messes.

At the same time, we have a pretty big body of evidence that the stock market will continue to roll with the punches and keep churning out positive returns.

Things are always changing, but what doesn’t change is people’s desire to wake up each day, go to work, and create a better life for themselves and their family.

Because of that, the stock market still works as an incredible wealth-building machine.

Thanks for reading!

Jake Elm, CFP® is a financial advisor at Dentist Advisors. Jake a graduate of Utah Valley University’s nationally ranked Personal Financial Planning program. As a financial advisor at Dentist Advisors, he provides dentists with fiduciary guidance related to investments, debt, savings, taxes, and insurance. Learn more about Jake.