A couple of weeks ago, I wrote about the best-performing asset classes of 2025. Emerging markets took the top spot, but coming in third was commodities—essentially tied with U.S. large-cap stocks at a 17% annual return.

Much of the success of commodities was due to the fact that silver was the single best-performing individual asset of 2025.

Yes, you read that right.

Would you have believed me if I told you at the beginning of last year that, despite all of the talk and attention on A.I., the Magnificent 7, tech company this, tech company that… that a shiny, gray metal would outperform them all?

Well, here we are. As I’m writing this, silver is up 17% over the past five days alone. And if you think that’s impressive, it’s up 60% in the last month and up 200% over the past six months.

And finally, up a massive 277% over the past year.

Whatever timeframe you want to choose, the returns have been crazy. For silver!

Why is silver skyrocketing? Who really knows? There are probably multiple contributing factors, including a weak U.S. dollar, a lot of recent industrial demand, and now some hype around the precious metal’s lofty returns.

An interesting tidbit is that Bitcoin has been touted as “digital gold” and the “preferred store of value for the future.” However, you would have been better off holding actual, tangible gold or silver, not only in 2025, but over the past five years as well.

Of course, now that I’m writing this, silver will likely tank by 20% next week because that’s how these things work.

Anyway, I don’t have some grand, sweeping point about silver’s rise; I just find it fascinating. Yet another story of how markets and the economy always find a way to surprise us.

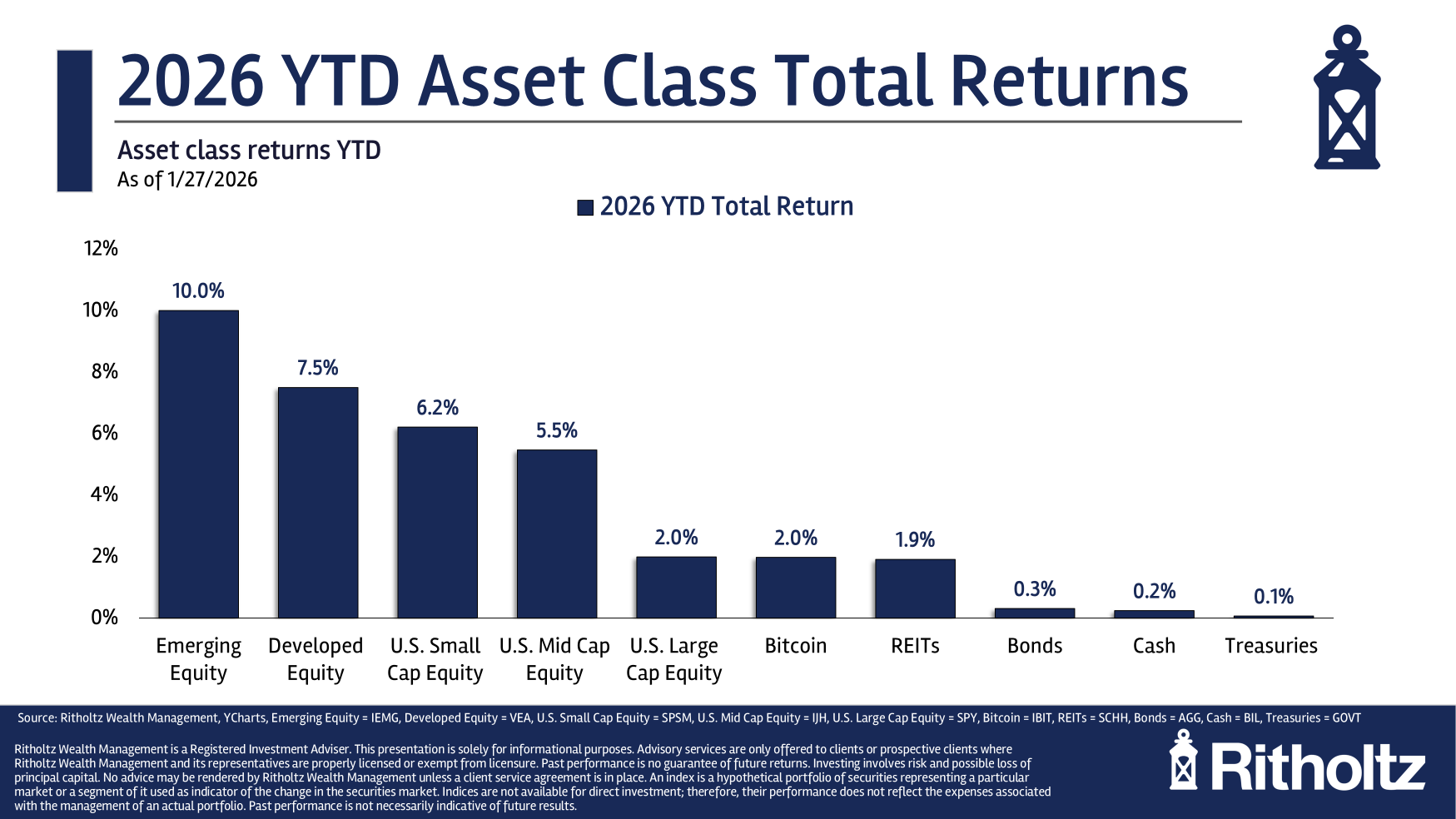

Speaking of surprises, international stocks have continued with their 2025 dominance over U.S. stocks into this first month of 2026. Here are some returns from January:

For those who have maintained a diversified portfolio and not kept all of their money in large tech stocks, this is a welcome sight. Maybe we’re finally starting to move away from the big, popular tech stocks hogging all the returns.

In fact, the smaller the company, the better the return so far in 2026:

Now, it’s easy for me to sit back and dissect past returns. If you were building an investment portfolio with the purpose of outperforming all of your neighbors over the past 20 years, you could do so very easily. Unfortunately, that’s a much harder task to accomplish for the next 20 years.

That’s where diversification comes into play.

Because who knows, maybe it’s aluminum’s turn to go on a run.

Thanks for reading!

Jake Elm, CFP® is a financial advisor at Dentist Advisors. Jake a graduate of Utah Valley University’s nationally ranked Personal Financial Planning program. As a financial advisor at Dentist Advisors, he provides dentists with fiduciary guidance related to investments, debt, savings, taxes, and insurance. Learn more about Jake.