Your income is important, but what you earn is not what you’re worth. Find out how to put more focus on building wealth.

Dentists and specialists are some of the highest paid individuals in the country, frequently appearing in top 10 lists of highest paid jobs in the US. Did you know that US News recently ranked dentists as one of the top careers in the country? If dentists are making such great money, why do so many struggle to build a successful retirement?

The answer is complex, and the reason why good financial advisors have jobs. I think it starts with a common misconception: “The more I make, the more successful I am.” The truth is, a great income doesn’t guarantee a successful retirement. In fact, in many ways it can make it even HARDER to retire successfully.

Worth Is More Important Than Income

One beautiful spring afternoon in 1984, Bill and Jim graduated from dental school. They were very similar: More talented than average, very personable and filled with ambition. It’s now 2014 – 30 years after graduation from the University of Maryland.

They got together with their wives for dinner to catch up on old times. In many ways, they were still very much alike: Happily married, four children, with great reputations in the community.

But there was a difference. Jim was thinking of adding a fifth work day to improve collections. But Bill was happily retired, spending most of his days, fishing, traveling & skiing with his grandkids.

What made the difference? They’ve both had very similar incomes every year since they started practicing. So how did Jim end up with such a different result?

It’s not intelligence or talent or dedication, and certainly not a lack of ambition. The difference is this: Bill was worth more. Bill made small, incrementally better financial decisions during his career, resulting in a higher personal worth at an earlier age.

And that’s why I’m writing this post – to help you start to see the difference between your income and your personal worth. If your personal worth is high enough, you can achieve financial freedom, and retire on time. Each decision you make has an effect on your personal worth.

It wasn’t just one thing; it was a lot of things. Maybe it was the fact that Jim paid a little higher interest on his real estate loans, bought a slightly larger home, spent a little too much on vacations, kept a little too much money in his business checking account, and delayed important decisions like maximizing his retirement plan contributions.

Remember this: what you earn is not what you’re worth; your worth is more important than your income.

Bill and Jim earned the same income. But they ended up in two entirely different places.

In order to have a secure retirement, you need to strategically grow your personal worth monthly and annually, and you need a plan of attack so that you avoid decisions that undermine it.

How Can I Determine My Personal Worth?

Your personal “worth” is calculated like this:

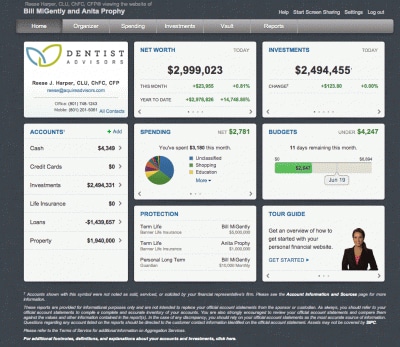

YOUR STUFF (ASSETS) – YOUR LOANS (LIABILITIES) = YOUR PERSONAL WORTH (NET WORTH).

The first step in figuring out your personal worth is identifying your assets. Assets include, but are not limited to: cash, mutual funds, retirement, real estate and practice value. Now subtract all of your debts (i.e. student loans, equipment, practice, mortgages, building, etc.). The difference is your personal worth.

If you want to prepare for a successful retirement, you absolutely need to know what your worth is and review this figure on a regular basis. By doing this, you’ll naturally make decisions that increase your worth over time.

More importantly, you need to measure how much your personal worth is increasing or decreasing over time. This will help you make adjustments and correct course early on and can help you from spending time in the hurt tank.

Protecting Your Personal Worth

The key to making intelligent decisions with your money is the awareness that all financial decisions either increase or decrease your net worth.

For example, your net worth grows when you pay off a debt, pile up cash in your business checking account, or make wise investments. On the other hand, it declines when you take out that equipment loan or put in that swimming pool.

I’m not here to say that all financial decisions have to increase your personal worth. Sometimes there are expenses we make simply because we can afford it. But, the point is this: earning a great income has a way of making people feel too comfortable about their ability to retire successfully. We’ve seen it many times at Dentist Advisors. As experienced financial advisors, we make sure your future retirement is secured by helping you realize and protect your personal worth.