I hope everyone had an awesome Thanksgiving weekend!

Now that we’re back in the swing of things, here are a few charts that have caught my attention.

These days, I get more questions about Bitcoin than any other asset class or investment. If you’re interested in more of my thoughts on cryptocurrency, you can find them here. But I saw something the other day that might suggest a new trend.

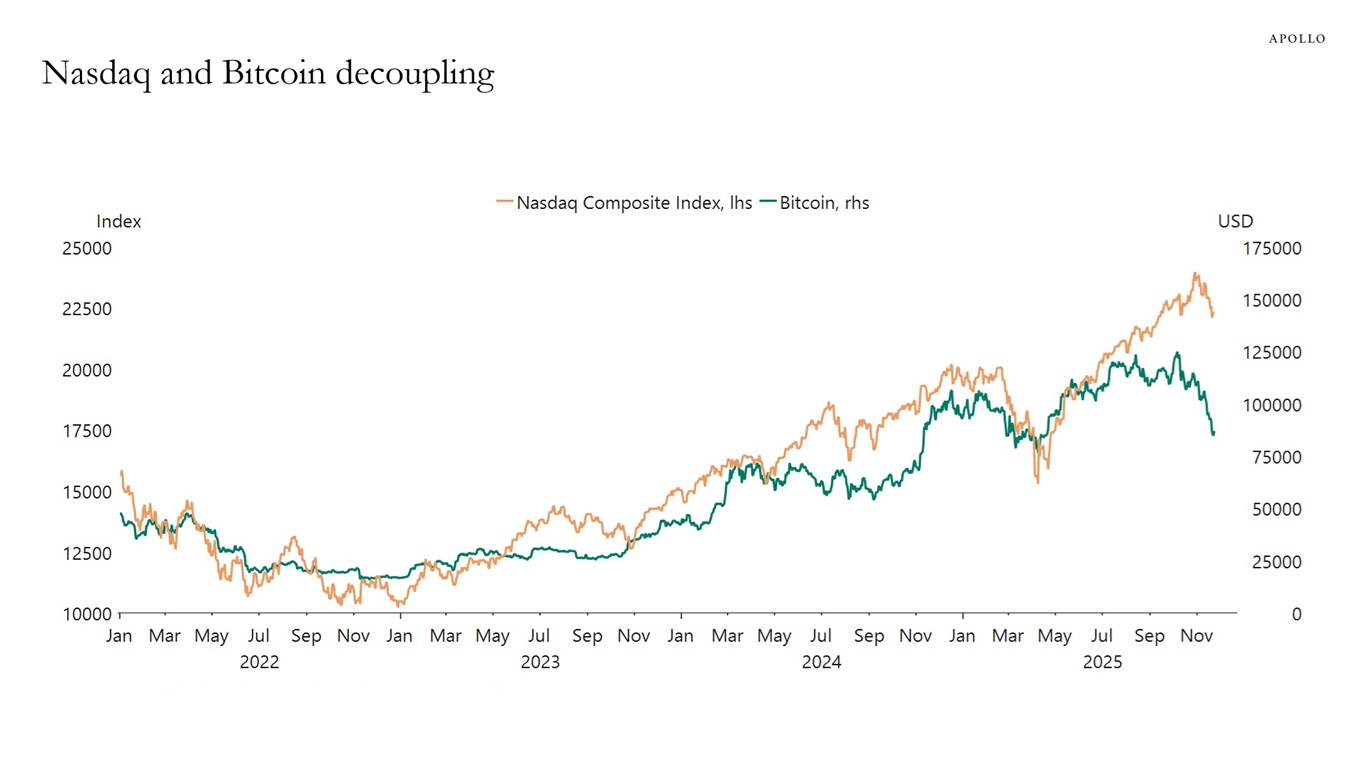

Historically, Bitcoin has performed much like a big tech stock. Meaning, when the Magnificent 7 (Google, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla) have gone up, Bitcoin also goes up. When the Mag 7 declines, Bitcoin follows suit. However, that strong correlation has broken down in recent months.

The following chart shows the price of the Nasdaq Composite (a market index heavily weighted toward technology companies) compared to the price of Bitcoin:

What does this mean for Bitcoin? I don’t know. I just found it interesting.

The Wall Street Journal published an article titled, “The Middle Class is Buckling Under Almost Five Years of Persistent Inflation.” As is typical with these types of articles, they interviewed a handful of people who were holding out for inflation to decline and prices to return to pre-pandemic levels.

“After nearly five years of high prices, many middle-class earners thought life would be more affordable by now. Costs for goods and services are 25% above where they were in 2020. Even though the inflation rate is below its recent 2022 high, certain essentials like coffee, ground beef, and car repairs are up markedly this year.”

Going through the anecdotes in that article highlighted a general misunderstanding of how inflation works. The long-term average inflation rate in the U.S. is around 3% annually. Since the pandemic, the inflation rate has only been above that long-term average from April 2021 to May 2023. We’re now back to around 3%.

The misconception comes from thinking that just because the inflation rate went down, the prices of goods and services should also drop. That’s not what inflation measures. The inflation rate measures how quickly prices are growing over time. If inflation goes down, that means prices aren’t rising as quickly. It does not mean prices are returning to what they were.

Yes, an $18 chicken salad is ridiculous. But once corporations know that consumers will buy their goods at a higher price, they’ll never voluntarily go back.

Moving to a more optimistic chart, we may be seeing some good news for first-time homebuyers.

According to Redfin, there were an estimated 36.8% more home sellers than buyers in the U.S. housing market in October (or 528,769 more, in numerical terms):

This is the largest gap in over a decade. This indicates a strong buyer’s market and hopefully gives first-time homebuyers some much-needed negotiating power because they have a lot of options to choose from.

Continuing with some encouraging information for young people, Vox came out with an article stating Gen Z may be doing better financially than the internet would have you believe.

According to an analysis from the US Federal Reserve, the median 25-year-old Zoomer made over $40,000 a year in 2022, after inflation, taxes, and transfers are taken into account. That is 50 percent more than the typical Boomer earned at the same age.

Wealth data tells a similar story. As of 2023, Americans born between 1990 and 1999 — in other words, young millennials and older Zoomers — had a median net worth that was 39 percent higher (in inflation-adjusted terms) than previous generations boasted at the same age:

Additionally, Zoomers have also had a favorable job market. As of this summer, the unemployment rate among Americans aged 16 to 27 was the lowest in 50 years:

Now, I’m sure some of you may be reading this thinking, “That’s not true! Young people are getting crushed!” And you wouldn’t be alone in that line of thinking. According to a survey from Pew Research, 72% of people of all ages said that children would end up being “worse off financially” than their parents.

As I’ve said in the past, I think a lot of this angst simply comes from not being able to afford a house. Which is understandable. I also think another huge part of the angst comes from our phones.

Young people don’t wake up grateful that they’re enjoying better living standards than the generations in the past, because as humans, we judge our prosperity in relative terms. We don’t care how people were living in the 1950s; all we care about is if we’re doing better or worse than our peers. And with social media, our “peer group” has exponentially grown. Not to mention that social media encourages negativity. We are far more easily captivated by negative news than positive.

The divergence between the widespread perception of economic performance and the actual reality will be an ongoing struggle moving forward.

Thanks for reading!

Jake Elm, CFP® is a financial advisor at Dentist Advisors. Jake a graduate of Utah Valley University’s nationally ranked Personal Financial Planning program. As a financial advisor at Dentist Advisors, he provides dentists with fiduciary guidance related to investments, debt, savings, taxes, and insurance. Learn more about Jake.