As I’ve written about on several occasions, people will overlook positive developments in the U.S. economy because right now all they really want is to be able to buy a house, and they can’t.

According to a Harvard study, the annual income needed to afford monthly payments on a median-priced home in the U.S. was $126,670 in 2024. That’s a massive 60% increase since 2021.

Meanwhile, the most recent data available shows U.S. median household income at only $80,610, up a mere 1.3% from three years earlier.

Given that differential, a good number of people are getting priced out of homeownership. And for a large portion of Americans, the only economic metric that matters is the housing market.

Which makes sense given that 66% of Americans own homes, and not only is a house most people’s biggest financial asset, it’s their only financial asset.

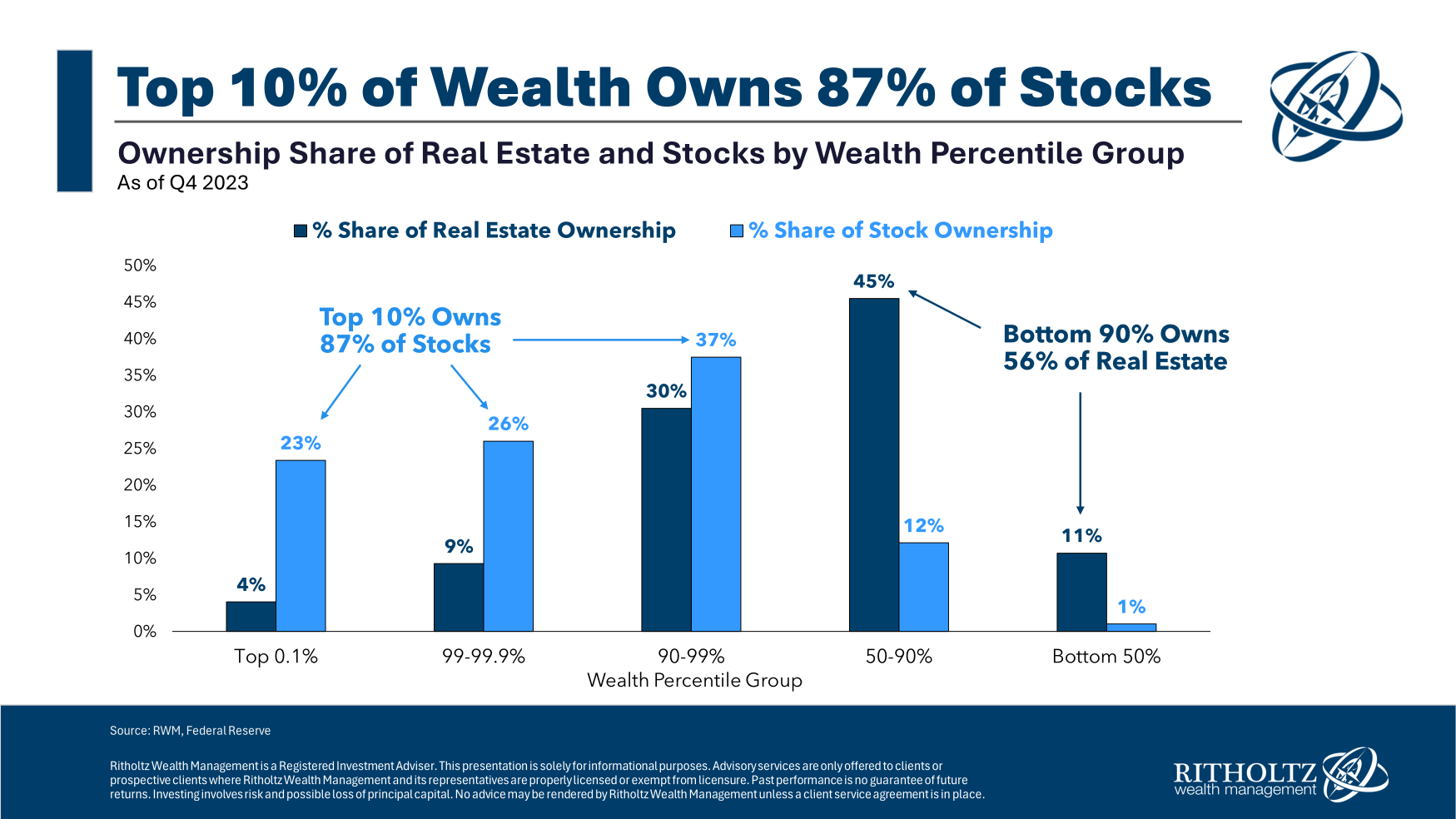

As opposed to the stock market, where the top 10% own nearly 90% of the stocks, the housing market is far less concentrated, with the other 90% of the population owning almost 60% of the market:

A majority of U.S. households have a lot of their wealth-building potential riding on their home.

Even more than the financial implications, owning a house has a big impact on your lifestyle. It’s a place you’ll put down roots, it’ll determine your community and neighborhood, your school district, your friends, and will be a place where you create precious memories with your family. There are other returns on a house that aren’t solely financial.

Owning a home is still at the center of the American dream.

But should it be?

What if our idea of the American dream needs to change?

Don’t hold me to this take, I’m just thinking out loud here and simply asking some questions.

Maybe not being able to buy a house right now isn’t the worst thing?

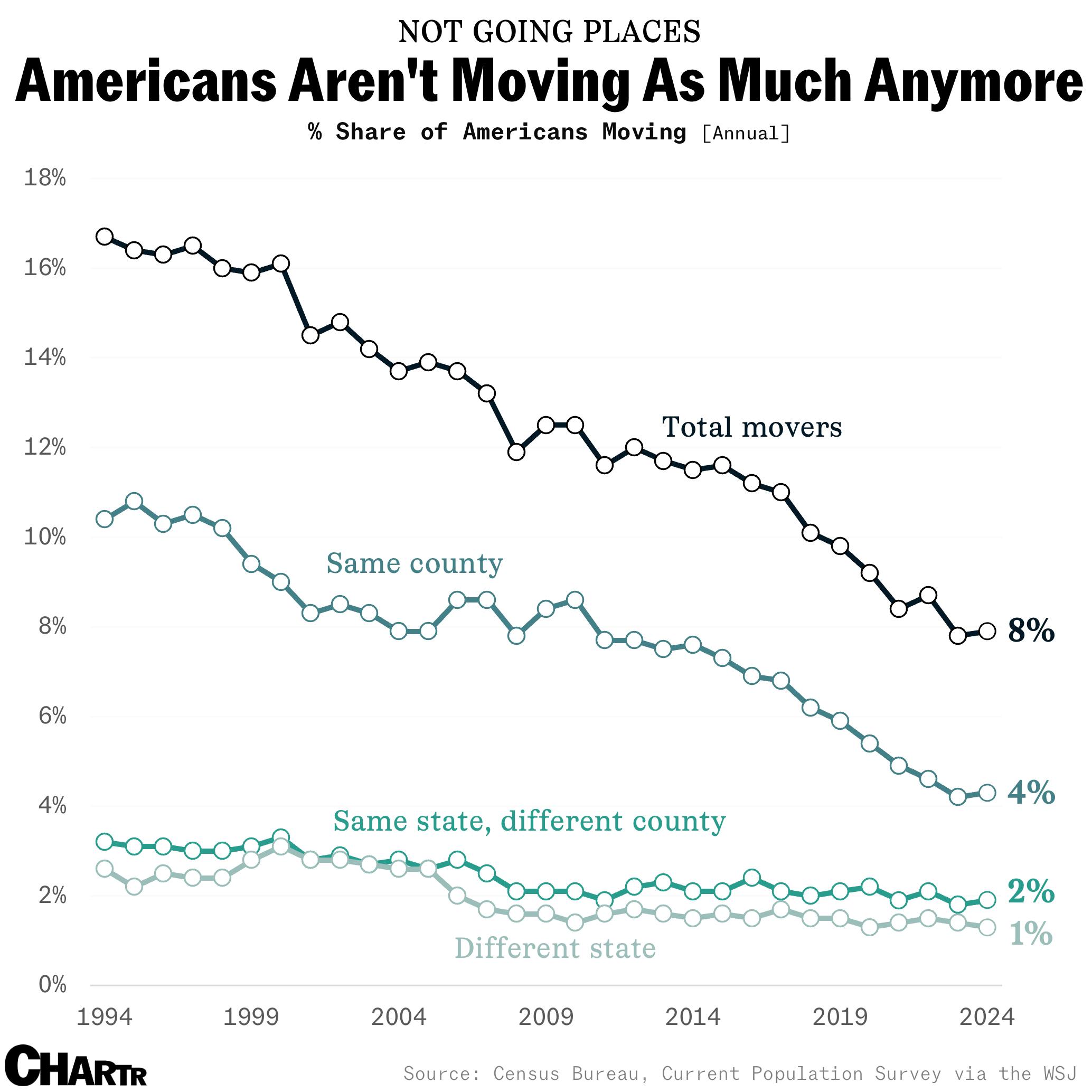

What’s interesting is that despite housing costs being so high, people aren’t moving:

People seem to really care about housing, but apparently, they don’t care enough to move to a more affordable area to find a cheaper house. Instead of looking for a new place to live, more and more people are opting to rent.

The number of renter households has surged 1.6 million since 2023 after being stagnant for the previous six years. That’s because renting is currently more affordable than buying.

The traditional argument for buying a house has been that monthly mortgage payments have generally been the same, if not a little cheaper, than a monthly rent payment. Plus, with a house, you have the benefit of building equity in an asset.

However, as of June, the cost of owning was higher in 49 of the 50 largest U.S. metros areas, according to Bloomberg. Pittsburgh is the last major city where owning is cheaper than renting:

Right now, renting is, on average, $908 a month cheaper than buying a starter home.

You can do a lot with an extra $908 a month.

Let’s say you were to take your savings from renting and invest those funds in the stock market. Assuming an average annual return of 10% (the historical U.S. stock market long-term average), after 25 years, you’d accumulate $1,071,589.

That’s a meaningful amount of wealth.

For the sake of comparison, what would your wealth grow to if you were to take that $908 per month and put it toward a house payment?

The median home price in America is currently around $400,000. The long-term average annual return for real estate has hovered around 4%. Over a 25-year period, that $400,000 home would grow to be worth $1,066,334.

Your net worth would be almost identical. But with one key difference.

Your home is what I call a “use asset.” Meaning its primary function is for personal use. You have to live somewhere. So even if you were to sell your house to try and access that gain, you have to find a new place to live. And if your home price has skyrocketed in recent years, that means the price of the other house you’re moving to has also skyrocketed.

Yes, eventually your house can be an asset that’s passed on to your family when you die, but rarely do people use the equity in their home to fund their retirement or other financial goals.

Not to mention the difficulty of calculating your actual return on your home because most people underestimate all of the ancillary costs involved, like property taxes, insurance, maintenance, upkeep, renovations, and borrowing costs.

I guess my point is that there are other options for building wealth outside of a primary residence. You don’t need to own a home to reach your financial goals.

Maybe an updated version of the American dream is spending less of your hard-earned money on housing, and spending more money on travel, experiences, entertainment, or a host of other things that make life enjoyable.

Thanks for reading!

Jake Elm, CFP® is a financial advisor at Dentist Advisors. Jake a graduate of Utah Valley University’s nationally ranked Personal Financial Planning program. As a financial advisor at Dentist Advisors, he provides dentists with fiduciary guidance related to investments, debt, savings, taxes, and insurance. Learn more about Jake.