Happy New Year! I hope all of your goals and resolutions are off to a strong start.

Before answering the question in the title, I want to take a quick look back at 2025.

Going into 2025, there were quite a few concerns about the stock market and the economy. The U.S. stock market was coming off back to back awesome years, and so naturally people were expecting some sort of drawback. Not to mention, impending tariffs had people nervous.

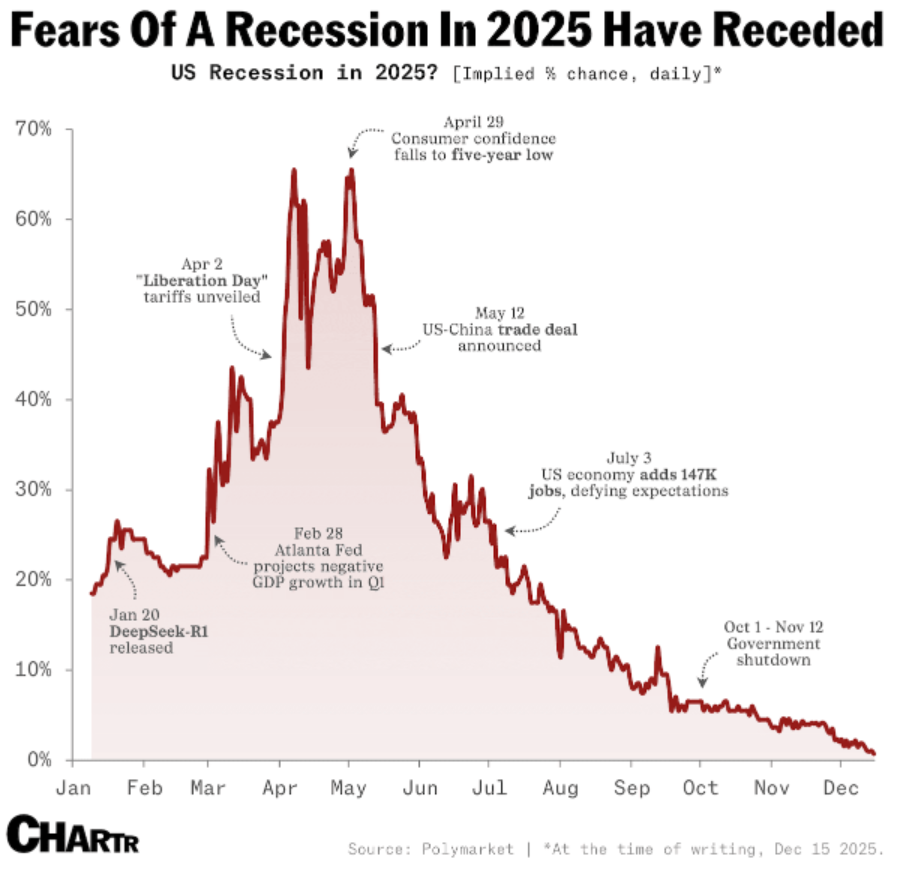

Here’s a chart that shows the fear of a recession throughout the year according to Polymarket:

As you can see, worry peaked in April and May with the whole tariff situation. The U.S. stock market fell 10% over two days. If you can remember back to 8 months ago, there was plenty of doom and gloom to go around.

But fears slowly melted away as the economy kept moving right along and the stock market continued to pump out positive returns.

Despite all of the worry, the S&P 500 returned 19.4% in 2025.

Even for stocks outside of the U.S., it was a good year. The MSCI World ex USA index was up 32% in 2025.

Here is the S&P 500 performance over the past three years:

- 2023 +26.1%

- 2024 +24.9%

- 2025 +19.4%

Pretty good.

Maybe a little too good. Just like this time last year, people are convinced these returns won’t last.

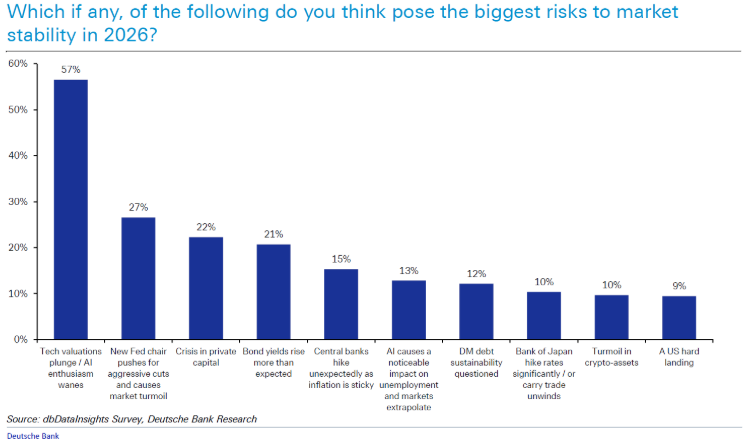

According to a survey by Deutsche Bank, these are people’s biggest worries about the stock market heading into 2026:

Now, it is true that the stock market won’t and can’t churn out positive returns every single year. In fact, on average, the U.S. stock market is up three out of every four years.

Well, since we’ve had three positive years in a row, that means 2026 has to be a negative year, right?

No. Not necessarily.

From 2009 to 2017, there were nine years in a row of positive returns. From 1991 to 1999, there were also nine consecutive years of positive returns. Long stretches of good market performance happen frequently.

If you’re looking for probabilities of a positive year or a negative year for 2026, since 1928, the S&P 500 has posted a negative annual return following a positive annual return only 18% of the time. On the flip side, the S&P 500 has been up roughly 55% of the time following a year with a gain.

But here’s the deal: even if 2026 turns out to be a bad year for the stock market, it doesn’t mean your portfolio is doomed. Nor does it mean you need to sell all of your stocks and move to cash.

Even with the COVID crash of more than 30% and the 2022 bear market decline of 18%, the S&P 500 is up more than 200% since the start of 2019. That’s good for annual returns of nearly 18%.

Remember, market downturns are a feature of the stock market, not a bug.

If you sold your stocks at the beginning of 2025 in preparation for the inevitable correction you thought we were due for, you missed out on an awesome year. If you had a $100,000 portfolio, you lost around $20,000. That hurts.

I would hate to miss another awesome year this time around.

So, should you invest in 2026?

Yes.

But not because 2026 is special.

I think you should take advantage of investing every year.

Thanks for reading!

Jake Elm, CFP® is a financial advisor at Dentist Advisors. Jake a graduate of Utah Valley University’s nationally ranked Personal Financial Planning program. As a financial advisor at Dentist Advisors, he provides dentists with fiduciary guidance related to investments, debt, savings, taxes, and insurance. Learn more about Jake.