I can never tell what piece of financial news is going to go “viral” and become a cultural talking point, but the Trump administration floating the idea of 50-year mortgages this past week sure did the trick.

I’m sure a lot of the discussion around the proposal has to do with people’s strong feelings toward the current state of the housing market. Which, as I’ve outlined in the past, isn’t exactly in a great place right now.

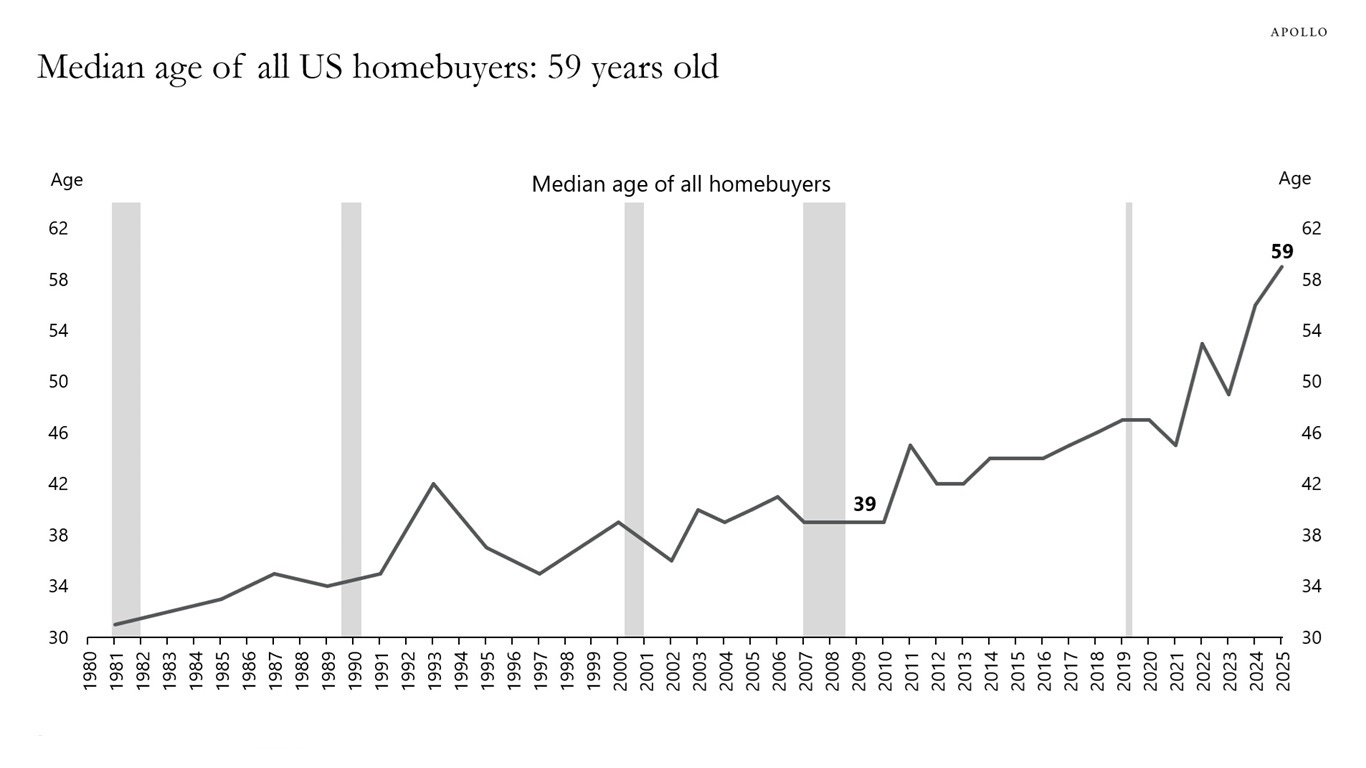

Just this morning, Torsten Slok’s newsletter shared that the median age of all U.S. homebuyers is up to 59 years old:

In 2010, the median age of all U.S. homebuyers was 39.

So, that’s where the idea of a 50-year mortgage comes into play: an effort to make homeownership more affordable.

From everyone I’ve talked to and the content I’ve seen in my corner of the internet, the response has largely been outrage. Which is understandable. I don’t think anyone loves being in debt, and I really don’t think anyone likes paying interest on that debt.

And with a 50-year loan term, you’re increasing your projected interest costs by a lot.

Currently, the median home price in America is around $415,000. Using that number, with a 30-year mortgage at 6% you’d pay $480,763 in interest over the life of the loan. More than the original cost of the home.

With a 50-year mortgage, you’d pay $680,932 in total interest costs over the life of the loan. That’s over $200,000 extra dollars.

But the trade-off is that a 50-year mortgage would lower the monthly payment and help more people get into a house, right?

Well, yes and no.

The monthly mortgage payment for a $415,000 home on a 30-year mortgage at 6% would be $2,488. If you extended the mortgage to 50 years, the payment would drop to $2,184. A $300 monthly difference.

To use some different numbers, an $800,000 mortgage over 30 years at 6% would have a $4,796 monthly payment. Using a 50-year mortgage, the monthly payment would be $4,211. A $585 difference.

So yes, the monthly required payment would go down, but not by a significant margin. It equates to about a 12% reduction as a percentage of the total payment. Is $300 a month really keeping people from buying houses? Is a 12% lower payment worth 20 extra years on your loan?

Maybe. Maybe not. Depends on the person.

Now, to offer a counterpoint, I don’t think 50-year mortgages are pure evil. Yes, it’s a crazy long time to be making payments on a house. But you know what other timeframe is also a crazy long time to be making payments on a house? 30 years.

So long, in fact, that hardly anyone does it. The average homeowner in America stays in their home for 11.8 years.

Everyone gets scared when they first apply for a mortgage and look at the total interest expense they’re projected to pay over the next 30 years. However, the percentage of people who make consistent payments to one house over 30 years is quite small. In almost every case, you’ll have an opportunity to refinance to a better rate or loan structure, you’ll make extra payments toward the principal, or move to a different house well before the mortgage is up.

If you only plan on being in an area for a short amount of time, let’s say three to five years, and you’re looking for a stable place to stay, getting into a 50-year mortgage to lower your payments before you have to move could be a viable option. And maybe you build some small equity during that time as well.

You could always get a 50-year mortgage and make extra payments to pay it off in 30 years anyway. You could pay it off in 15 years if you wanted. But the lower required payment could give you some flexibility when cash flow is tight.

If you think 50-year mortgages are a terrible idea for most people, it’d be hard for me to disagree with you. If you think there could be some interesting use cases for them, I’d also hear you out.

How’s that for a take?

Thanks for reading!

Jake Elm, CFP® is a financial advisor at Dentist Advisors. Jake a graduate of Utah Valley University’s nationally ranked Personal Financial Planning program. As a financial advisor at Dentist Advisors, he provides dentists with fiduciary guidance related to investments, debt, savings, taxes, and insurance. Learn more about Jake.