A recent survey by Empower asked Americans when they think they should reach certain financial milestones. Based on the responses, Americans think that you should land your dream job by 29, buy your first home at 30, and earn six figures by 35. They also say you should become debt-free at 41 and retire at 58.

Now, your reaction to this information likely depends on how much stock you put into surveys like this. Whether you agree with the responses or not, I did want to investigate a little further to see if these are reasonable expectations for our lives.

Research shows that the average person changes jobs 12 times between the ages of 18 and 56. Based on that information, I don’t think it’s common to stumble into your dream job in your late 20s and stay there for the rest of your career.

Unfortunately, the average age of first-time homebuyers in America is now 38 years old, not 30.

Earning a six-figure salary by the age of 35 seems like a reasonable goal, but in recent years, only around 18% of individuals make $100,000 or more each year. And I would guess that a significant percentage of those individuals are over 35.

The average age Americans pay off student loans is 45, while mortgages are typically paid off around age 60.

The average retirement age in the U.S. is 62, so about four years longer than the people in the survey expect.

So no, I don’t think the survey responses are a realistic expectation for what most Americans can accomplish. However, I’m not surprised at all by the discrepancy between expectations and reality.

It’s never been easier to compare ourselves with others. Where in the past we would compare our situation to our immediate friends and neighbors, the internet and social media now have us keeping up with the Joneses from all across the world who flaunt their wealth for all to see.

It’s never been easier to be bombarded with a million things you have to buy. It’s never been easier to feel dissatisfied with our own financial situations. It’s never been easier to lose patience in a slow and steady wealth-building process.

Even for the 18% of individuals who are making six figures a year, they don’t feel like it’s enough. Another survey asked these high-income earners how much they “needed” to make to feel comfortable in today’s economy, and the answer was $500,000 or more.

Only 0.8% of all jobs in the U.S. pay $500,000 or more.

What’s interesting is if we set aside feelings and expectations, Americans are doing pretty well for themselves.

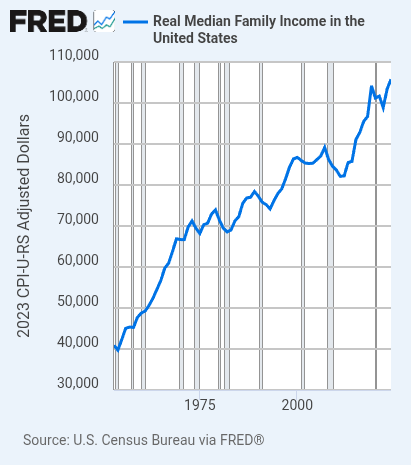

Jeremy Horpedahl posted that median family income is at an all-time, inflation-adjusted high of $105,800 in 2024:

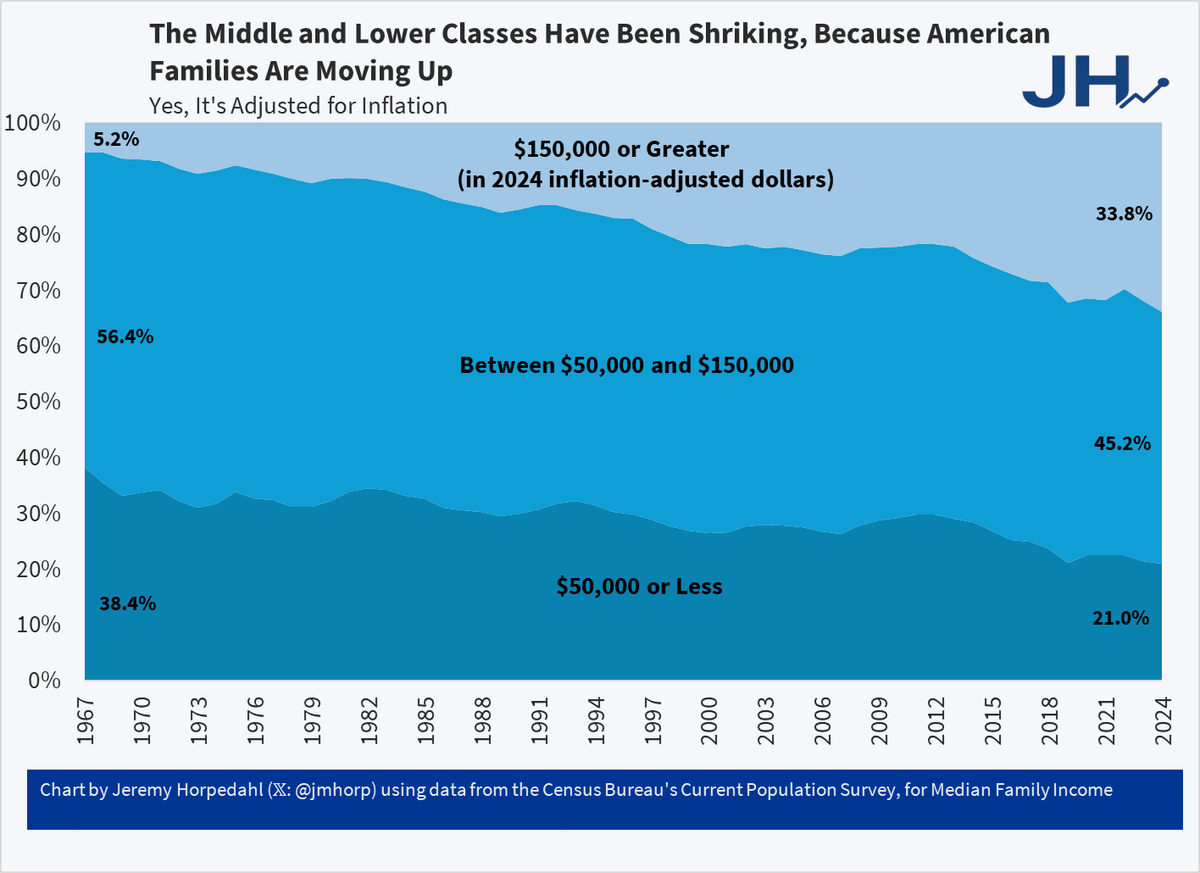

Additionally, for the first time in history, nearly 34% of American households have over $150,000 of annual income:

For comparison, just 2-3% of British households earn more than $150,000.

Everyone always talks about the shrinking middle class, but a big part of that is because the upper class is growing. The middle class isn’t moving down to the lower class; they’re graduating to the upper class.

Keep in mind that these numbers are adjusted for inflation. I’ll repeat that: these numbers are adjusted for inflation. Meaning that Americans are making more money than ever before, even after accounting for the increased cost of living.

However, we can’t set aside feelings and expectations when it comes to money, can we? We’re not spreadsheets; we’re humans with aspirations, flaws, and emotions.

Despite our relative success compared to other countries or even compared to past generations, that success may not feel all that great because we compare ourselves to those around us today. Or the people we see on our phones.

In one Harvard study, researchers gave participants two options:

- Earn $50,000 per year while everyone else earns $25,000.

- Earn $100,000 per year while everyone else earns $200,000.

The participants were told to assume everything else was equal, so more money meant they could buy more.

Option 2 seems like the obvious, logical choice. Who doesn’t want more money?

However, more than half the people in the study chose option 1. They didn’t want more money; they just wanted more than everybody else.

“If one only wished to be happy, this could be easily accomplished; but we wish to be happier than other people, and this is always difficult, for we believe others to be happier than they are.” —Montesquieu, 275 years ago

Thanks for reading!

Jake Elm, CFP® is a financial advisor at Dentist Advisors. Jake a graduate of Utah Valley University’s nationally ranked Personal Financial Planning program. As a financial advisor at Dentist Advisors, he provides dentists with fiduciary guidance related to investments, debt, savings, taxes, and insurance. Learn more about Jake.