Gallup conducts a survey each year asking Americans their biggest financial concern:

As you can see, starting in 2022, worries about inflation soared.

In 2022, the inflation rate reached a whopping 9%. What’s interesting is that 2022 was the first time in American history that inflation exceeded 5% without leading to a recession. The inflation rate has since returned to a normal range, but the absence of a recession has caused prices to remain higher.

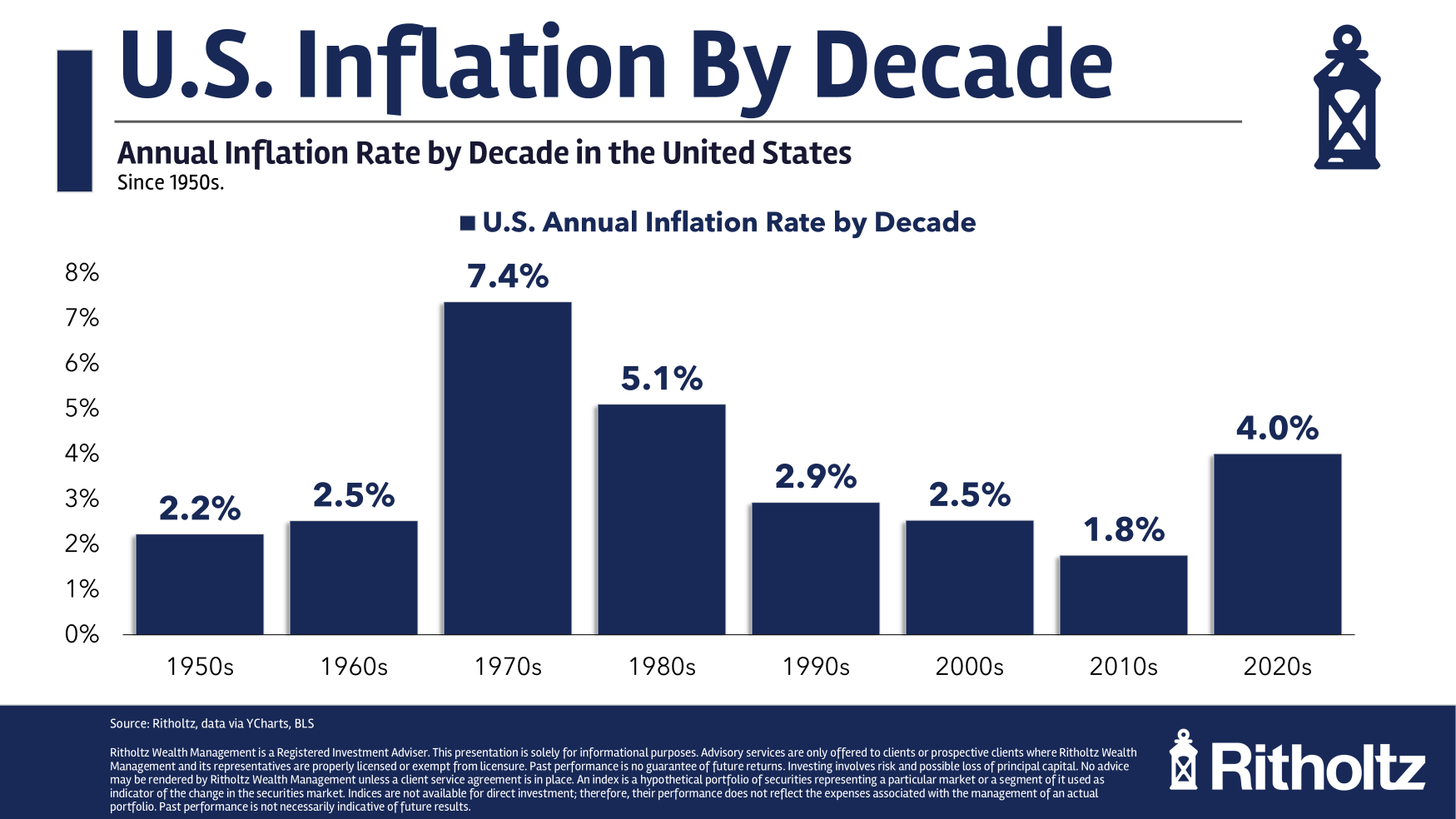

Since 1950, the average annual inflation rate has been around 3.5%. Here’s a chart from Ben Carlson showing inflation by decade:

I think part of the reason inflation has felt so painful in recent years is that we were coming out of a decade where people might have forgotten inflation existed. The 2010s had the lowest levels of inflation of any decade over the past 70 years.

As a quick aside, can you imagine the discourse around inflation if they had social media in the 70s and 80s?

Anyway, people really don’t like higher prices.

Yet… it doesn’t seem like we’re having too hard a time paying those higher prices.

I attended a Nate Bargatze comedy show the other night, and the entire 20,000-seat stadium was full. And this was an optional 4th show that he added because the first three already sold out, and there was demand for more.

The cost of going to see movies in theaters has skyrocketed. We’re close to the point with popcorn where if the price goes up any more, we’re going to have to finance it over multiple payments. Yet, each time I go to the theater, it’s full of people. Zootopia 2 just made $900 million over two weekends.

Black Friday sales reached an all-time high this year. U.S. shoppers spent $11.8 billion, a 9.1% jump from last year.

Where is all this money coming from?

Well, we’re making more of it.

Adjusting for inflation, only around 5% of Americans earned more than $150,000 a year in 1967 (in 2024 dollars). Today, more than 30% do. In 1967, more than 38% earned less than $50,000. Today, that number has dropped to 21%:

Yes, the middle class is shrinking. But they’re not moving down to the lower class; they’re graduating to the upper class. The upper class is growing as the lower and middle classes are shrinking.

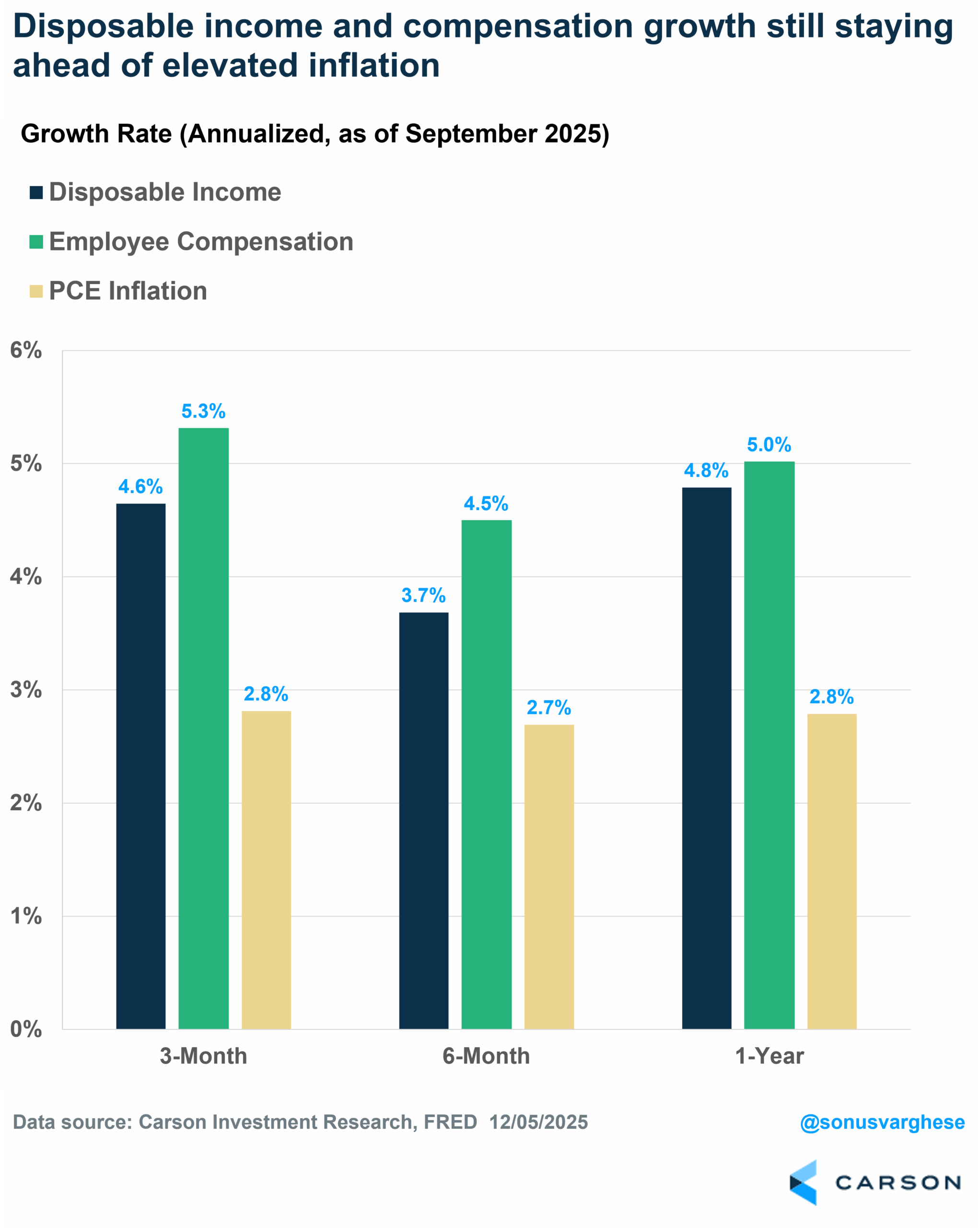

Even with the higher-than-average inflation we’ve seen, incomes have kept pace:

Going back to 2019, incomes have grown 15% higher than inflation:

We keep spending and spending because, although prices have gone up, incomes have followed suit. Even exceeded inflation in many cases.

If you’re reading this data and thinking to yourself, “Well, that hasn’t been the case for me. My income has stayed the same while everything has gotten more expensive.”

If your personal income didn’t go up, your friend’s did. That’s how stats work. Yes, there are plenty of people who have been significantly hurt by inflation, but more people have seen their wages compensate.

Going back to my previous statement about people really not liking inflation.

I think most people would prefer a decade like the 2010s with low inflation and low wage growth, rather than the 2020s with high inflation and high wage growth. I think it hurts more to get a 25% raise and prices follow, because it feels like even with all this extra money that you didn’t have before, you still can’t get ahead.

Aside from no one liking to see their cheeseburger go from $3 to $7, another big reason why people may feel disappointed with the current cost of living is that while average incomes have kept pace with inflation, they’ve been left in the dust by our expectations.

The things that people 30+ years ago would consider luxuries, we now consider commonplace, or even necessary.

Morgan Housel writes in his book, Same As Ever:

“Today’s economy is good at generating three things: wealth, the ability to show off wealth, and great envy for other people’s wealth.

It’s become so much easier in recent decades to look around and say, ‘I may have more than I used to. But relative to that person over there, I don’t feel like I’m doing that great.’

We have higher incomes, more wealth, and bigger homes—but it’s all so quickly smothered by inflated expectations.”

One of the only ways I know of to try and combat our rising expectations is to try and be grateful for what we do have. I don’t think it’s crazy to say that today is a wonderful time to be alive.

John D. Rockefeller was an American industrialist who became one of the richest men the world had ever seen. But for most of his adult life, he didn’t have electric lights, air conditioning, or sunglasses. He never had penicillin, sunscreen, or Advil. And this isn’t ancient history; Rockefeller died in 1937.

Warren Buffett has said:

“Rockefeller certainly had power and fame; he could not, however, live as well as my neighbors do now.”

This Christmas season, it might do us some good to focus on all the material things we have to be thankful for.

Thanks for reading!

Jake Elm, CFP® is a financial advisor at Dentist Advisors. Jake a graduate of Utah Valley University’s nationally ranked Personal Financial Planning program. As a financial advisor at Dentist Advisors, he provides dentists with fiduciary guidance related to investments, debt, savings, taxes, and insurance. Learn more about Jake.