I came across this chart the other day that showed the value of equities held by people under 40 years old has grown by 300% since 2020:

Young people seem to be participating in the stock market like never before. In general, I think this is awesome news, especially since saving early and often is half the battle when it comes to investing.

As more people invest in the stock market, it’s also important that investment education comes to the forefront so that those hard-earned savings can turn into real wealth over time.

One lesson I’d like to focus on today is that there will always be a segment of the market or one specific asset class that is outperforming the broader stock market.

The one that comes to mind right now, that I’ve been getting a lot of questions about, is gold.

The shiny rock is up over 50% this year alone, and has actually outperformed the S&P 500 over the past five years with a 112% total return compared to 94% for the S&P 500.

Not too bad. Does this mean we all need to abandon whatever we have been doing in our investment portfolios and move all of our money into gold?

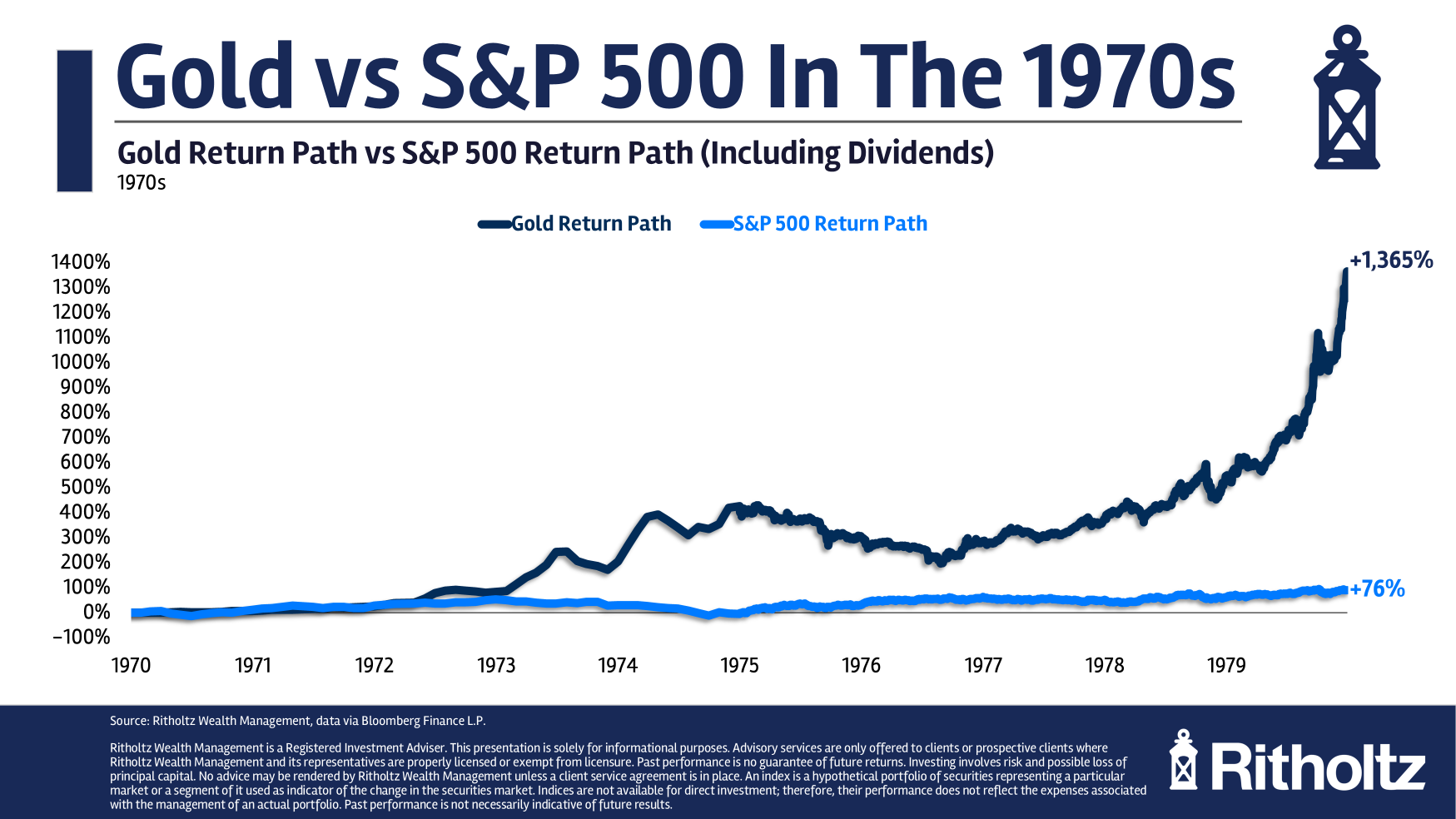

Well, that’s up to you. But if we look back a little further than just the past five years, we’ll find a different story. Here’s a chart from Ben Carlson comparing gold and the S&P 500 during the 80s and 90s:

That’s quite a large discrepancy.

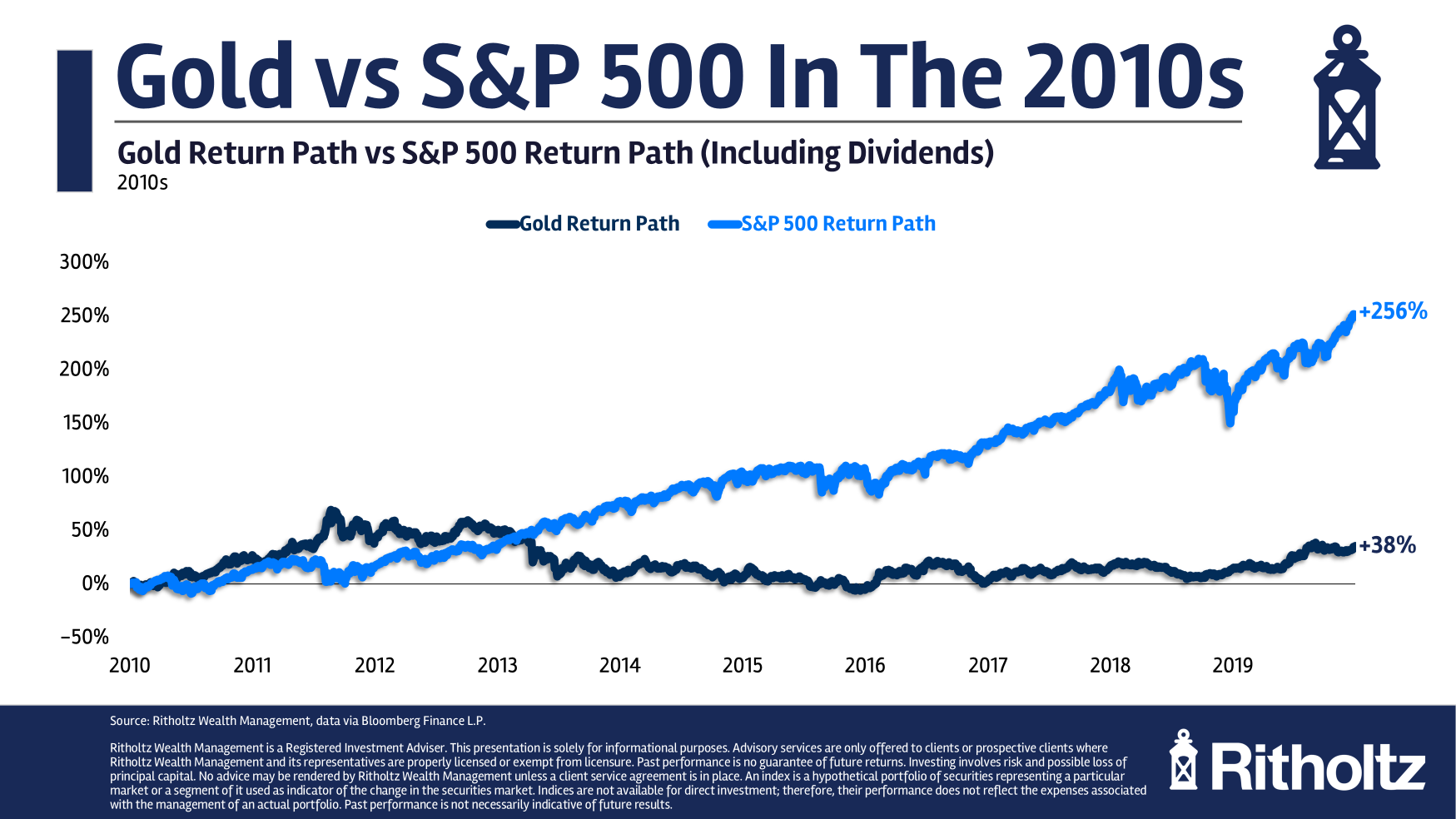

Gold then had a good decade during the 2000s, followed by another poor decade in the 2010s:

While gold has outperformed the S&P 500 over the past five years, the long-term return of both investments hasn’t been close. From 1980 to 2020, the S&P 500 had a total return of 8,242% compared to a 197% return for gold.

That’s a 2.8% annual return for gold versus an 11.7% return for U.S. stocks. Considering the annual inflation rate was 3.1% over that same time, gold lost money to inflation over that four-decade stretch.

Now, I want to be clear that I’m not anti-gold. I’m really not anti any specific asset class. The point is, just because something has performed well in recent years, it does not mean that it will continue to do so forever.

This can happen with individual stocks, too.

Over the past five years, 241 individual stocks have outperformed the S&P 500’s total return. That’s nearly 50%. It’s been a good five years for the stock market. You’ve had a 50/50 chance of buying and holding a stock that would outperform the overall market.

Over the previous five years (2015 to 2020), 149 stocks outperformed the index. That’s just under 30%.

However, if you count the total number of stocks that have outperformed over both periods (the past 10 years), the number is only 40. Just 8%. And that percentage keeps shrinking the more you expand the timeframe.

So if you have a friend who is bragging to you about his returns from some big tech stock he got in on last year, keep in mind that’s not overly impressive. He (and I’m using “he” because it almost always is) had a coin flip’s chance of doing so.

The real question is, how does he plan to keep that up over the next 30 years?

One of the few dependable features of investing in the stock market is that it’s cyclical. Nothing lasts forever. There is no one strategy that always works all of the time.

There will always be certain investments or strategies that do better than others at any given time. Unfortunately, many investors will pile into these investments only after they’ve already experienced strong outperformance—which is a sure way to underperform.

While still no guarantee, it’s not that difficult to identify a single stock that will outperform the broader market over the course of a year or a handful of years. It becomes nearly impossible to do over decades.

And therein lies the dilemma, wealth isn’t built over a handful of years, it’s built over decades.

Thanks for reading!

Jake Elm, CFP® is a financial advisor at Dentist Advisors. Jake a graduate of Utah Valley University’s nationally ranked Personal Financial Planning program. As a financial advisor at Dentist Advisors, he provides dentists with fiduciary guidance related to investments, debt, savings, taxes, and insurance. Learn more about Jake.